Spreads and yields/rates is the simple answer to the above question. Let’s take a look at what is going on:

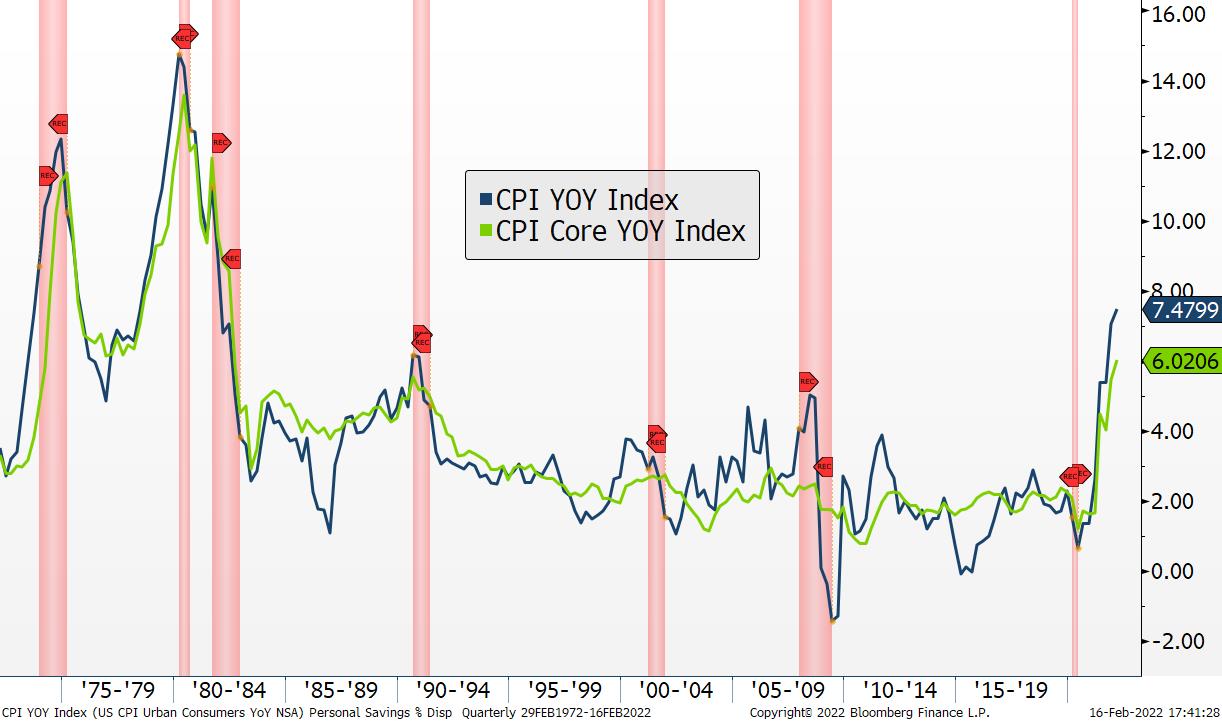

The benchmark 10yr. Treasury yield recently broke 2% as the market opened weak after a higher-than-expected CPI reading hit the tape, reminding investors that inflation might not be so “transitory” after all. Actually, the 7.5% year-over-year increase in January marks a four-decade high.

Gains were quite broad-based, which worried experts as it became more difficult to blame it on used car prices, parts shortages and supply issues. We added a recession indicator (red shading) field to our chart not to scare you, but more so as an additional guidepost to help digest the historical significance of these readings.

If that were not enough to make bond investors nervous, prominent regional Fed president James Bullard recently moved risk markets when he called for a full percentage rate move by July. He cited, “we’ve been surprised to the upside on inflation” and “our credibility is on the line here, and we do have to react to the data.” Sometimes we wonder whether anyone at the Fed sets foot in a grocery store, looks at a utility bill, or has planned a vacation in the last six months? We do, however, suspect there are a lot of folks like you and me who might have some real-life examples of inflation starting earlier than January of 2022. Yet, the market was caught off guard.

Speaking of “off guard,” Wall Street economists are scrambling to keep up with each other on their year-end rate forecasts and have now adjusted in 175bps of tightening. The bond market seems to agree as yields are moving higher across the curve with the most severe action happening on the short-intermediate part of the Treasury curve. If you find statistics to be of interest, the jump in 2yr. U.S. Treasury yields on Thursday, February 10, 2022, was a six standard deviation move. Not since the ’70s has the market witnessed such a violent move in the 2yr benchmark. So much for efficient markets!

What also stood out within this sell-off in short duration Treasuries (seen as a very safe asset class) is the fact that some bond investors are facing mark to market losses or negative returns when they look at their statements or holdings. According to Bloomberg, bond mutual funds have experienced two consecutive weeks of outflows totaling $30 billion and exchange-traded funds adding $10 billion more. This is not something that folks are used to. While these redemptions have not caused undue stress on bond markets, we have noticed a bit of apathy among participants as both end investors, and trading desks have pulled back their bids in a number of areas. Unfortunately, there are instances when selling begets selling in the bond market, the two most recent being late 2018 and at the onset of the Covid pandemic. In each of these instances, the Fed stepped in and either reversed their hiking stance or initiated a buying program, neither of which seems likely given the inflation backdrop. It seems as though the bond market will have to figure it out as the Fed holds the keys.

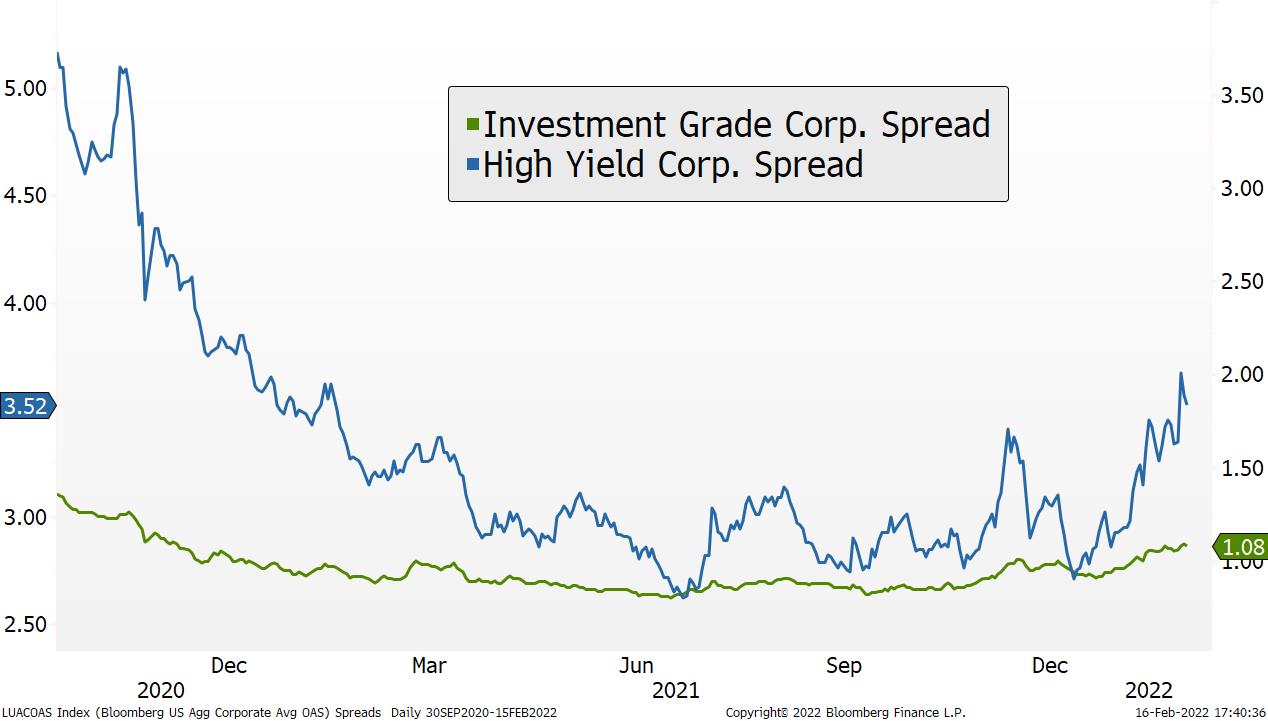

We have noticed that dealer quoted markets have widened in recent weeks as risk-taking seems out of favor on Wall Street. One need not look further than bond spreads for evidence of the risk-off tone. Bond spreads are a risk barometer in our world as they indicate what yield over and above a Treasury will a buyer of the corporate bond demand. Looking at both investment grade and high yield corporate bonds, we sense there is growing angst in the market.

Not since the fourth quarter of 2020 (pre-vaccine) has the bond market been so nervous. Bond investors, like most investors, seek clarity. We, along with many others, anxiously wait for more to come out of the Federal Reserve and what is said at their meeting on March 16th. In the meantime, it still feels some bond investors are heading for the exit doors despite the higher yields.

ABOUT THE AUTHOR:Mark Anderson, CFA, is the chief strategy officer at National Investment Services. DISCLAIMER:National Investment Services is an Associate member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of National Investment Services or TEXPERS. These views are subject to change. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about Texas' public pension industry.