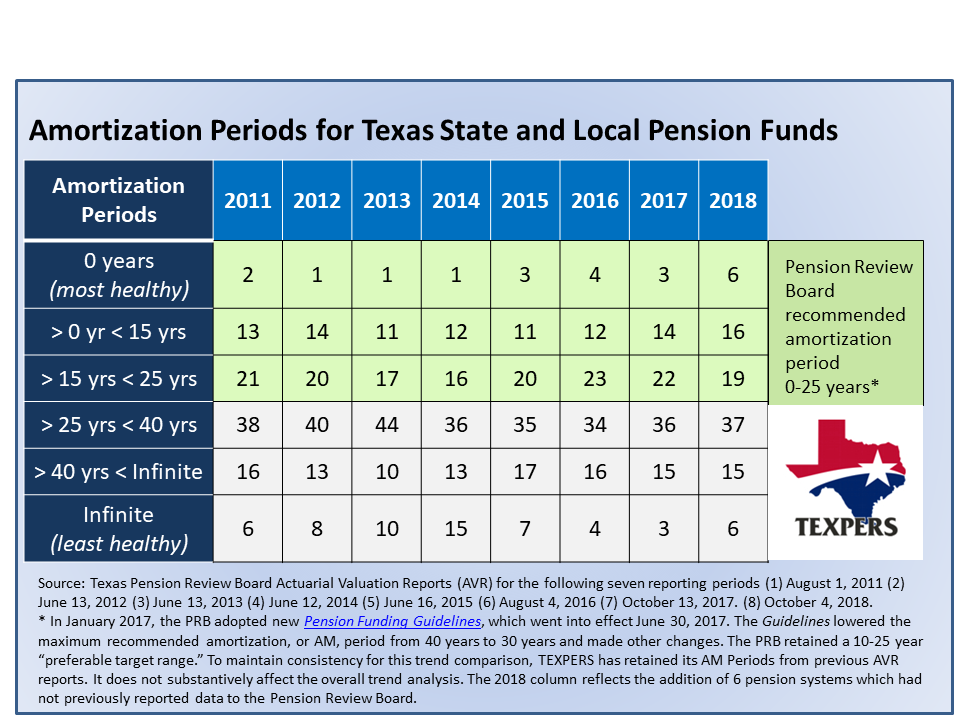

Special Report: Texas’ State and Local Pension Funds Continue Trend Improvements through 2018*

The 99 state and local pension funds that report financial statistics to the Texas Pension Review Board combined in 2017-18 to improve their aggregate amortization periods, according to a TEXPERS comparison of PRB data. The amortization period, which can be compared roughly to the years left to pay on a home mortgage, is the PRB’s single “most appropriate” measure of public retirement systems’ health.** The improvements are occurring even while Texas pension funds lower their target rates, a move which mathematically could lengthen pension amortization periods.

Chart 1

.png)

Chart 2

TEXPERS offers these observations:

- The most instructive way to read Chart 1 is to understand that increases in the top three rows and decreases in the bottom three rows show improvement.

- There are 41 pension systems in the Pension Review Board’s recommended amortization period of 0-25 years, which is two more than the 2017 report.

- The most substantial improvements in the 2017-18 period are the three pension systems moving into the 0 years category, meaning all promised benefits are funded.

- In Chart 2, there is continued movement toward lower target rates. Only one system targets eight percent plus, and 11 target eight percent. This is a 50 percent decrease from 2017.

TEXPERS Executive Director offered the following comments on the report:

“We continue to maintain that Texas pension fund Trustees and staff are doing their jobs. Pension fund improvements manifest slowly in their metrics, which is why trend analysis of amortization periods offers the best look at Texas pension systems overall health.

“Amortization periods continue to improve despite the systems’ efforts to lower their target rates for investment returns. The good investment environment and the pensions' gradual approach to change is ultimately benefitting their city sponsor.”

More graphics are available at 2018_am_period_charts.

* The figures indicated in this report include data from eight full years from 2011 through the fall of 2018. Most pension funds file their calendar year results with the PRB by June of the following year.

** The PRB defines amortization period as “the length in time, in years, needed to pay for the unfunded actuarial accrued liability (UAAL) and reflects a system’s ability to pay its normal cost plus UAAL.” UAAL is the present value of benefits earned to date that are not covered by plan assets and normal cost is the portion of cost of projected benefits to the current year. See the PRB’s “Summary: Study of the Financial Health of Texas Public Retirement Systems,” December 2014, page 2. http://www.prb.state.tx.us/files/reports/financial_health_study_summary.pdf

|

.png)