The demand for single-family housing in the U.S. should be exceptionally strong over the next decade due to a combination of demographic forces and lagging underinvestment in residential stock. Hines Research estimates that the market will require 17 million single-family housing starts from 2021–30. This would represent a dramatic escalation of home construction relative to any decade of the past fifty years and a generational opportunity for residential lot development.

The demographic case for accelerated single-family housing construction in the U.S. has three primary arguments:

- The household formation rate is well below its long-term average; a return to average would create more households and thus more housing demand.

- Homeownership rates are below average in most age cohorts; a return to average would be a net positive for housing demand.

- The millennial generation is aging; if this group follows historic precedent by graduating from a primarily renter to a primarily owner group, it would generate significant housing demand.

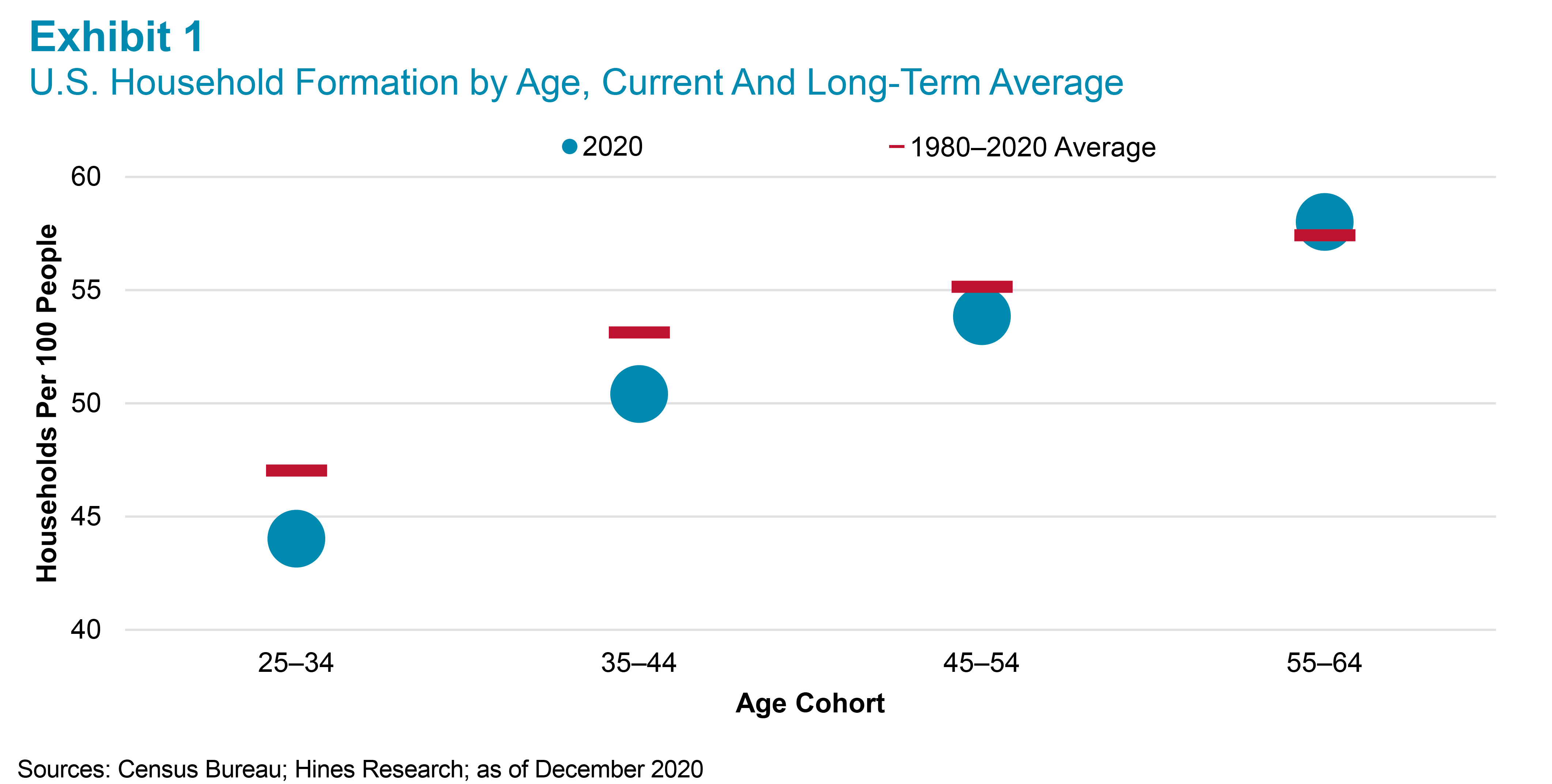

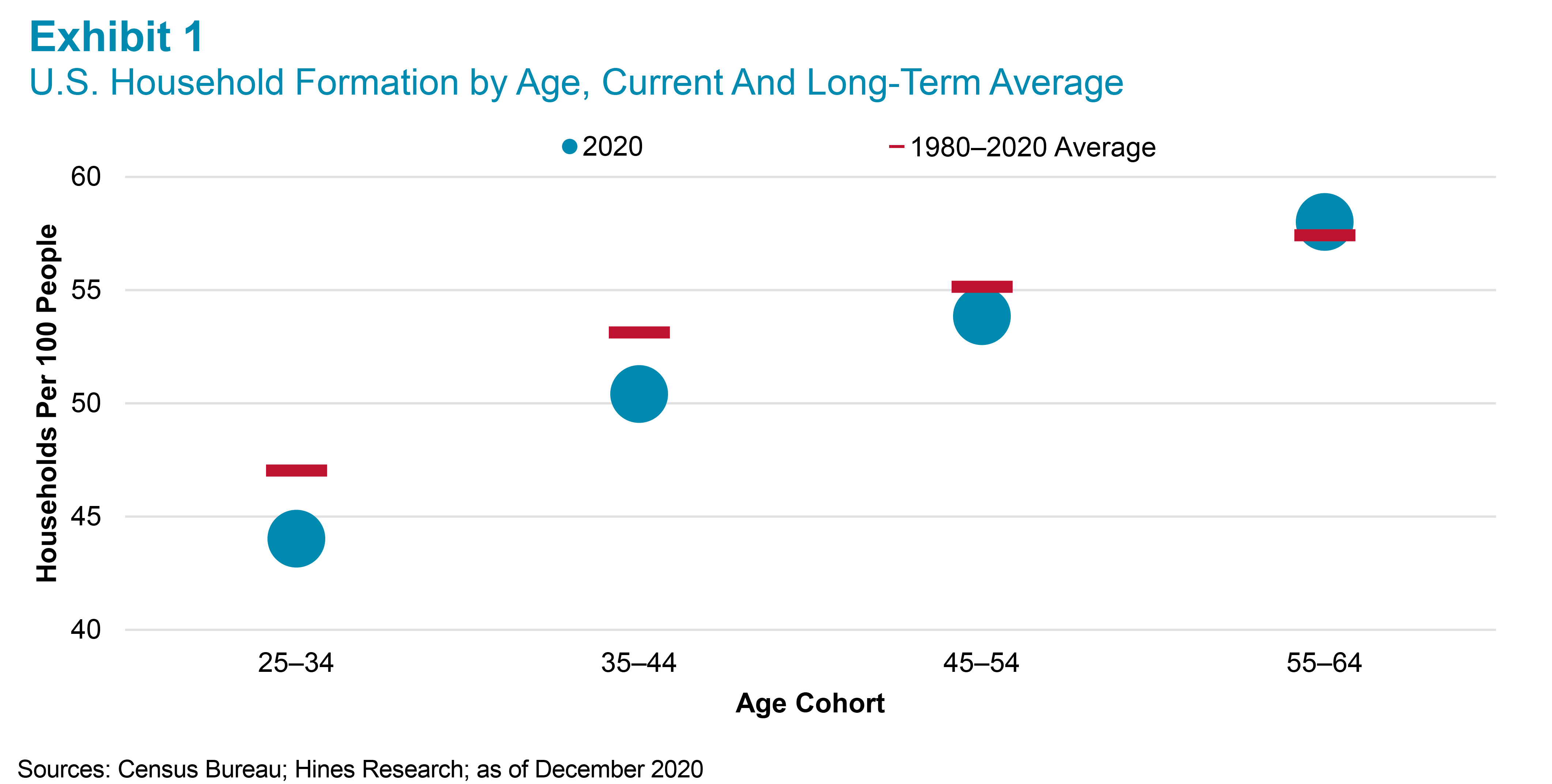

The first argument concerns household formation. The Global Financial Crisis (GFC) depressed household formation rates across age cohorts, and it has yet to fully recover. As shown in Exhibit 1, the number of households in most age groups is well below the long-term average. For 25–34-year-olds, there are today three fewer households per every 100 people than would be expected under normal conditions, while the 35–44-year-old cohort has 2.7 fewer households per 100 people. Summing up the deficit across all generations implies that the U.S. is currently 2.8 million households below trend. At a 2020 homeownership rate of 65.8%, that suggests a pent-up demand of 1.9 million single-family homes if household formation rates were to normalize.

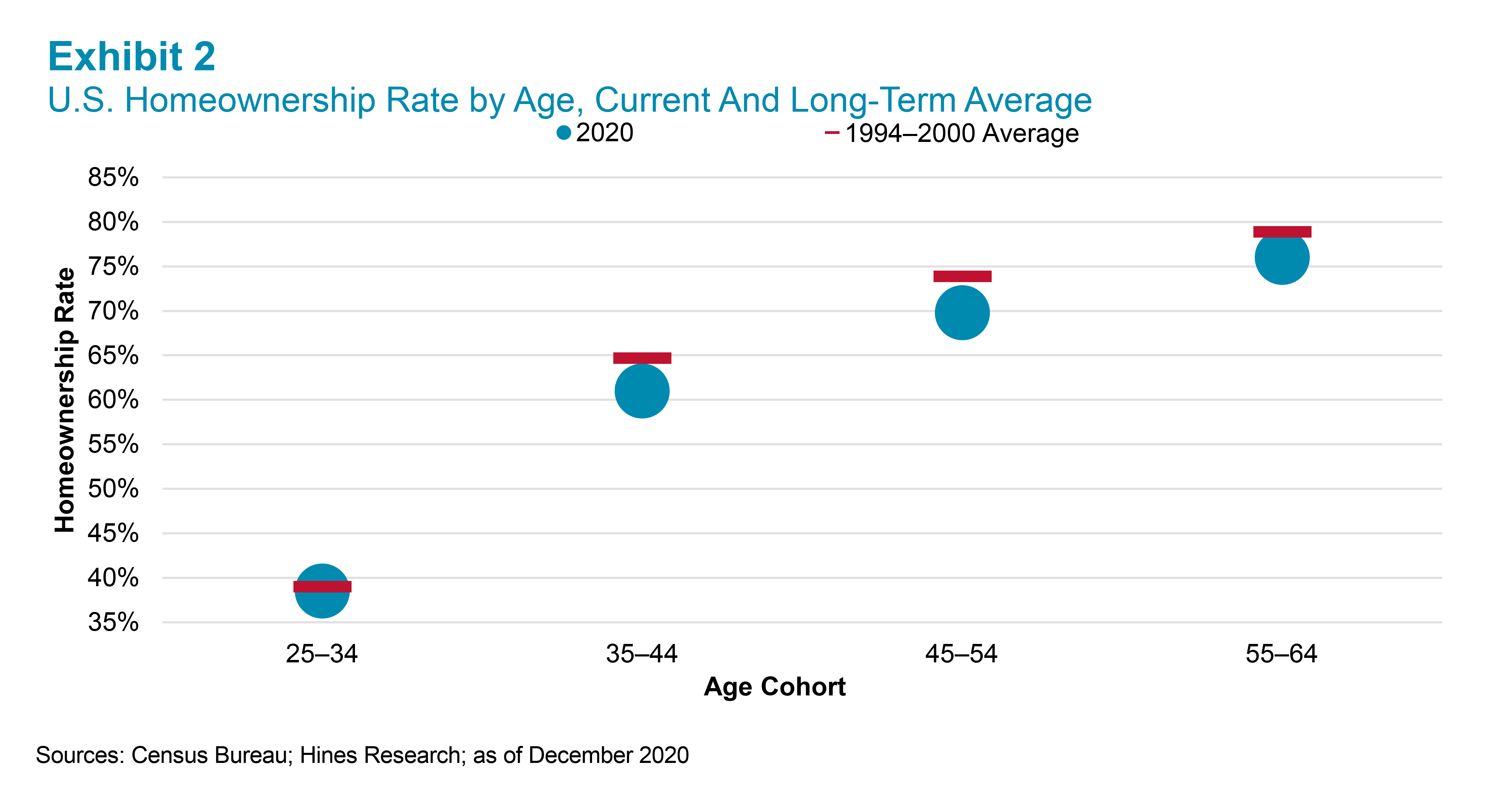

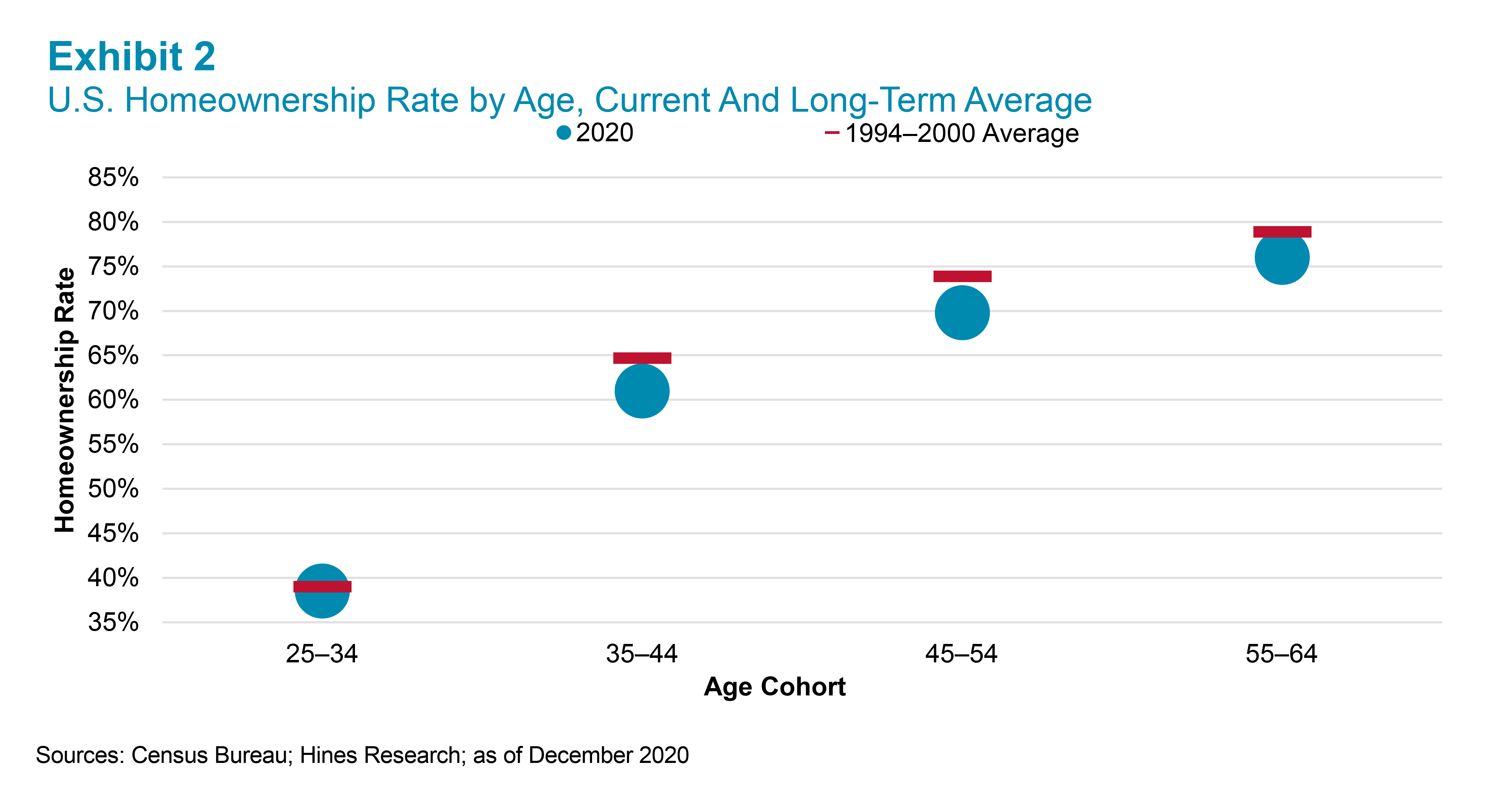

The second argument concerns homeownership. While the 2020 headline homeownership rate of 65.8% is only 50 bps below the 1994–2020 average, the divergence becomes more pronounced when controlling for household age. The headline rate is buoyed by the 65+ age group, which currently represents a larger-than-average share of the U.S. population. This cohort has the highest propensity to homeownership (80%) and is slightly above its long-term rate today. Among the younger demographic cohorts, however, homeownership is low. The key 35–44 and 45–54-year-old cohorts are currently 370 bps and 410 bps, respectively, below their long-term averages. This again appears to be another effect of the GFC. If these rates were to normalize over the next decade, they would unleash demand for 3.1 million additional single-family homes.

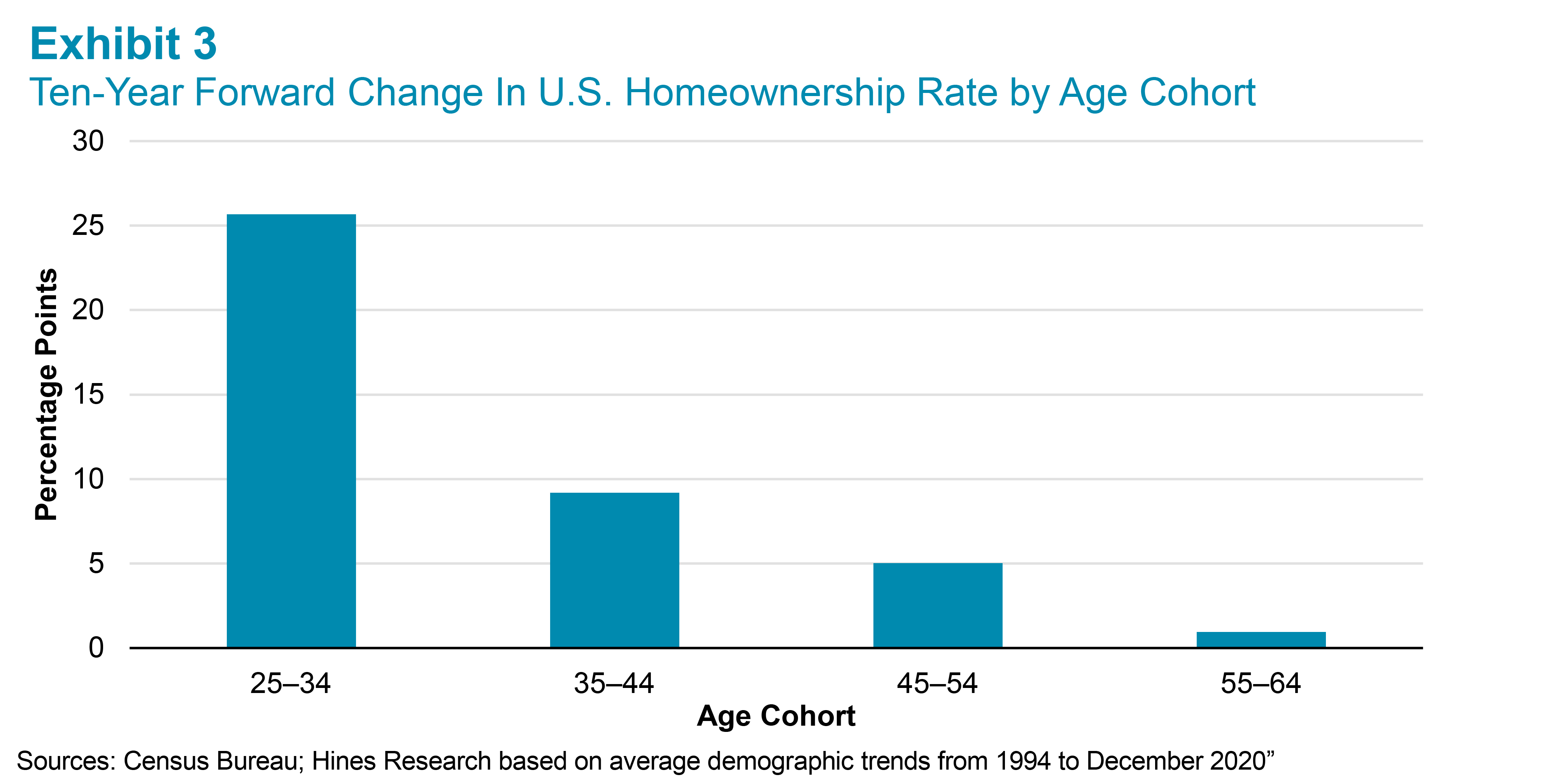

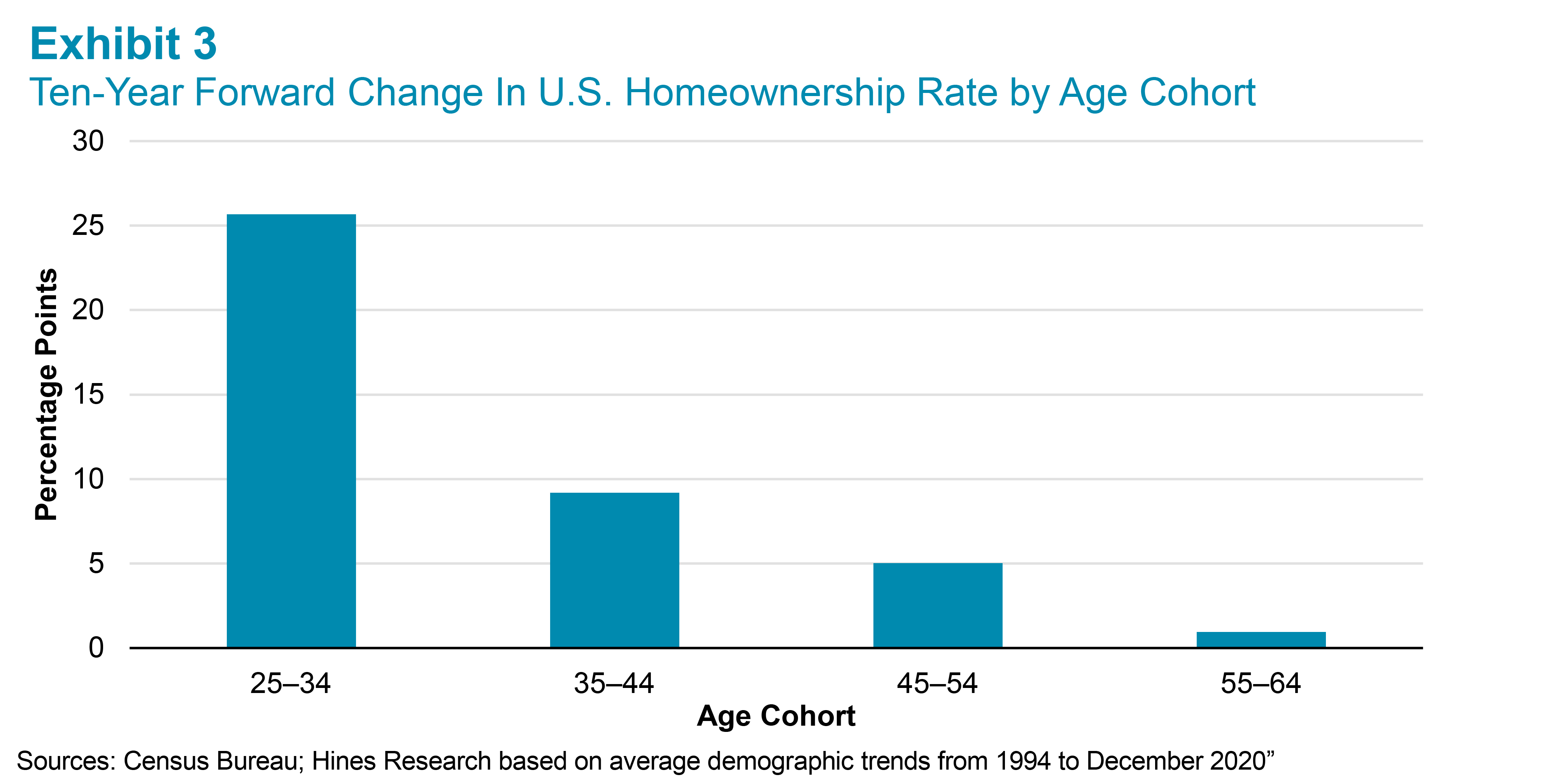

The third, and most compelling, demographic argument for single-family construction is the age profile. The U.S. has an uncharacteristically large share of its population in the 25–34 age cohort, a demographic with a low propensity to homeownership. Over the next 10 years, this cohort will age into the 35–44-year-old bracket, one with a dramatically higher homeownership rate. This transition would typically result in a 26% increase in the group’s homeownership rate. As shown in Exhibit 3, other age cohorts are also expected to contribute to an increase to the overall homeownership rate, albeit less dramatically.[1] This aging effect would by itself be expected to represent 9 million units of single-family housing demand.

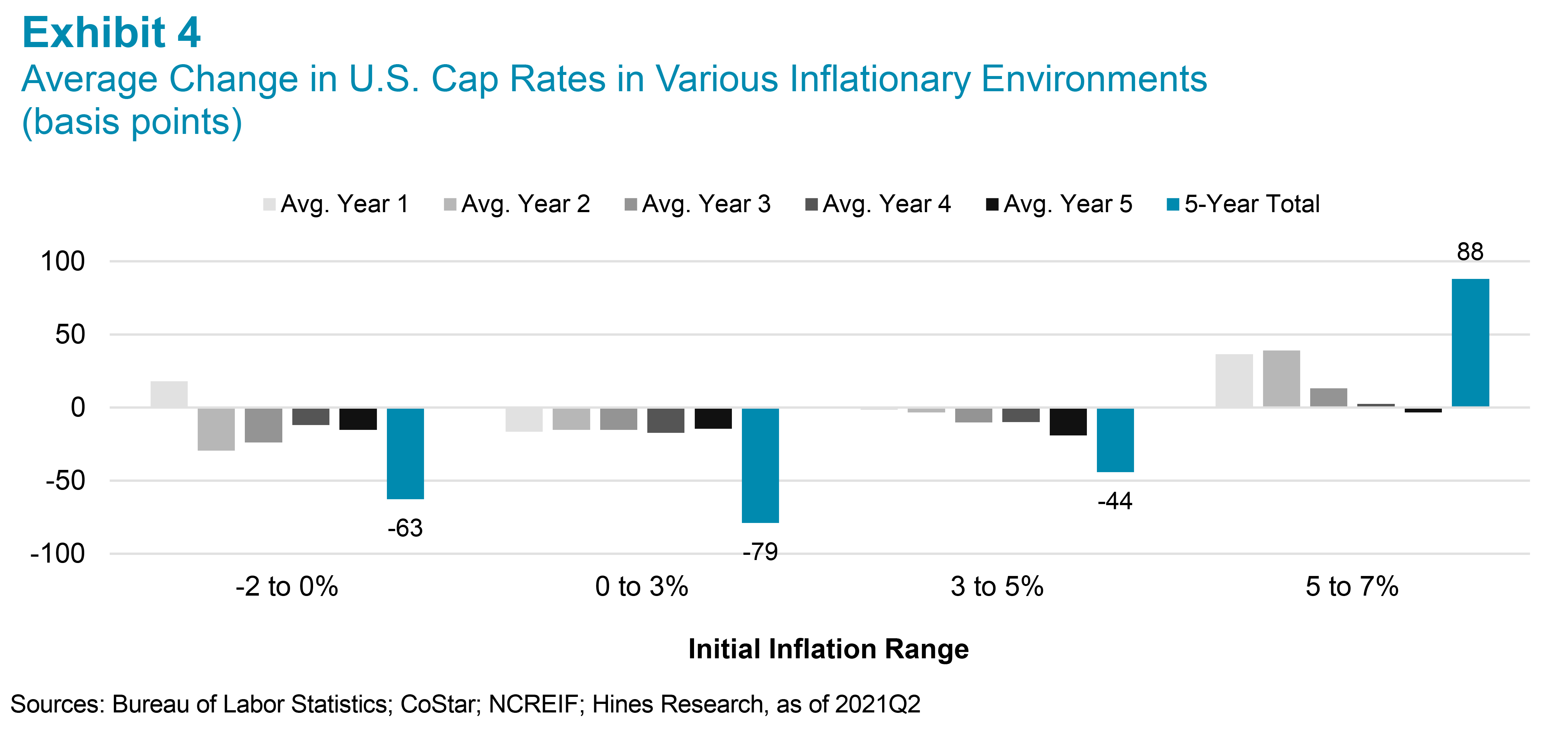

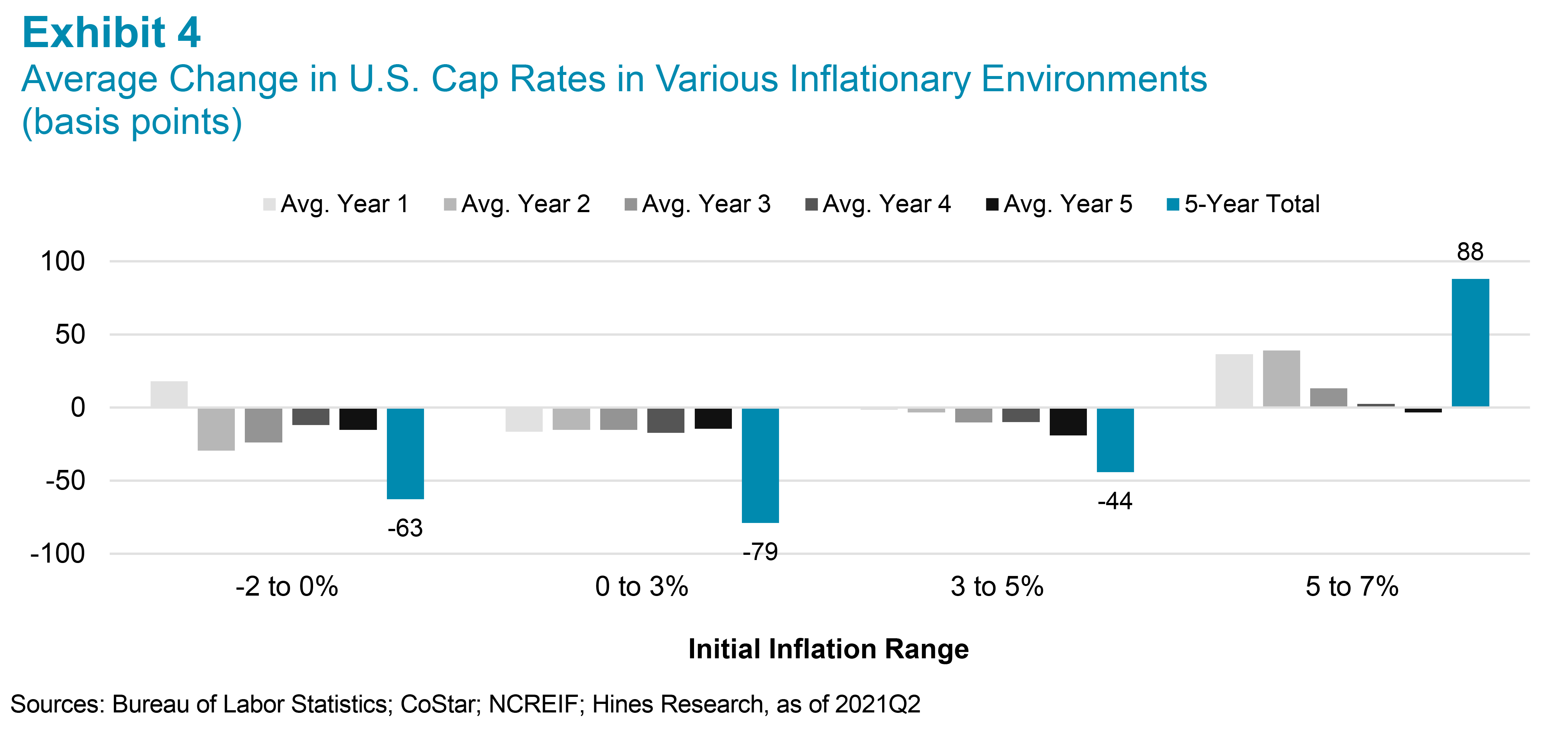

Taking all three demographic factors into consideration and controlling for obsolescence,[2] Hines Research projects demand for 16.8 million new single-family housing starts over the next 10 years. As shown in Exhibit 4, that figure would be by far the highest of any decade going back to the 1980s. It may, however, underrepresent the true requirement due to underinvestment in the previous decade. The 2011–20 period saw 6.6 million fewer single-family housing starts than what would be expected per demographics so there may be some additional pent-up demand from the last decade still to satisfy.

The demographic outlook for new housing development is generally favorable throughout the U.S. While data limitations prevent an identical replication of the single-family starts needed analysis at the metro level, the chart below shows the implied need over the next decade using some base assumptions.[3] In the majority, demographic trends imply that housing starts needed from 2021–30 will be well above each metro’s 30-year average for single-family construction. In the case of Tampa, Seattle, San Antonio, San Diego and San Jose, implied starts needed are more than twice the historical average. Only in a handful of Midwestern markets like Chicago, Indianapolis and Cleveland are implied starts needed below historic level of construction.

Conclusions

The magnitude of single-family housing demand projected by this paper would require a substantial escalation of construction. In this scenario, holders of prime land sites should benefit from increased demand from builders. Developed residential lots ready for immediate construction should sell at a premium. Alternatives like larger-format apartments and multifamily communities with amenities that appeal to aspirational homeowners may also thrive should supply of for-sale housing fail to keep pace with demand. Single-family rentals that offer the benefits of homeownership and convenience of professional management could be particularly well-positioned for growth over the next ten years, but there is insufficient data to estimate the ultimate potential size of the market at present.

[1] Not pictured in Exhibit 3 but included in the analysis is the 15–24-year-old demographic, which would presumably increase its homeownership from a negligible amount to 39% over 10 years; the 65–74-year-old demographic, which is assumed to have no change in homeownership rate over 10 years; and the 75+ demographic, which is assumed to revert to zero homeownership over 10 years.[2] Historical analysis using the method described in this paper concludes that for every four new homes demanded, there have historically been five housing starts. Hines Research credits this discrepancy to the replacement of obsolescent stock and has used this five-to-four ratio to project demand for future housing starts.[3] Starts needed projections based on Moody’s metro-level demographic forecasts, 2021–30. Metro-level analysis assumed metro household formation and homeownership rates revert to long-term averages by 2030; local population-to-household ratios to be same as national; 2019 metro single-family-to-condo occupancy ratios to be predictive of future homeownership preferences; metro single-family obsolescence ratios to be consistent with CoStar’s historic multifamily demolition/redevelopment rates; and metro homeownership rates by age of householder to be relatively consistent with national levels but calibrated to the metro overall homeownership rates over the 2016–20 period. About the Author:Ryan McCullough, Director - Research at Hines Research, reports to Hines Senior Managing Director – Research Joshua Scoville, who is a voting member of the firm's global Investment Committee and reports to the Global Chief Investment Officer. Other members of the Hines Research team include Michael Hudgins, Erik Thomas, Farhaz Miah and Michael Spellane. The team is responsible for constructing the Hines macroeconomic view and outlook for commercial real estate market fundamentals and pricing; assisting with the development of investment strategies for the firm’s investment programs; working closely with the local and fund management teams, clients and partners; and supporting U.S. regional and international country heads in identifying market/submarket opportunities and risks. Disclaimers: Past performance is no guarantee of future results. Investing involves risks, including possible loss of principal. The opinions presented herein cannot be viewed as an indicator of future performance. Confidential Information This document is intended only for the recipient to whom it has been furnished by Hines. The reproduction of this document in whole or in part is prohibited. You are not permitted to make this document, or the information contained herein and/or the information provided to you, available to any third parties. Preliminary Selective Information This document is being provided to you on a confidential basis for the sole purpose of providing you with initial and general information at your own responsibility. This document is not suitable to inform you of the legal and factual circumstances necessary to make an informed judgment about any prospective investment. Prospective investors are requested to inform themselves comprehensively and, in particular, to verify the contractual documentation that will be provided in the future. Not an Offer This document does not constitute an offer to acquire or subscribe for securities, units or other participation rights. The distribution of this document is reserved to institutional investors and may be restricted in certain jurisdictions. It is the responsibility of the recipient of this document to comply with all relevant laws and regulations. Third Party Information This material contains information in the form of charts, graphs and/or statements that we indicate were obtained by us from published sources or provided to us by independent third parties, some of whom we pay fees for such information. We consider such sources to be reliable. It is possible that data and assumptions underlying such third-party information may have changed materially since the date referenced. You should not rely on such third‑party information as predictions of future results. None of Hines Interests Limited Partnership (“Hines”), its affiliates or any third-party source undertakes to update any such information contained herein. Further, none of Hines, its affiliates or any third-party source purports that such information is comprehensive, and while it is believed to be accurate, it is not guaranteed to be free from error, omission or misstatement. Hines and its affiliates have not undertaken any independent verification of such information. Finally, you should not construe such third‑party information as investment, tax, accounting or legal advice. Forward Looking Statements This material contains projected results, forecasts, estimates, targets and other “forward-looking statements” concerning proposed and existing investment funds and other vehicles. Due to the numerous risks and uncertainties inherent in real estate investments, actual events or results or the actual performance of any of the funds or investment vehicles described may differ materially from those reflected or contemplated in such forward-looking statements. Accordingly, forward‑looking statements cannot be viewed as statements of fact. The projections presented are illustrations of the types of results that could be achieved in the given circumstances if the assumptions underlying them are met but cannot be relied on as accurate predictions of the actual performance of any existing or proposed investment vehicle. Disclaimer The statements in this document are based on information that we consider to be reliable. This document does not, however, purport to be comprehensive or free from error, omission or misstatement. We reserve the right to alter any opinion or evaluation expressed herein without notice. Statements presented concerning investment opportunities may not be applicable to particular investors. Liability for all statements and information contained in this document is, to the extent permissible by law, excluded. ©2021 Hines. All rights reserved. Hines is an Associate member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Hines nor TEXPERS. These views are subject to change. Follow TEXPERS on Facebook, Twitter and LinkedIn for the latest news about Texas' public pension industry.