TEXPERS Special Report: Texas' State and Local Pension Funds Achieve Best Five-year Measure of Financial Health in 2014-15

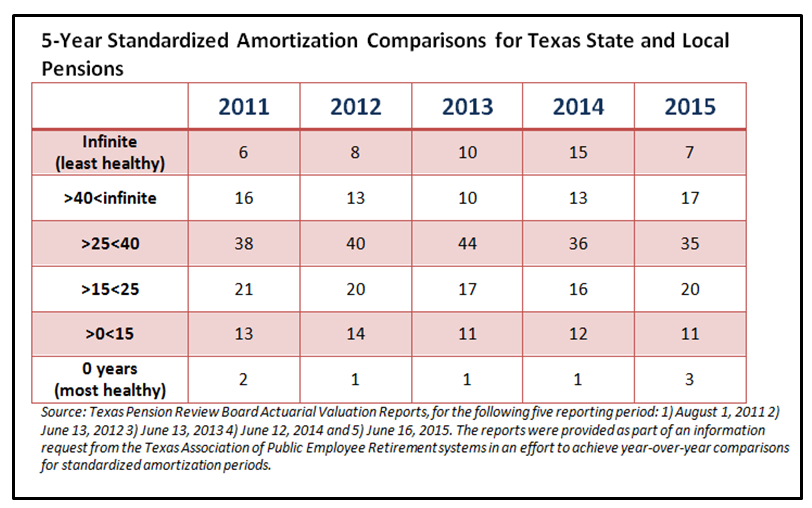

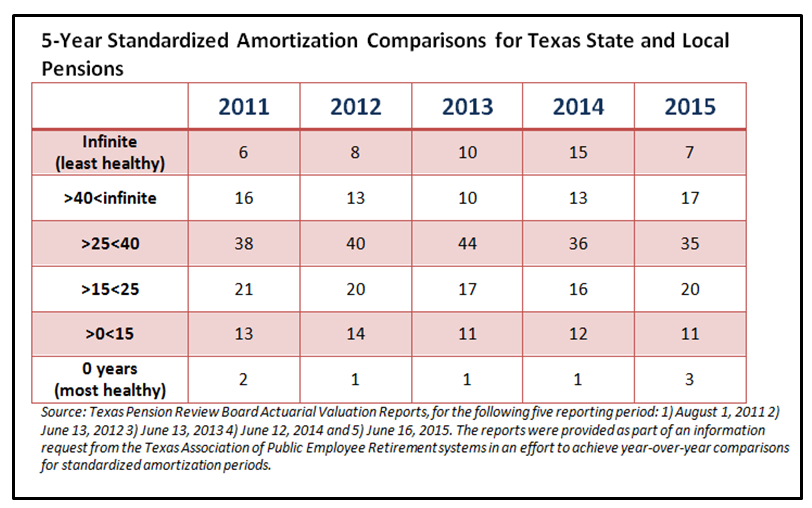

The 93 state and local pension funds which report financial statistics to the Texas Pension Review Board combined in 2014-2015 to achieve the best overall five-year improvement to their amortization periods, the PRB’s single “most appropriate” measure of public retirement systems’ health, according to a TEXPERS comparison of PRB data.

The PRB defines amortization period as “the length in time, in years, needed to pay for the unfunded actuarial accrued liability (UAAL) and reflects a system’s ability to pay its normal cost plus UAAL.” UAAL is the present value of benefits earned to date that are not covered by plan assets and normal cost is the portion of cost of projected benefits to the current year.[1]

TEXPERS based its assessment on specific information requests it made of the PRB for standardized year-over-year comparisons of its Actuarial Valuation Report for the previous five years.

A PDF of this report is available here. The PRB Actuarlal Valuation data used to form this report is available for the following years: 2015, 2014, 2013, 2012, 2011.

TEXPERS offered the following observations on how to interpret the data:

- Use as reference the far left column which shows the desired decrease in amortization periods.

- For the yearly data, decreases in top rows and increases in bottom rows show improvement.

- The far right column for 2015 shows overall decreases in 5 of the 6 amortization periods for the latest report in 2015. This is desired improvement.

- For purposes of this review, we assume uniform movement from the top, least healthy indicator, to lower, more healthy categories. We did not explore the data for the number of pensions making offsetting moves from lower to higher amortization periods because overall trend is the most important consideration.

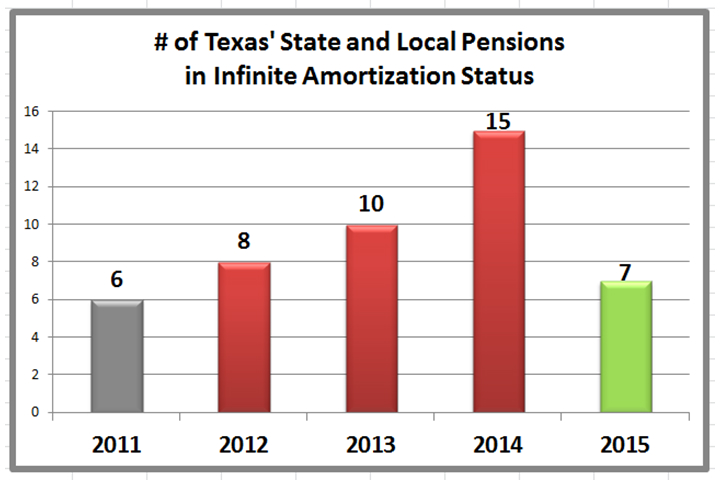

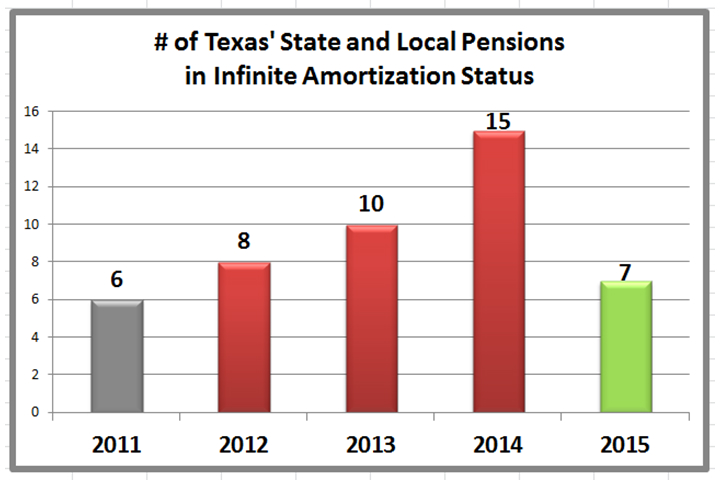

- The most substantial improvement in the 2014-15 period occurred in the number of pension systems moving out of the infinite period, from 15 to 7. This means that eight pension funds will be distributed to lower amortization periods.

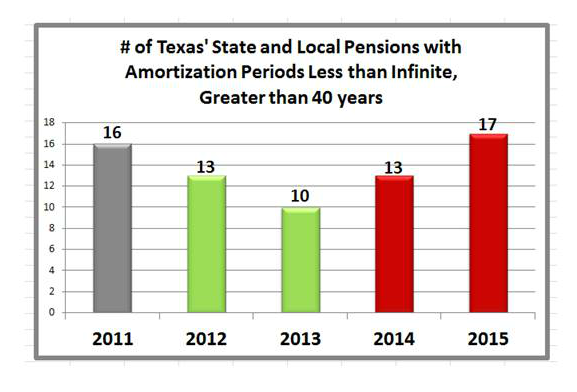

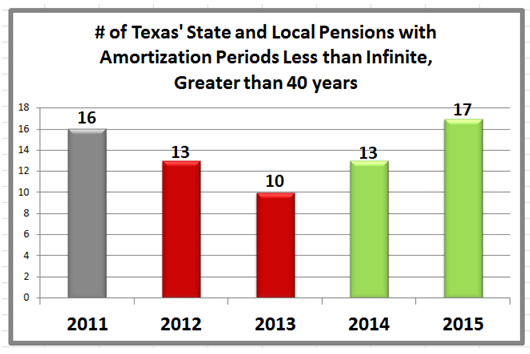

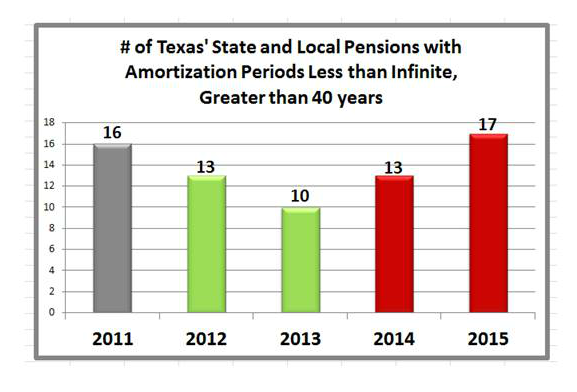

- The increase, to 17 from 13, in the number of pension funds at less than infinite and more than 40 years amortization is likely a function of the improvement of four systems out of the infinite category.

- Note that eight progressed out of the infinite category while the 40-to-infinite increased by four. This indicates that four others moved to a lower category, which signals greater improvement.

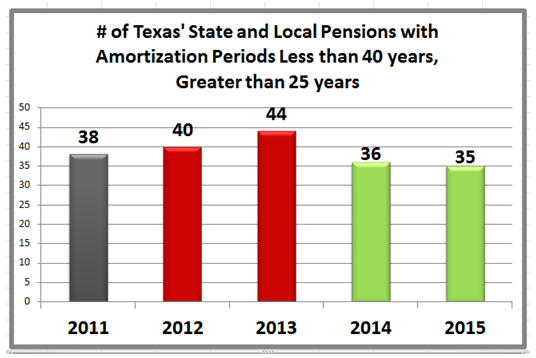

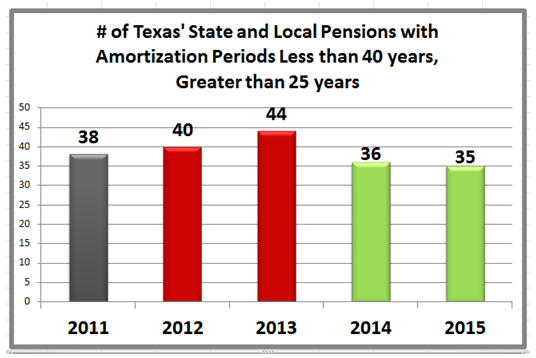

- Pension funds with a 25-40- year amortization period decreased by one from 2015, but reflects an improvement as this indicates five pensions must be distributed to even lower amortization periods.

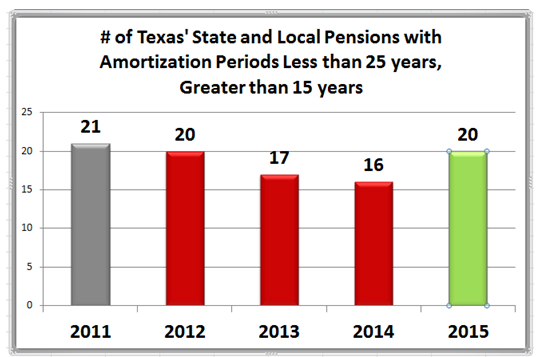

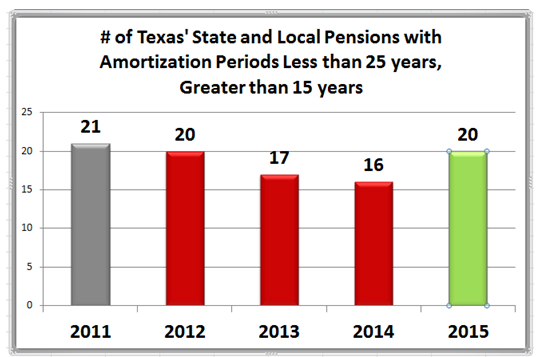

- Pension systems with a 15-25- year amortization period increased by four, which is due to improvements from pensions with higher amortization periods to lower, more healthy categories.

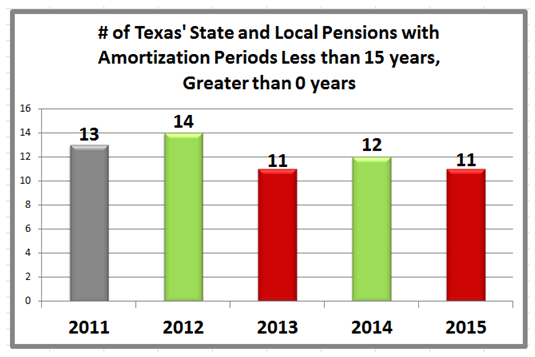

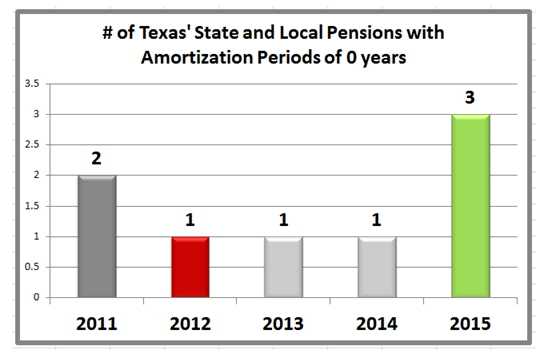

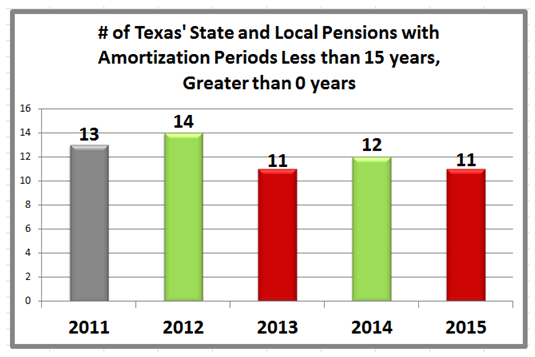

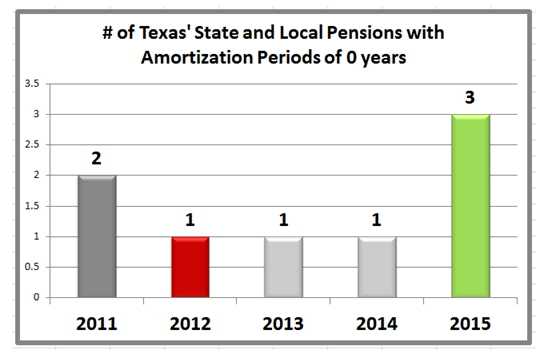

- Pension systems in the 0-15- year amortization decreased to 11, which is a tie for the lowest in 5 years, but that should be taken in context with the largest improvement, from 1 to 3, of pension funds with the best possible amortization of 0 years.

TEXPERS Executive Director offered the following comments on the report:

- “This report stands in stark contrast to those produced by organizations like the Texas Public Policy Foundation and the Laura and John Arnold Foundation which focus on unfunded liabilities in order to produce alarming headlines. Pension fund experts will tell you that trends matter more than accountants’ moment-in-time snapshots of unfunded liabilities in assessments of pension fund health. The trend demonstrated here is correctly viewed as improving dramatically over the last five years in the single most important measure of pension fund health as determined by the Texas Pension Review Board.”

- “The trend toward lower amortization periods across all Texas pensions, in conjunction with the TEXPERS Asset Allocation report showing overall excellent pension fund performance in the 20- and 30-year periods, should provide lawmakers with the confidence to maintain the status quo. Defined benefit plans are achieving the public policy goals of attracting and retaining qualified workforces at lower salary levels, at moderate costs to taxpayers in most cases across the state. The statutes which govern 12 of the largest local pension funds in seven of the largest Texas cities also are working well to create these positive trends. Maintaining a conservative view of the pension fund status quo is the right course for Texas.”

[1] “Summary: Study of the Financial Health of Texas Public Retirement Systems,” by the Texas Pension Review Board, December 2014, page 2. http://www.prb.state.tx.us/files/reports/financial_health_study_summary.pdfAmortization Period Comparisons In 2015, state and local pensions achieved greater than a 50% decrease in the number of funds with amortization periods reaching to infinity, the least deisrable condition. It's important to note that the 8 funds moving from the infinite category will be distributed in the following charts, so increases in those charts will be mostly positive achievements. In 2015, state and local pensions achieved greater than a 50% decrease in the number of funds with amortization periods reaching to infinity, the least deisrable condition. It's important to note that the 8 funds moving from the infinite category will be distributed in the following charts, so increases in those charts will be mostly positive achievements.

The increase of four pension funds achieving less than infinite amortization period from 2014 to 2015 is a positive indicator because 8 pension funds had achieved movement out of the infinite categorization. Four more pension funds achieved even better results in 2014-15 and will be distributed among the amortization categories that follow.

The decrease of one pension fund from this amortization period in 2015 likely reflects another jump in overall financial health, as there are now five pension funds which need to be distributed in the lesser amortization periods below.

The increase in pension funds achieving the less than 25, greater than 15 amortization period categorization accounts for four of the five pension funds which improved from the higher amortization periods, as previously noted. This is a net overall improvement. The increase in pension funds achieving the less than 25, greater than 15 amortization period categorization accounts for four of the five pension funds which improved from the higher amortization periods, as previously noted. This is a net overall improvement.

The decrease in pension funds with this amortization by one is negative from the previous year on a objective level, but subjectively that one pension fund and one remaining from higher categories had to move lower, as will be seen in the following chart. The decrease in pension funds with this amortization by one is negative from the previous year on a objective level, but subjectively that one pension fund and one remaining from higher categories had to move lower, as will be seen in the following chart.

The increase of two pension funds of those with 0 years amortization, or fully funded status, is further affirmative indication for positive interpretations of overall pension fund improvements. The increase of two pension funds of those with 0 years amortization, or fully funded status, is further affirmative indication for positive interpretations of overall pension fund improvements.

|