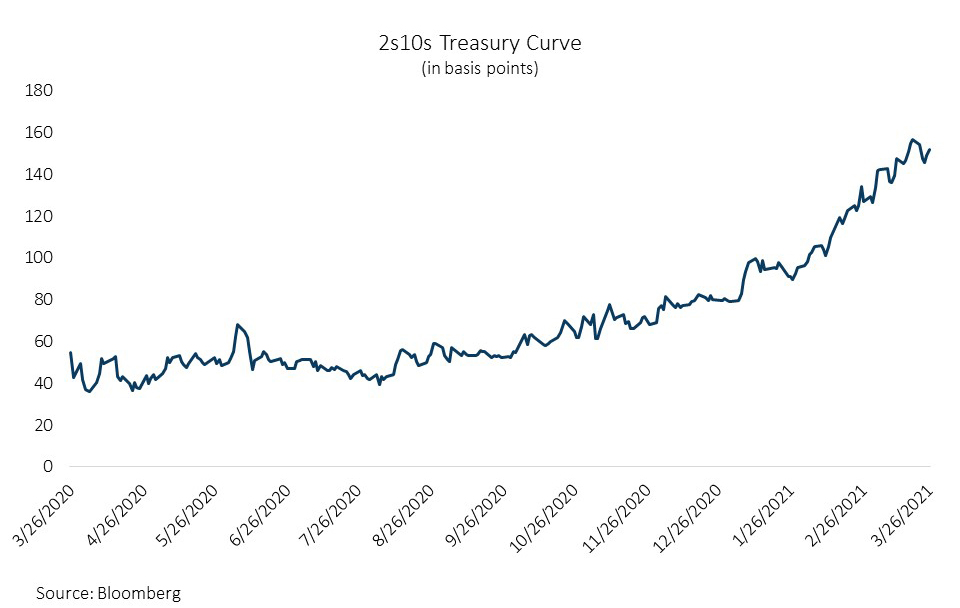

Despite the Federal Reserve’s promise to keep the federal funds rate low and support the bond market via quantitative easing, interest rates have seen an acute increase since August 2020. The yield on the 10-year Treasury was 0.52% on August 4 and stood at 1.74% on March 31. Additionally, the U.S. Treasury yield curve has steepened dramatically since August, reflecting rising inflation or growth expectations. The “2s/10s” curve has steepened from around 0.50% to nearly 1.10% over the past year.

The move higher in rates and steepening of the yield curve has resulted in negative total returns for bond investors. The Bloomberg Barclays U.S. Aggregate Bond Index returned -3.37% for the first quarter of 2021 and -3.56% from July 31, 2020 to March 31, 2021. These negative fixed income returns, along with concerns about runaway inflation, have led some to speculate that the long bull market in bonds has finally come to an end.

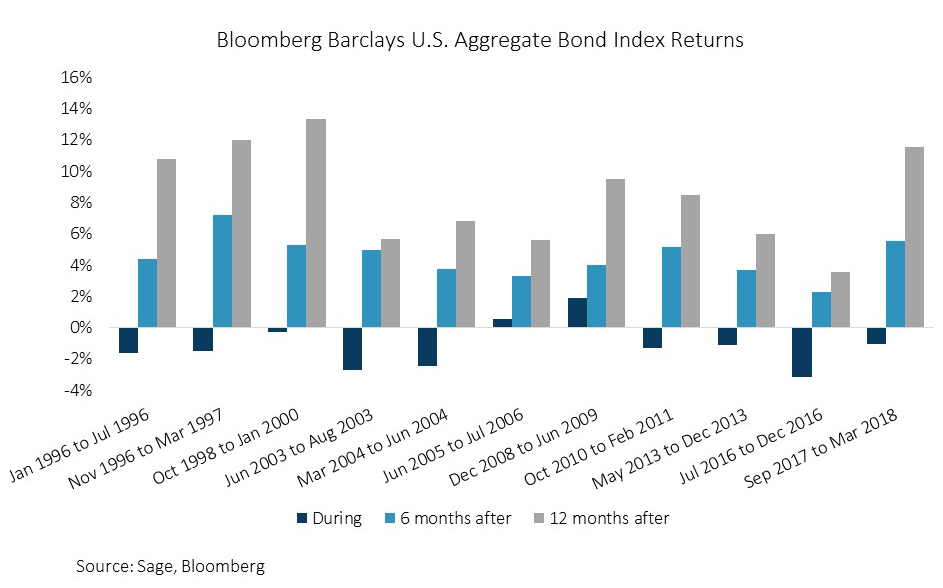

While we may be entering an era of higher GDP growth and inflation expectations, it’s important to remember what typically happens to core bond returns following such sharp interest rate moves.

Sage has looked at 11 such instances of rising rates since 1996 – defined as at least a 75-basis-point increase in the U.S. 10-year Treasury note – and found that in every previous occurrence, bonds outperform once these moves have been exhausted. The aggregate bond index experiences modest negative returns during these periods, on average -1.35%; however, over the course of the next 12 months, returns are usually very strong.

In fact, all 11 instances we’ve studied since 1996 have produced positive returns, with an average return of 8.16% – more than double the typical 4% return expectation for the index.

Asset allocators should take note of this historically strong return stream, especially given the large run-up in equities over the past few years. While much has been written to warn investors that inflation could continue to weaken fixed income returns, the history of the past four decades tells a very different story: it suggests that now may be the time take a fresh look at fixed income.

Historical aggregate bond index returns during and after a 75-basis-point increase in the U.S. 10-year Treasury note.About Ryan O'Malley

Ryan O’Malley serves as Fixed Income Portfolio Strategist at Sage. He began his investment career in 2004 as a Senior Equity Analyst at Origin Capital Management. He then worked as an Equity Analyst at Tidal Creek Capital Management, LLC. Later, O'Malley worked as a Corporate Credit Analyst at Payden & Rygel. He received his MBA from the Anderson School of Management from the University of California Los Angeles and his bachelor's degree in Economics from Columbia University in New York City. He is a Chartered Financial Analyst (CFA) and member of the CFA Institute.

Ryan O’Malley serves as Fixed Income Portfolio Strategist at Sage. He began his investment career in 2004 as a Senior Equity Analyst at Origin Capital Management. He then worked as an Equity Analyst at Tidal Creek Capital Management, LLC. Later, O'Malley worked as a Corporate Credit Analyst at Payden & Rygel. He received his MBA from the Anderson School of Management from the University of California Los Angeles and his bachelor's degree in Economics from Columbia University in New York City. He is a Chartered Financial Analyst (CFA) and member of the CFA Institute.

This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results. Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Sage Advisory Services is an Associate member of TEXPERS. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of TEXPERS. Views are subject to change over time. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about the public pension industry in Texas.