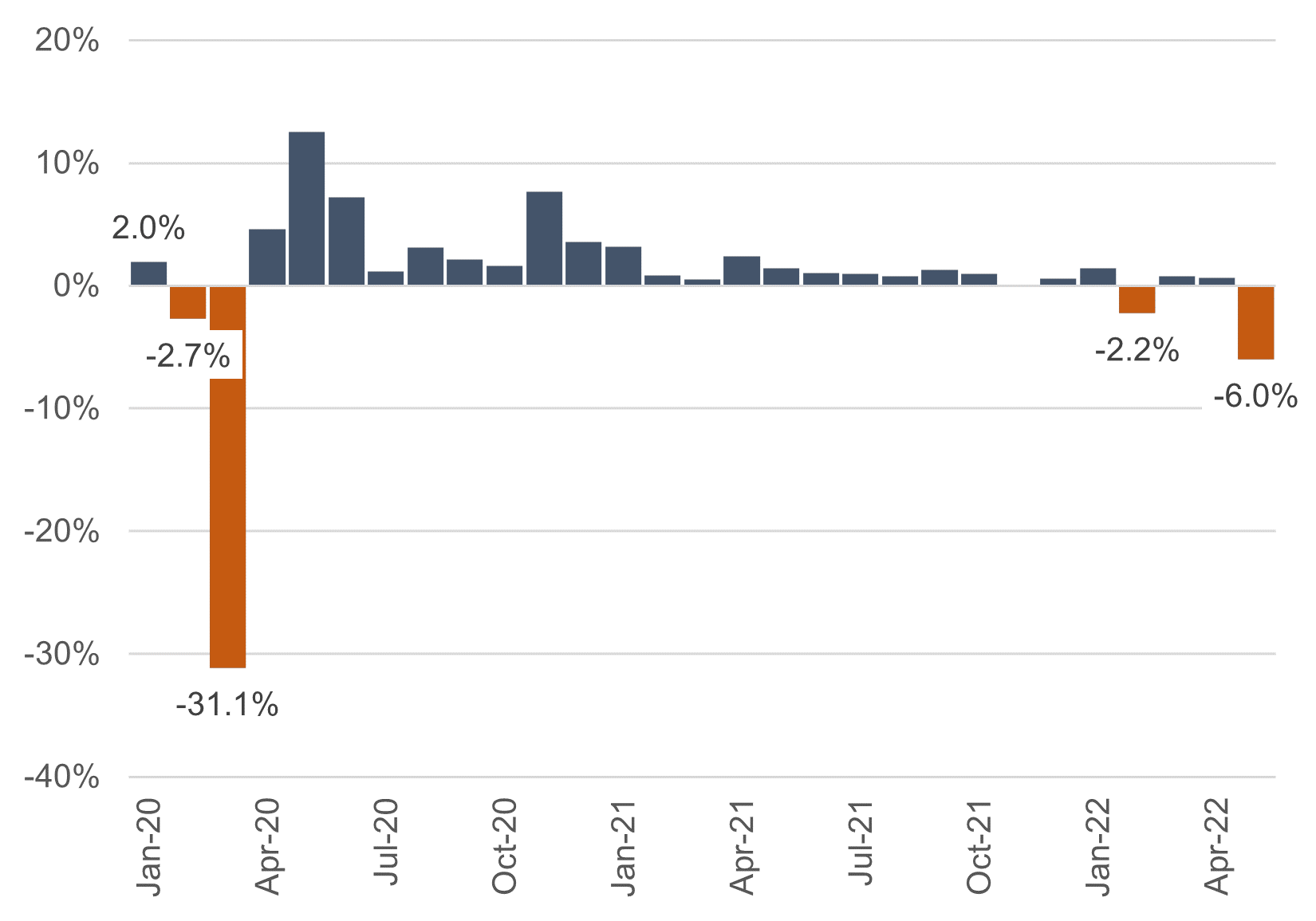

The Creditflux CLO Hedge Fund Index, an index of CLO debt and equity tranche investment managers, ticked down notably in February (-2.2%) and more significantly in May (-6.0%). These were on the back of a 22-month string of positive returns that began in April 2020, after the initial brunt of the Covid-19 crisis.

Falling Loan Prices

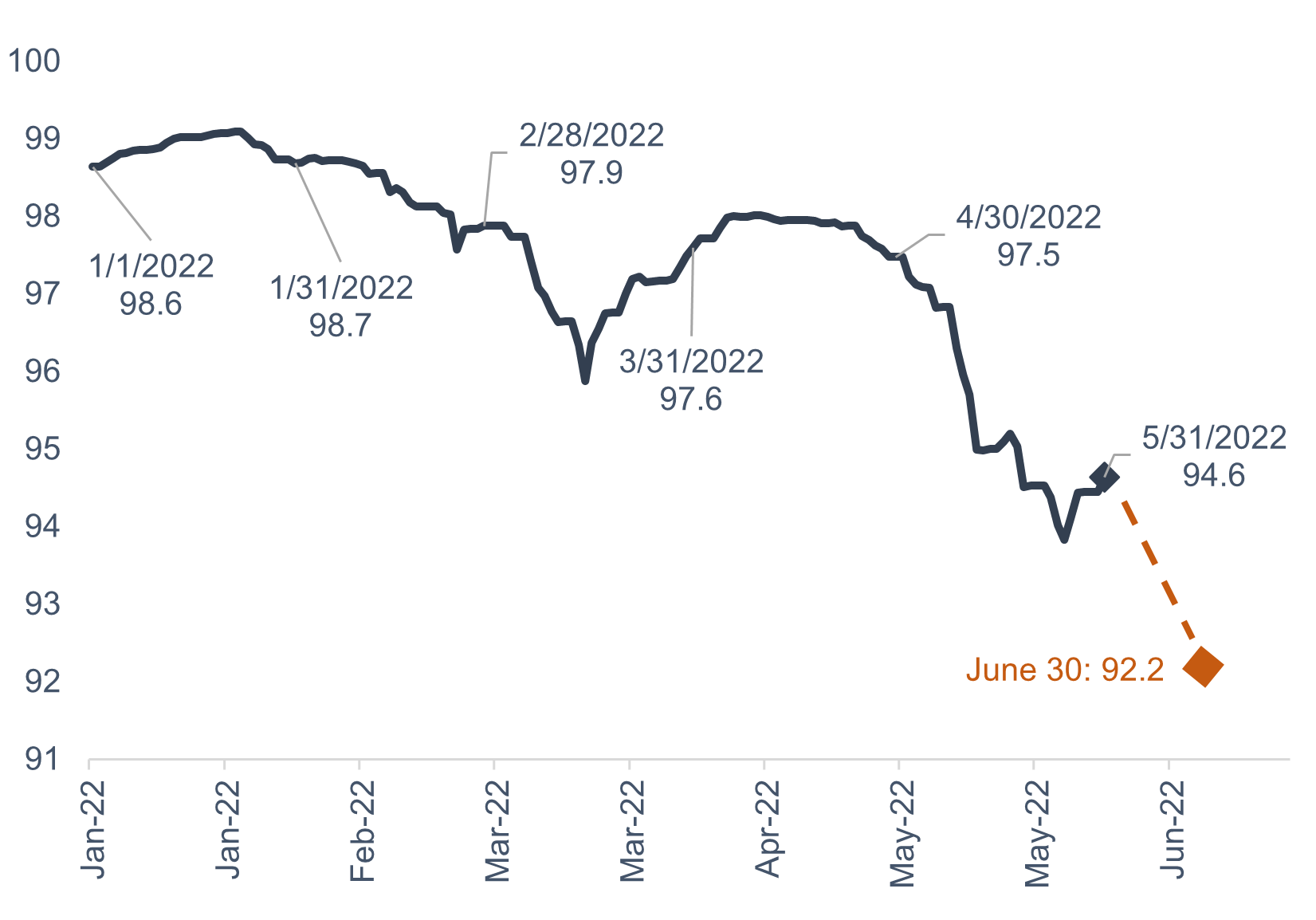

The drawdown in CLO hedge fund returns was not surprising given the decline in leveraged loan prices. The S&P / LSTA Leveraged Loan Index fell 4 points to 94.6 between January 1st and May 31st. It fell further in June and ended the month at 92.2, a 6.4 point drop since the beginning of the year. We expect further declines in the Creditflux index when June performance estimates are published.

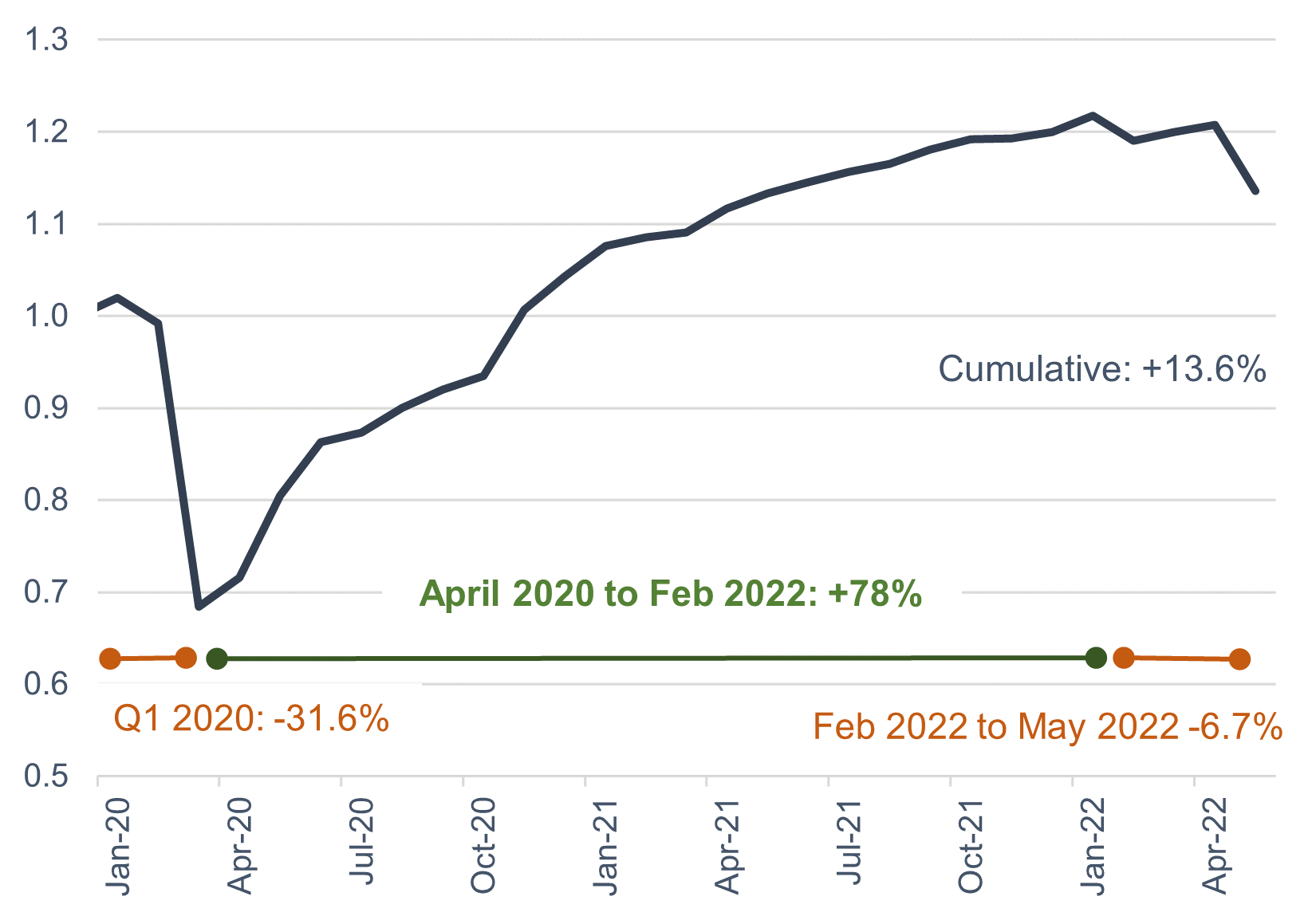

After falling over 30% in the first quarter of 2020, the index had an uninterrupted recovery of +78% until February 2022. Cumulatively, the index gained +13.6% from January 2020 through May 2022.

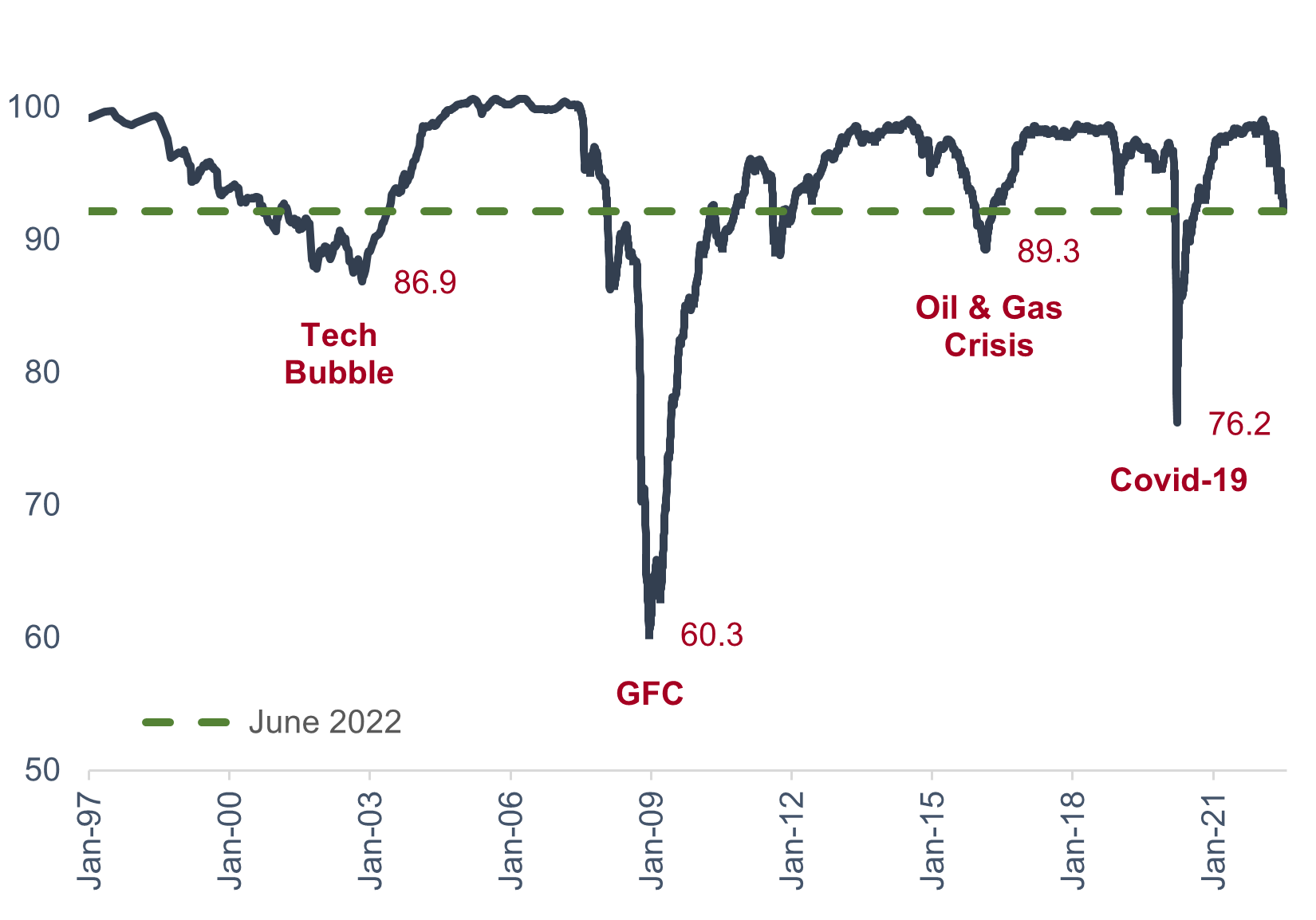

Although significant, the recent moves in leveraged loan prices are not extraordinary. The chart below shows index levels from January 1997 to June 2022. We see that it fell into the 80s following the late 1990’s tech bubble and the 2016 oil & gas crisis, the mid-70s during the Covid-19 crisis, and the low 60s in the depths of the GFC.

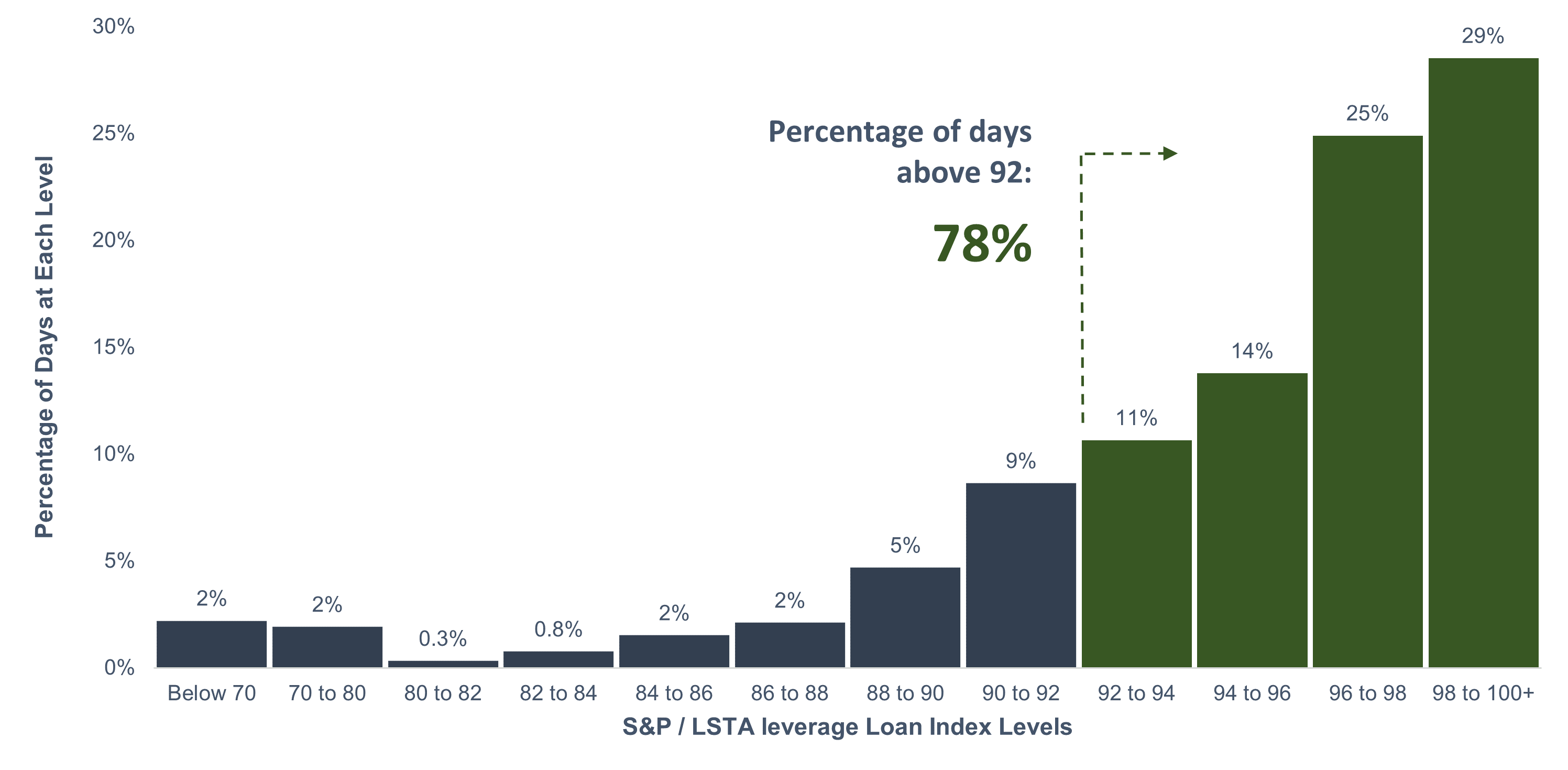

As US leveraged loans tend to approach par value as their maturity dates near, the S&P / LSTA Leveraged Loan Index has tended not to hover too far from par for too long. The following chart shows the percentage of days at various index levels from January 1997 to June 2022. It shows that the index hovered in the mid to high 90s on most days, as expected, and was above the current level of 92 in 78% of the days in its history.

What Does This Mean for CLO Equity?

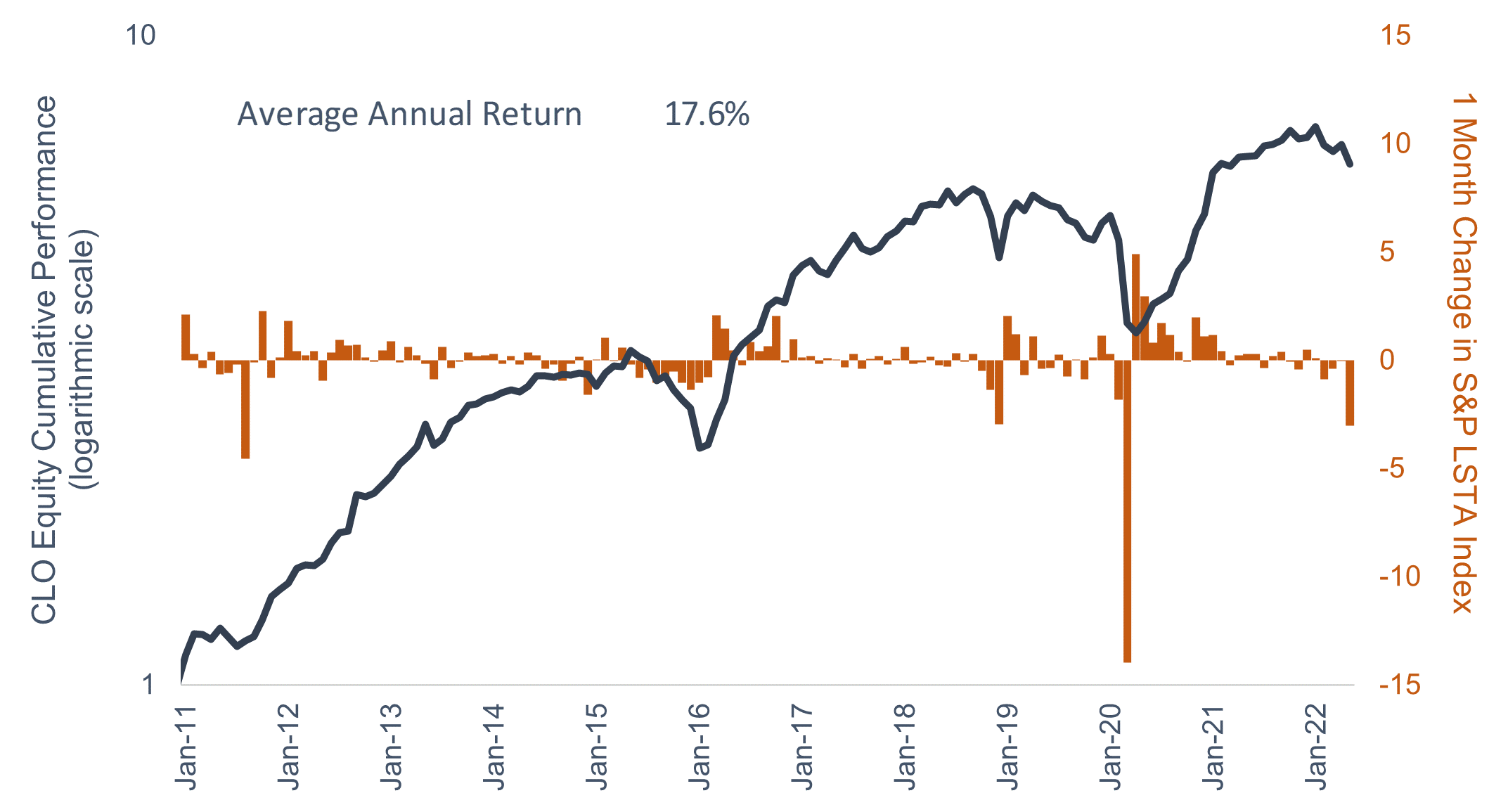

Citigroup has been collecting data on the performance of CLO tranches for many years, including CLO equity starting in January 2008. However, we limit our analyses to data starting in 2011, when substantial CLO equity trading in the secondary market began.

First, we look at the full period return of the asset class. According to Citigroup research, the average CLO equity tranche had a return of 17.6% per year from January 2011 to May 2022. This is not an investable index, but it gives us a useful indication of asset class performance over time. Additionally, we chart the monthly changes in the S&P / LSTA Leverage Loan Index to highlight the relationship between loan prices and CLO equity performance.

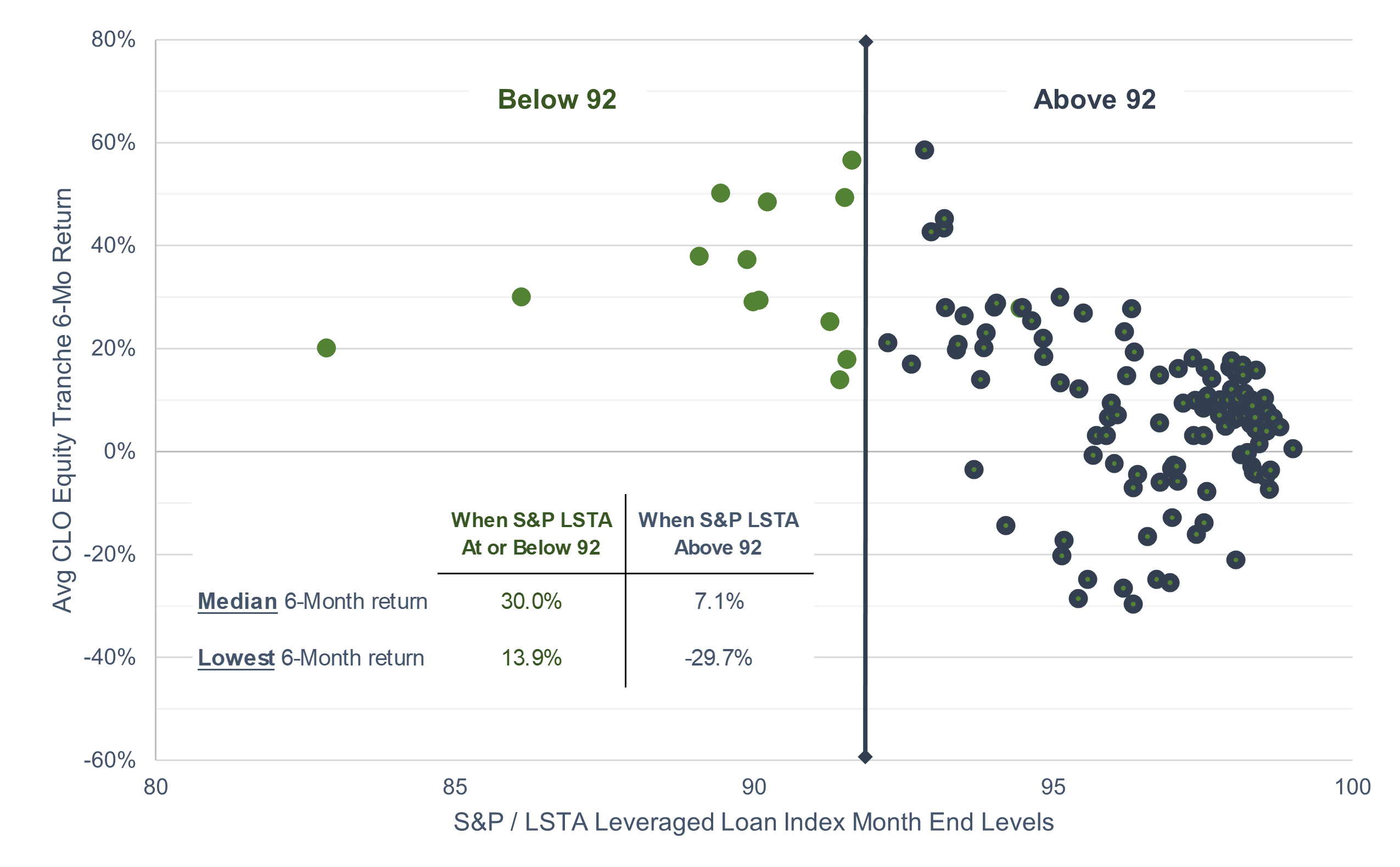

Looking at month-end levels from January 2011 to May 2022, there were 13 months when the S&P / LSTA Leveraged Loan Index was below 92. In those instances, CLO equity had a median return of +30% over the following 6 months, and the lowest 6-month return was +13.9%. When the index was above 92, the median 6- month return was +7.1%, and the lowest 6-month return was -29.7%.

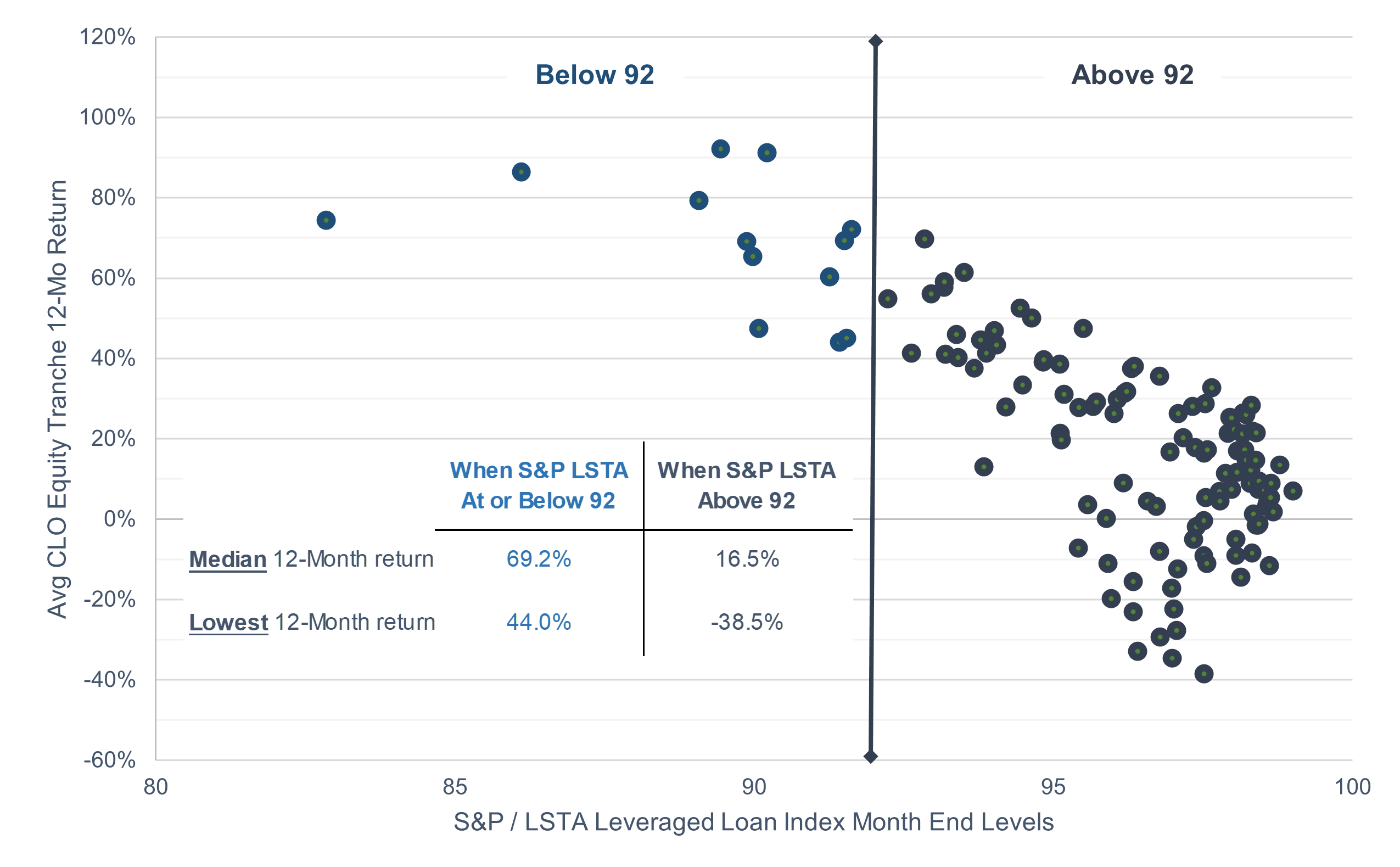

Looking at a slightly longer performance frame: the median 12-month return was +69.2% when the S&P / LSTA Leverage Loan Index was below 92, and the lowest 12-month return was +44%. When the index was above 92, the median 12-month return was +16.5%, and the lowest 12-month return was -38.5%.

Dislocations Are Opportunities | Timing is Hard

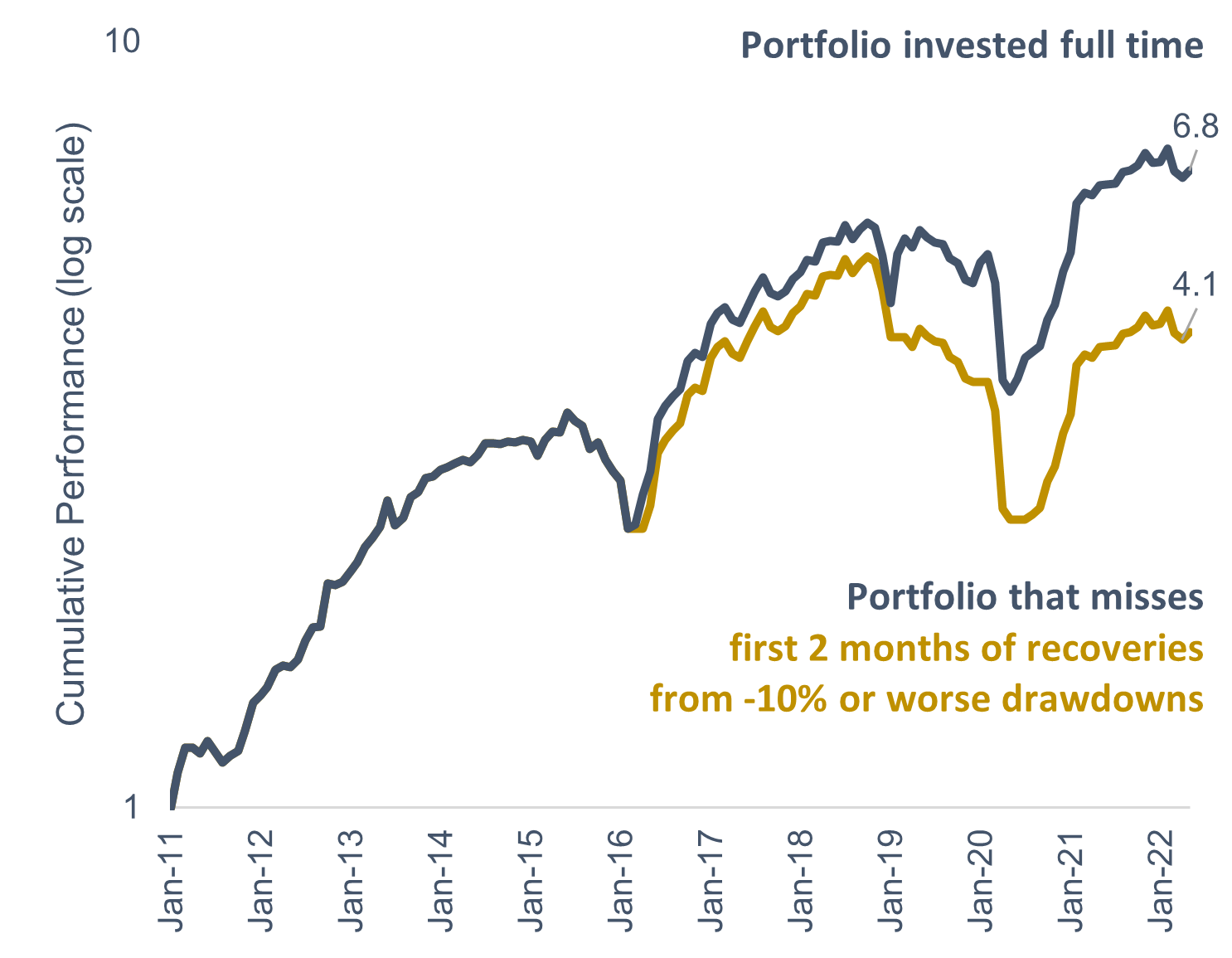

Certainly, loan prices can fall further if the economy continues to falter. However, CLO equity returns have been much better than average when loan prices were at or below the current levels. Although it’s tempting to try to catch the bottom of a downturn, we believe that market timing is exceptionally difficult within the asset class. The chart on the left below shows the cumulative performance of CLO equity based on the Citigroup data previously referenced. It also shows the performance of a portfolio that missed just the first two months of recovery from moderate to large drawdowns (-10% or worse). Note the significant difference; as with other asset classes, the cost of missing the early parts of recoveries is high.

|

|

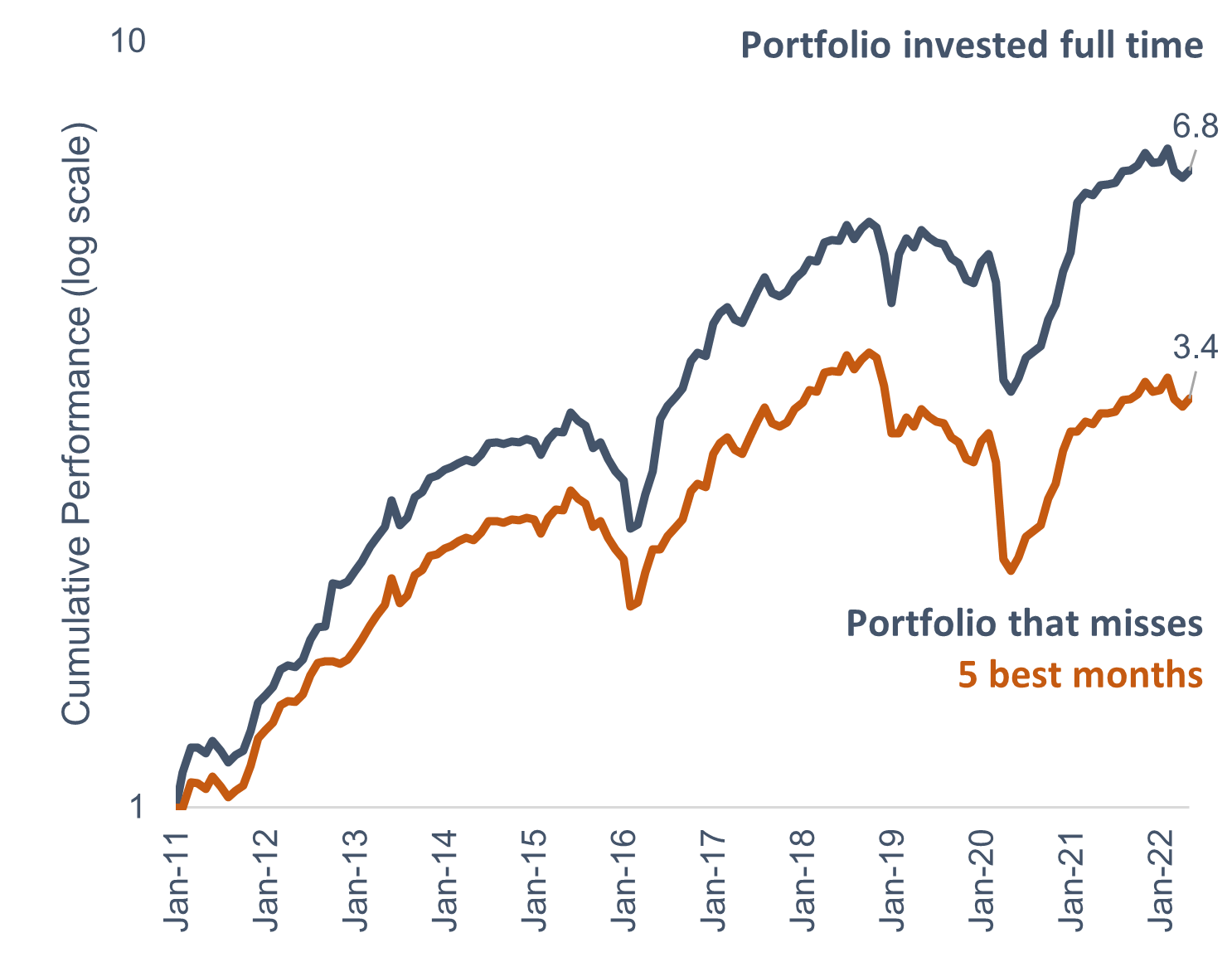

To further illustrate the difficulty of market timing, the chart on the right above shows the performance difference between the portfolio that is invested full-time and one that misses just the five best months in the sample period. The result is predictable but worth noting, given how large the cost of mistiming could be.

Summary

CLO equity offers the potential for attractive long-term returns, and history suggests that the best returns may come after periods like the one we are in today. The convexity to loan prices can produce material outperformance when leveraged loans begin to recover back to par.

DisclaimersOxford Funds is an Associate Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Oxford Funds nor TEXPERS. These views are subject to change.- The Creditflux Index for CLO funds is calculated by Creditflux based on monthly fund performance as submitted to Creditflux by the respective fund managers.

- S&P LSTA Leveraged Loan Index sourced from Bloomberg. Analysis by Oxford Funds.

- Representative CLO equity data is from Citigroup Research. Citigroup calculated actual CUSIP-level CLO equity total returns, using month-end prices from Citi’s trading desk, and took the average total return after excluding the outliers (top and bottom 5% percentile). The Citigroup Avg CLO Equity Tranche performance is unmanaged, and its past performance is not necessarily indicative of Oxford Fund’s future results. Oxford Funds actively manages its portfolios. Active management, the ability to leverage, cash drag or security selection among other factors may result in a return profile that would differ from the return profile shown above.

- CLO equity data is from Citigroup Research. Analysis of alternate portfolio performance was produced by Oxford Funds.