Addressing the Environmental Challenge in the Maritime Industry

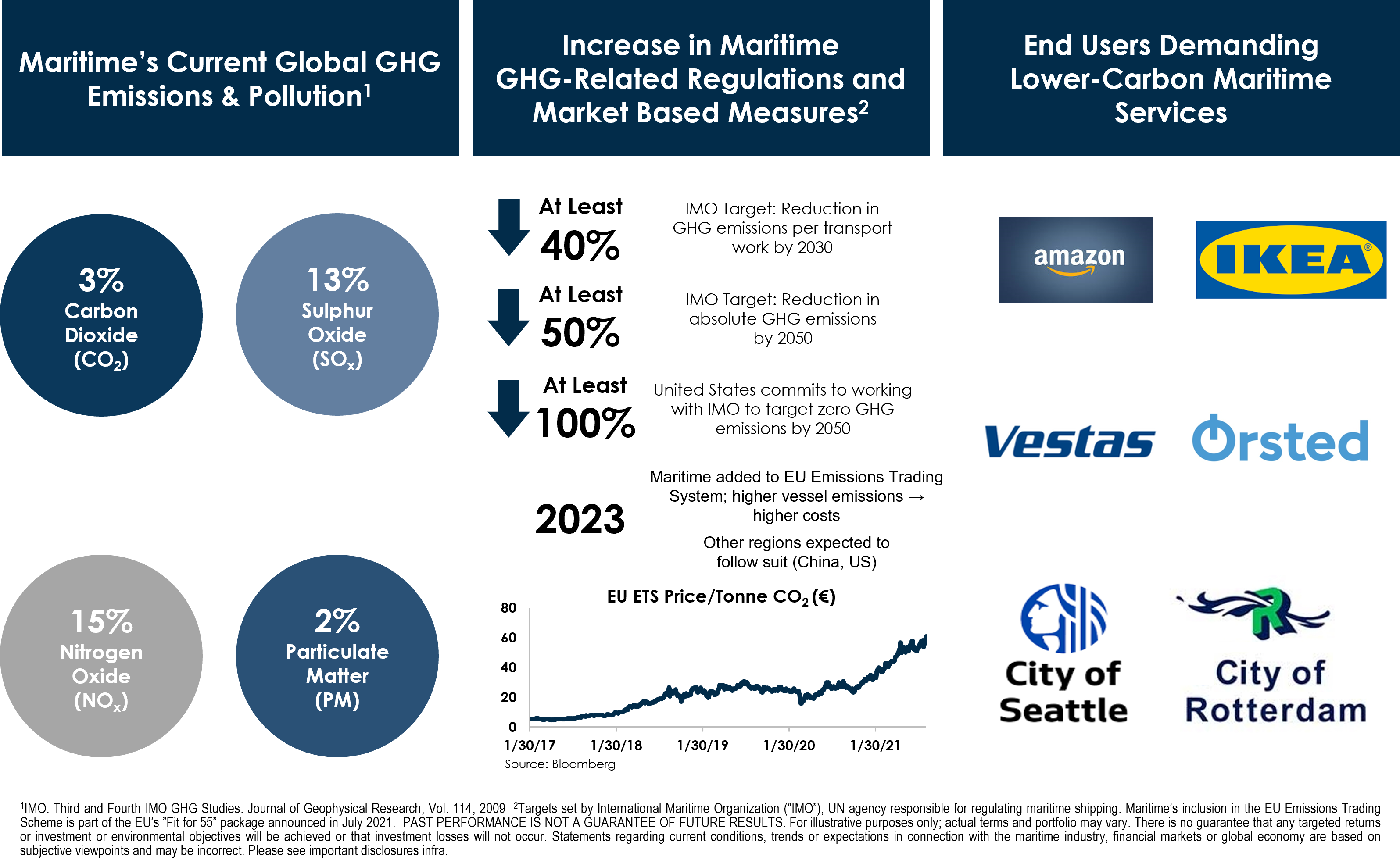

The maritime industry is a massive and critical component of the global supply chain, responsible for transporting approximately 90% of global goods and commodities,[1] as well as producing clean electricity and low-carbon food. Due to its size, the industry is responsible for approximately 3% of global CO2 emissions,[2] as well as other pollutants.

As a result, there is an increasing demand for low-carbon maritime vessels and infrastructure equipment (“maritime assets”), driven by corporates and governments looking to decarbonize their supply chains and infrastructure, as well as by increasingly tightening environmental regulations and market-based-measures such as carbon tax regimes.

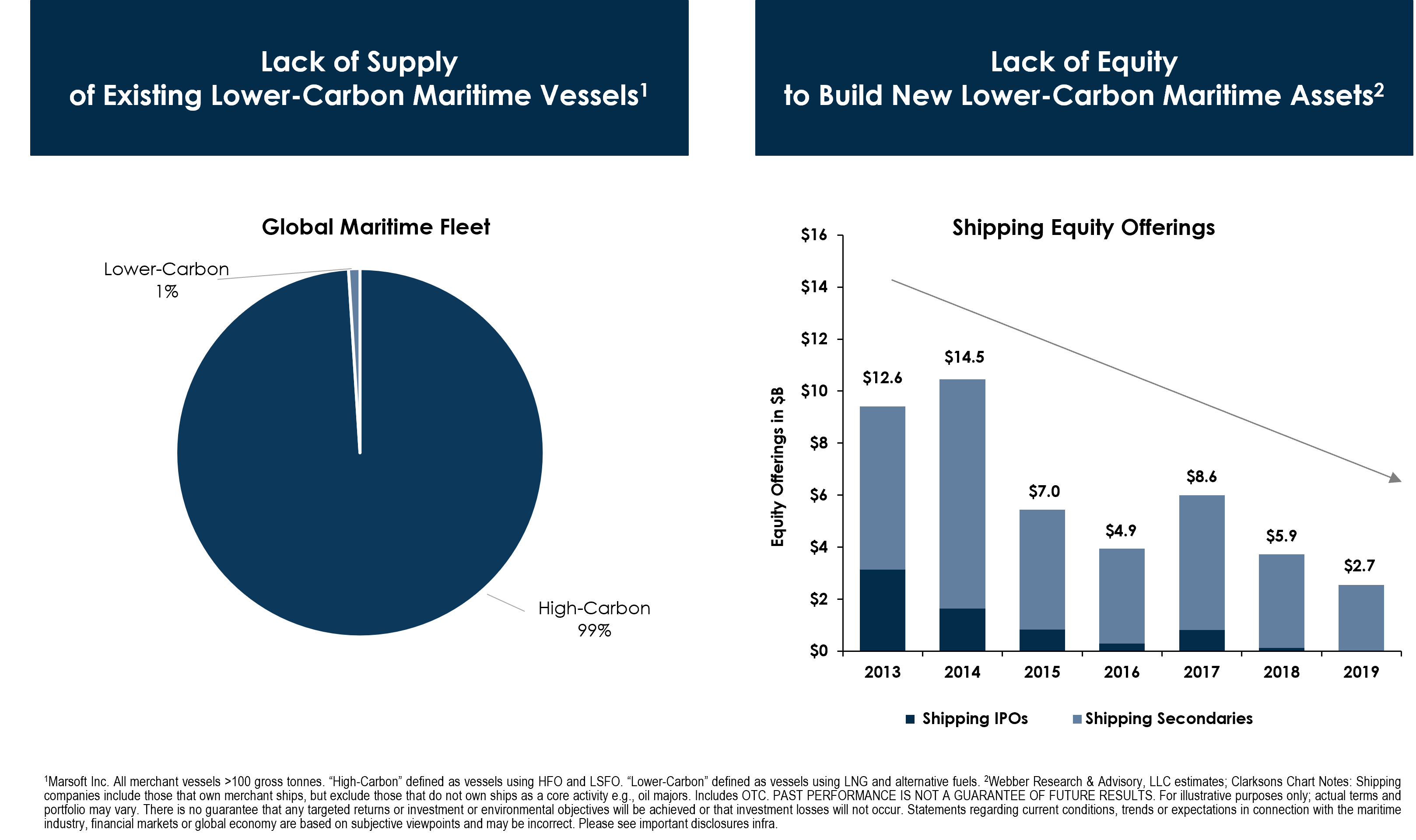

However, with approximately 99% of the current global maritime fleet being high-carbon,[3] there is a significant lack of supply of lower-carbon maritime assets, as well as a lack of equity capital to build such assets. According to Clarkson’s, a leading shipbroker, over $3 trillion of capex is needed for investment in lower-carbon maritime assets to meet the current maritime regulatory decarbonization targets, which are expected to get more ambitious over time.

We believe the lack of lower-carbon maritime assets, and the lack of equity capital to build such assets, presents a compelling equity investment opportunity. The opportunity is enhanced by the amount of debt capital focused on sustainable lending. Like real estate and infrastructure, maritime assets are typically acquired with a combination of equity and bank debt. As an example, 28 leading global banks representing approximately $185 billion in maritime finance have committed to the Poseidon Principles, a global framework for supporting the decarbonization of the maritime sector by incorporating climate considerations into lending decisions.

Decarbonization Pathways – There is No Silver Bullet

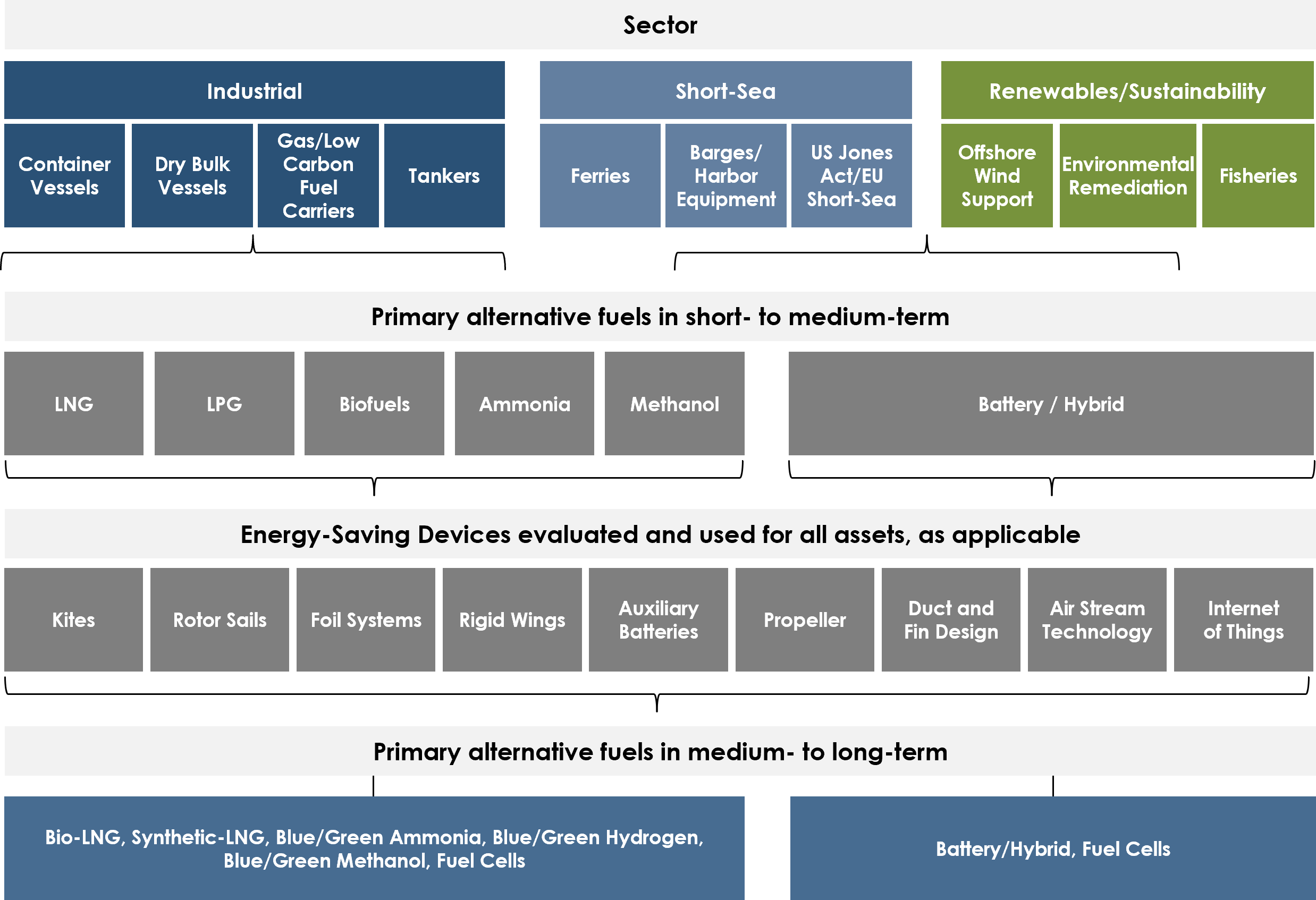

Due to the vast size of the maritime industry and the diverse uses of vessels and maritime equipment, no single “silver bullet” solution exists to decarbonize and reduce the environmental impacts of the entire ocean industry. Rather, different fuel technologies, as well as digital and operational solutions, will need to be deployed for various vessel types and sectors.

For example, battery technology, either as the sole solution, or as part of a hybrid system, is a viable pathway for the primary propulsion of certain vessels such as offshore wind service operation vessels (“SOVs”) and passenger ferries, given the relatively short distances travelled by such vessels, their set schedules, and their access to charging stations.

For other sectors such as industrial shipping, where energy use is much higher and the required energy storage is substantial, zero-emission solutions are currently unworkable.

For these “hard-to-abate” sectors, low-carbon fuels such as liquefied natural gas, liquefied petroleum gas and biofuels are being increasingly utilized, in combination with energy-saving devices and design and operational efficiencies where economically feasible, until ultra-low carbon and zero-emission fuels/technologies (e.g., electrofuels such as green ammonia, hydrogen, methanol and synthetic LNG) are available and successfully commercialized.

Given that the economic life of a vessel is generally 25-30 years (so vessels built today may still be in service in the 2040s), capital budgeting decisions regarding which vessels to acquire, and what their primary and auxiliary propulsion systems should be, are incredibly important. Accordingly, we believe that investing in vessels with the ability to switch to increasingly low-carbon fuels in the future at the lowest possible cost is key.

The relative price of these ultra-low carbon and zero-emission fuels will dictate their long-term uptake. The relative price and commercial availability of these fuels will depend on the buildout and relative cost of their production, distribution and storage infrastructure, which is in turn dependent on regional industrial energy policies, carbon/environmental regulations, large ocean industry companies’ corporate strategies, and the capital expenditure financing available.

In addition to next-generation primary propulsion and auxiliary power systems, improvements to the energy management and emissions efficiency of vessels should be further enhanced through digitalization and other operational improvements over the vessels’ economic lives.

Such measures are a key part of the overall strategy of vessel owners, operators and end-user corporations to improve energy and cost efficiencies. For example, energy-saving devices such as modern sails can be installed cost-effectively on many vessels today, while the wide use of sensors on board allows data to be collected and analyzed to improve engine system efficiency and enhance hull designs to better suit the operational profile of the vessel.

The Need to Act Now

Progress on reducing emissions needs to begin now, aligning with customer/corporate demands for sustainable supply chains, while developing the technologies and infrastructure needed for a full decarbonization of the maritime industry in the future.

National and local governments, as well as corporations, are recognizing that there is no time to wait and that the global carbon budget (e.g., the amount of GHG we can emit into the atmosphere) to stay within a 1.5°C to 2°C warmer world will likely be breached in the next decade or so,[4] unless significant action is taken now.

Given the maritime industry’s integral role, for any sector, industry, company, country, or city to fully decarbonize, the maritime industry must also decarbonize.[5] The progress made by the maritime industry today and over the next decade to reduce its carbon emissions and environmental impact will be critical to accelerate the transition to a net zero-carbon and sustainable future to meet the objectives of the Paris Agreement and Sustainable Development Goals.

About the Author: Svein Engh is Head of the Blue Ocean Group, EnTrust Global’s maritime investment platform. EnTrust Global is a roughly $20 billion alternative asset manager based in New York.

Svein Engh is Head of the Blue Ocean Group, EnTrust Global’s maritime investment platform. EnTrust Global is a roughly $20 billion alternative asset manager based in New York.