Special Report -- Texas Pension Funds Achieve Milestone in 2018-19

November 13, 2019

The Number of Texas State and Local Pension Funds within Recommended Guidelines Reaches Multi-Year High

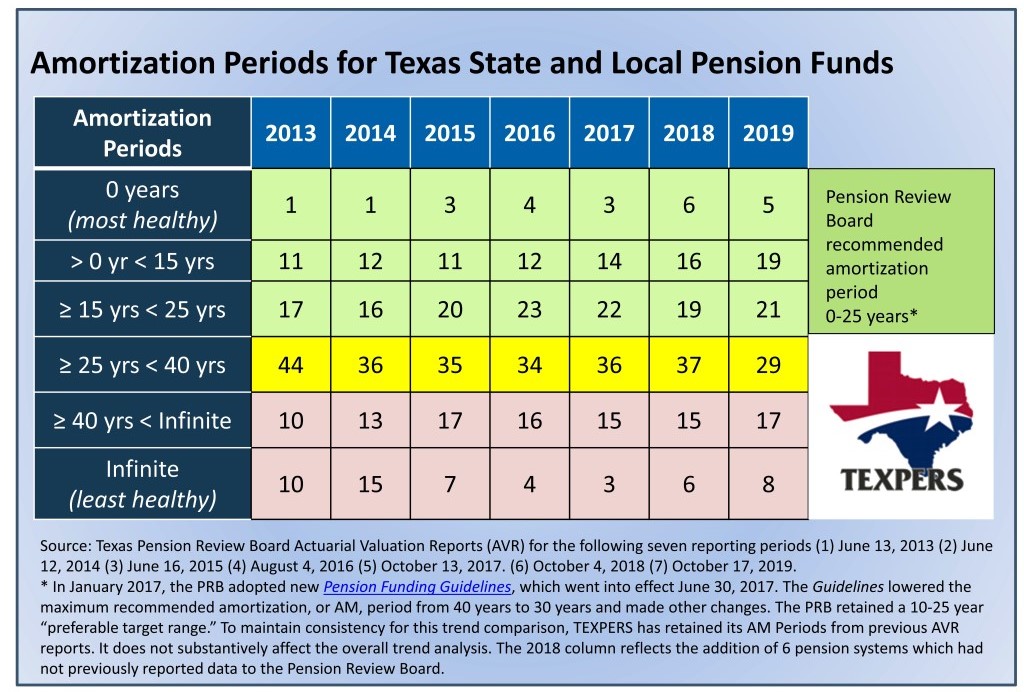

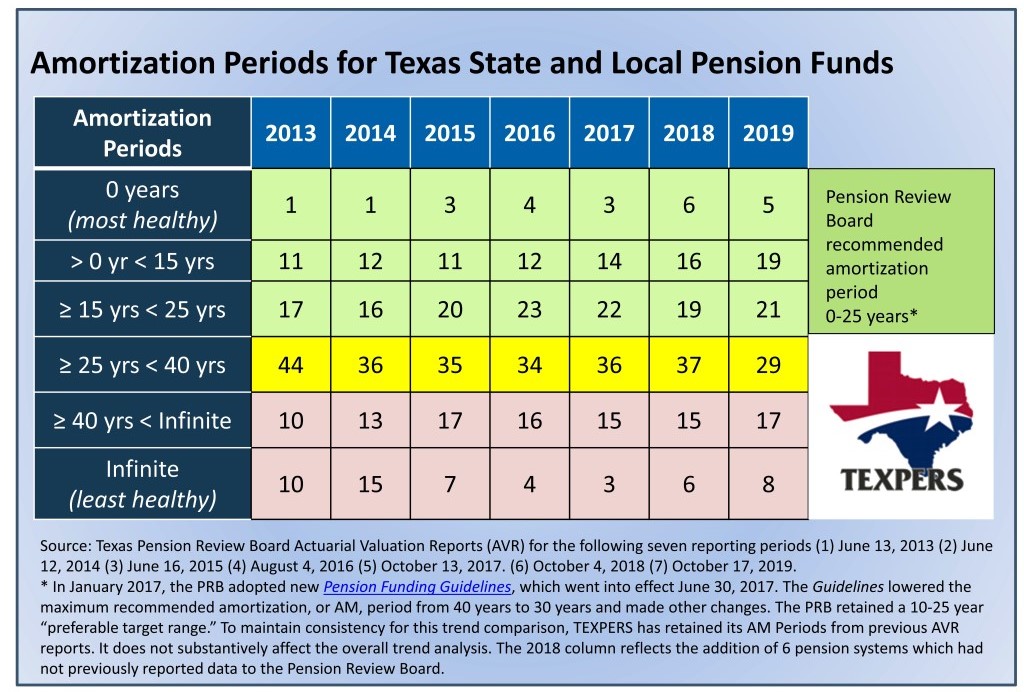

The 99 state and local pension funds that report financial statistics to the Texas Pension Review Board combined in 2018-19 to improve their aggregate amortization periods in record-breaking fashion, according to a TEXPERS study of PRB data.

Forty-five (45) pension funds achieved the Pension Review Board’s recommended amortization period of 0-25 years, the highest most attaining this recommended level in at least the last eight years for which TEXPERS has consistent records from the PRB.*

The amortization period, which can be compared roughly to the years left to pay on a home mortgage, is the PRB’s single “most appropriate” measure of public retirement systems’ health.** However, this report seeks to advise that amortization periods are certainly not the only measure of pension fund health, and the Pension Review Board in recent years has developed other tests to trigger “Intensive Reviews.” These PRB evaluations help detect whether certain measures might be giving warning signs before worrisome amortization period changes actually occur.

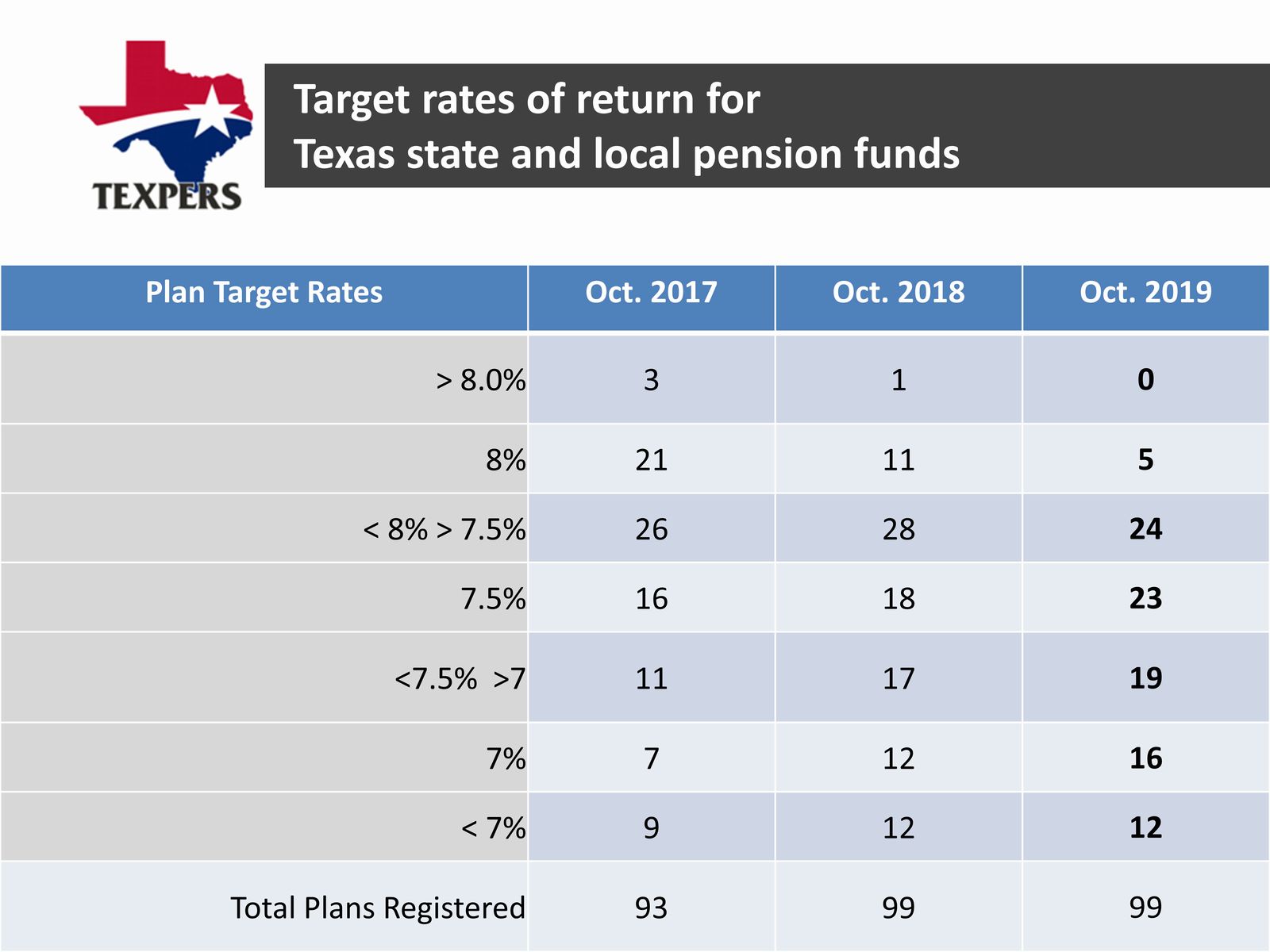

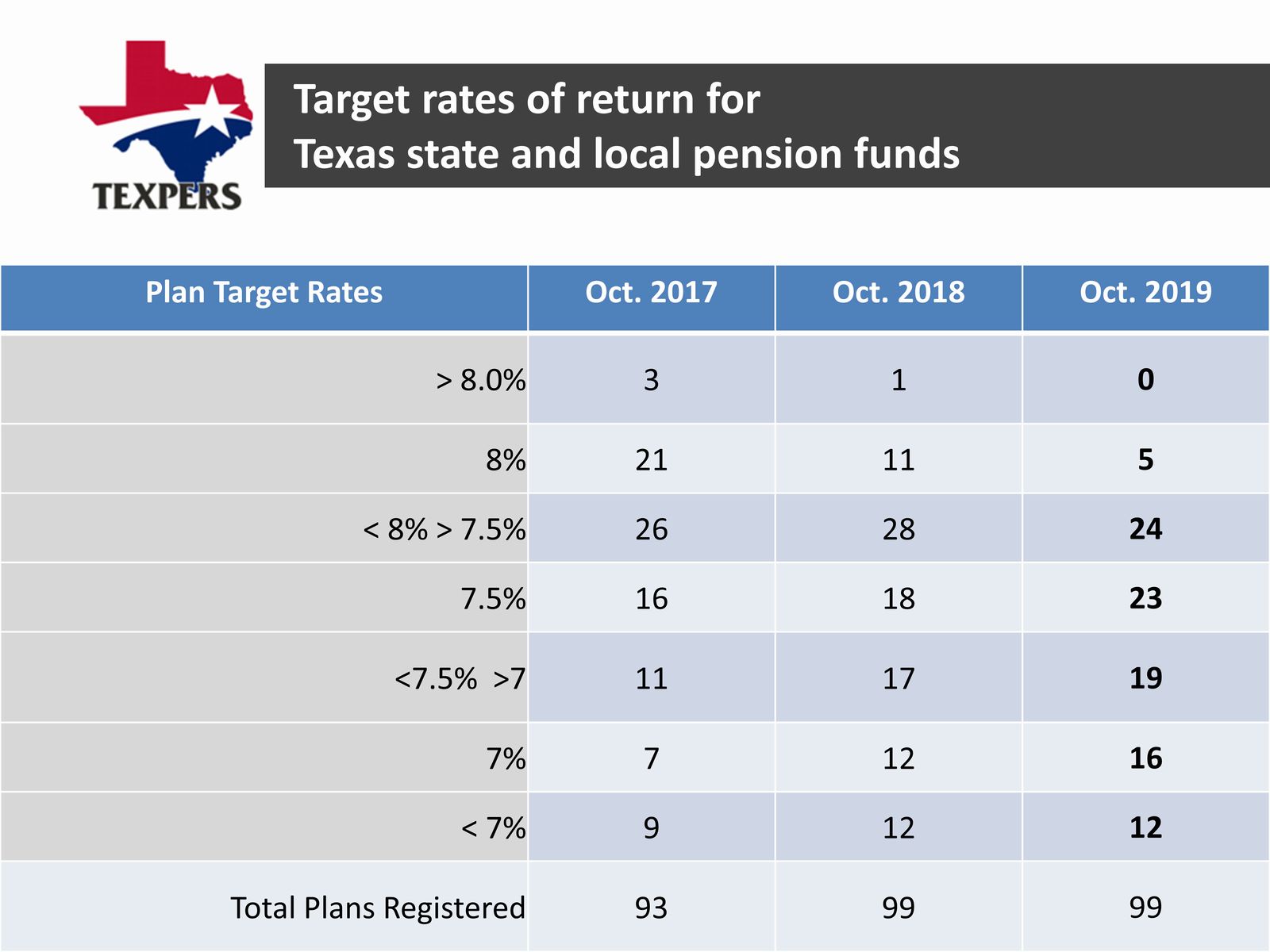

Target Rates Continue Lower

In addition to the amortization period trends, the Pension Review Board’s October 2019 Actuarial Valuation Report shows that, for the first time in at least 10 years, no Texas pension fund has a target rate of return above eight (8) percent. Only five (5) systems have an eight (8) percent target.

Lowering system target rates helps pension systems manage their investments in more conservative ways, but sometimes require additional contributions from public employees and/or their governmental-employer sponsor. The Pension Review Board has informally advised systems that lowering target rates will help them align their forecasts to guidance from industry experts, that domestic and global capital markets will have generally lower returns for the foreseeable future.

TEXPERS' Observations:

- The number of Texas state and local pension funds entering the PRB’s recommended amortization period of 0-25 years increased by 10 percent (4), to 45 from 41, from last year’s report.

- The number of Funds in the warning range of 25-40 years decreased by almost 20 percent, to 29 from 37, compared to last year’s report.

- There are no Texas pension funds with target rates above 8 percent. Pension funds target rates for their investment returns so that they can set member and employer contribution rates which are sustainable. The PRB only began publishing the target rates for the last three years, but TEXPERS believes, in its experience, that this is the first time in decades that no system had a target rate above eight percent.

- Funds with target rates of 7.5-8 percent dropped to 29 in 2019, compared to 39 in 2019. Other downward revisions should be noted.

TEXPERS Executive Director Art Alfaro offered the following comments:

“This is indisputably the best overall set of data we’ve seen regarding the aggregate health of Texas’ state and local pension funds. Clearly, the public policies that have been put in place over the long-term by the Texas Legislature are working to achieve intended results.

“Of course, our member pension systems can always strive to do better and the Pension Review Board’s expansion of issues of concern is warranted. The intensive reviews it established a few years ago to explore other measures of pension fund health may already be having effect in the data here.

“The most compelling feature of this report is the fact that amortization periods continued to improve despite a very bad year-end in 2018 and despite systems’ continuing efforts to lower target rates for investment returns. If the target rates had remained the same, we might have seen even greater improvement in the number of funds improving their amortization rates.

“Moreover, some of the funds being called into intensive reviews this year were caught in the 20 percent downdraft of markets in the fourth quarter of 2018. We think an honest view of all these factors, in the proper context, affirm the value of defined benefit pension plans for public employees.”

Art Alfaro may be reached for comment by emailing Joe Gimenez at [email protected] or calling him at 713.478.8034.

More graphics are available at 2019_am_period_charts

A press release is available at 2019-amperiod-news-release.

_______________________________________________________________________________________

* This report includes data from 2013, but our analysis for this headline and report includes data from 2011-2019, and for some pension funds which reported fiscal year results in mid-2019.

** The PRB defines amortization period as “the length in time, in years, needed to pay for the unfunded actuarial accrued liability (UAAL) and reflects a system’s ability to pay its normal cost plus UAAL.” UAAL is the present value of benefits earned to date that are not covered by plan assets and normal cost is the portion of cost of projected benefits to the current year. See the PRB’s “Summary: Study of the Financial Health of Texas Public Retirement Systems,” December 2014, page 2. http://www.prb.state.tx.us/files/reports/financial_health_study_summary.pdf

|