Experience in emerging markets (EM) teaches the importance of knowing when to react quickly and when to ride out the storm.

To date, 2022 has proven volatile for global equity and bond markets. In particular, the Russian invasion of Ukraine and subsequent economic sanctions have brought attention to the always-present potential for local geopolitical events to affect both developed (DM) and emerging markets investors. It has also served as a reminder of the growing complexity and interdependence of international markets. Russian issuers, prior to the Ukraine invasion, were among the healthiest in the EM world. The vast majority (92%) of EM funds tracked by Morningstar held investments in Russian companies as of 12/31/2021. However, fund concentrations of Russian debt were generally low, reflecting the broadness of available emerging market debt (EMD).

It is extremely difficult to know how sanctions and Russian debt liquidity will ultimately play out. As always, during periods of market strain, investment managers must consider hold and sell decisions with both current volatility and the future market in mind. Macro outlook, local conditions and issuer fundamentals must all be assessed.

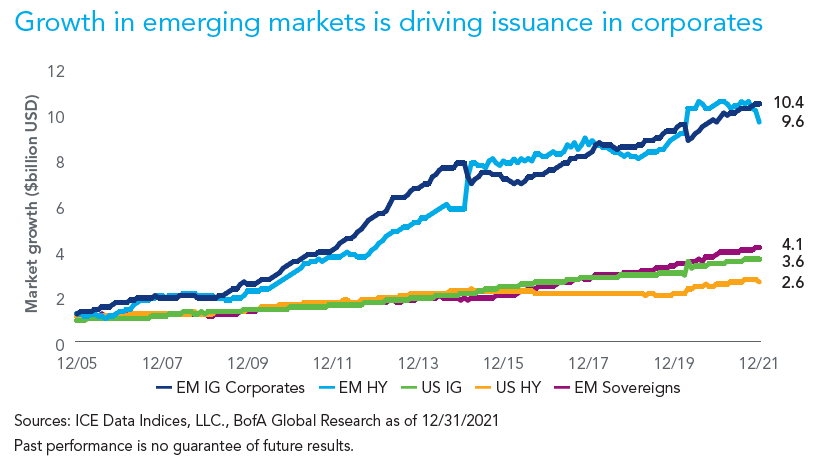

As global inflationary pressures and uncertainty about the Ukraine crisis persist, it may be helpful to consider that EMD has grown to more than 25% of the global bond universe. Today, many EM countries, depending on size and resources, have fundamentals similar to DM countries due to rapidly expanding economies, infrastructure and capital markets. The investment risks of these countries’ debt can be comparable to that found in DM.

While EMD issued in non-local or “hard currency” (USD for example) still represents the vast majority of foreign investment, most of the cumulative growth in issuance has been in local currency sovereigns and corporates, both investment grade (IG) and high yield (HY). The benchmarked EMD universe is now more than $10 trillion, about 75% of which is local currency sovereigns.

Although many EM bonds are not easily accessible to foreign investors, select EM sovereigns, corporates, and bonds issued in local currency each may offer the potential for attractive total return for U.S. investors. Tactical investing in local currency EMD can provide distinct alpha opportunity via foreign exchange to help improve portfolio returns during U.S. inflationary periods. In general, EMD can require longer-term investment, given the economic cyclicality of local currency performance.

As previously stated, EMD investing adds a layer of complexity to security selection. As current events demonstrate, each issuer is subject to a range of idiosyncratic factors created by their unique position in local markets and beyond. Even in a normal market, bid/ask spreads, the primary measure of secondary market bond liquidity, will vary widely country-to-country based on local currency and economic factors. Another EM variant is that nationally recognized statistical rating organizations (NRSROs) may, in our opinion, overweight local government and regulatory risks in EM corporate bond ratings. A successful EMD strategy requires the ability to look beyond ratings to identify relative value across countries and regions.

In spite of the wide range of current geo-political concerns, our overarching view is that local currency bonds will ultimately be the biggest beneficiary of EM growth. Strategies that focus on non-local currency EMD issuers typically allocate only three-to-10 % to local currency. Strategies with higher assets under management may also be constrained by the relatively small sizes of individual local currency offerings. Allocations to local currency bonds, which represent about 50% of EM issuance, expand the range of assets to choose from.

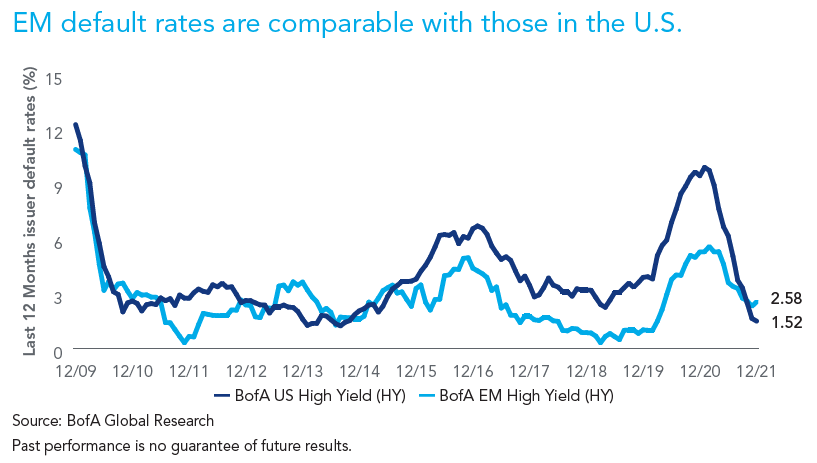

With risk-on assets performing well over the last several years (and some more recent help from increasing discount rates), pensions are as well-funded today as they were before the Global Financial Crisis. Despite this recent success, the path to maintaining and improving funded statuses remains murky as U.S. IG fixed income returns continue to be pressured. EMD can help by providing exposure to unique economic factors and additional return sources (e.g., currency) while delivering a total return profile in line with U.S. HY but with IG-like creditworthiness and volatility.

Read the full white paper about emerging market debt at Federated Hermes site.

ABOUT THE AUTHOR:Jason DeVito, CFA is Vice President, Portfolio Manager and Senior Investment Analyst at Federated Hermes and a member of the Emerging Market Debt key investment team. DISCLOSURES:Federated Hermes is an Associate Member of TEXPERS. The views expressed herein do not constitute research investment advice or recommendations, do not necessarily represent the views of Federated Hermes or TEXPERS, and are subject to revisions over time.

22-40178 (4/22). Federated Global Investment Management Corp. INSTITUTIONAL Sales Material. Not for Distribution to the Public. Past performance is no guarantee of future results. Views are as of 12/31/21 and are subject to change based on market conditions and other factors. These views should not be construed as a recommendation for any specific security or sector. Investments are subject to risks and fluctuate in value. International investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards. Prices of emerging markets securities can be significantly more volatile than the prices of securities in developed countries and currency risk and political risks are accentuated in emerging markets. Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. High yield, lower-rated securities generally entail greater market, credit/default and liquidity risks, and may be more volatile than investment-grade securities.