Spreads and yields/rates is the simple answer to the above question. Let’s take a look at what is going on:

The Texas 2022 Primary Election is set for Tuesday, March 1st, 2022. Due to redistricting, all 181 legislative seats are up for re-election this year. If needed, primary election runoffs will be held on May 24th, 2022.

Read More

Even after strong performance in 2021, listed infrastructure stands to potentially benefit in 2022 from a favorable macro backdrop, investors’ search for inflation protection, and attractive valuations.

Read More

Why the End of Monetary Accommodation Could Be a Tailwind for Active Bond Investors

The north star of active bond management is simple: avoid losing money. Over the last eighteen months, that proved quite easy to accomplish. In the period since credit spreads hit their pandemic-highs, outperforming has proved reasonably straightforward as long as investors stayed overweight the market. Unprecedented central bank and fiscal support has driven a swift bounce back in economic activity that has resulted in positive returns for credit market investors (and investors in risk assets of almost every stripe). But as the Fed looks to withdraw monetary accommodation, and fears about inflation, record debt levels and uneven and unstable recoveries intensify, investors could be forgiven for thinking that the outlook will be much more challenging in the year ahead.

Read More

Editor's note: Before Steve Toyota, a Vice President on the Business Development team at fund management and investment advisory firm Capital Dynamics, he spent 28 years with the Miramar Police Department. He retired from the police department in February of 2021. He had served as a trustee on the Miramar Police Officers' Retirement Plan Board since 1998 and was chairman of the Board from 2005 to 2019. During his 20-plus years as a trustee on this retirement plan's Board, he worked with investment managers of nearly every asset class, helping grow the plan from $20 million to $260 million. At Capital Dynamics, as a global private asset manager, he focuses on private equity, private credit, and clean energy infrastructure and has gained extensive knowledge and experience developing solutions tailored to meet the needs of a diverse and global client base of institutional investors, including public pension systems. In this blog post, he explains why it is important for trustees to get involved in their retirement plan's decisions, why he moved from policing to investment management and offers advice to trustees.

Read More

Note: This piece was adapted from a roundtable discussion. -- What do corporate fundamentals look like in a year where inflation and rates are taking center stage? Developed and emerging market (EM) corporates look fairly well-positioned, supported by the continued re-opening of economies and largely successful vaccine rollouts around the world. Earnings have also improved across the board, and defaults are expected to remain low going forward. That said, there are ongoing concerns around inflation amid rising raw material costs and supply-side disruptions. Although many companies have been able to pass higher costs through to consumers, the longer-term casualties from the tangled supply chain will have repercussions for some time to come—and we have likely not yet seen the full effects of wage inflation. These factors raise questions around how much margin compression may result from continued inflationary pressures going forward and the ultimate impact of inflation on consumer demand. On the positive side, for both developed and EM companies, we've seen a significant amount of refinancing in 2020 and 2021, meaning many companies have locked in lower funding costs and now have a stronger buffer against these pressures. This should help keep corporate fundamentals relatively stable.

Read More

Equity markets were jolted in January amid growing concerns about macroeconomic threats. For investors seeking more stable equity allocations, stocks “in the middle,” with high-quality features and reasonable valuations, can help portfolios cope with volatility.

Read More

Increasingly, investors are concerned about sustainability, social responsibility, and corporate governance issues

It is becoming increasingly apparent that Environmental, Social, and Governance (ESG) considerations are at the forefront of Investors’ minds. ESG and sustainability considerations are becoming a focus throughout all stages of the investment process. Considering the current events and how ESG factors are shaping the ways we live, in October, world leaders met at the United Nations Climate Change Conference in Glasgow, Scotland, to address the issue at hand. Numerous Investment Managers and hundreds of Investors have made the pledge to commit to net zero carbon. CBRE highlighted key trends influencing Investor strategies in 2021 and beyond, many with ESG considerations taking the lead. A recent study by the Harvard Business Review concluded a third of all professionally managed assets, roughly $30 trillion, are now subject to ESG criteria across the globe.[1] While the list of sustainable initiative efforts grows exponentially, Diversity, Equity, and Inclusion (DEI) initiatives are also moving to the fore in our industry.

We would like to thank Sarah Welton, Business Growth Director, at Longevity Partners and Zoe Hughes, Chief Executive Officer of NAREIM for their contributions to this article, given their extensive knowledge and expertise in the ESG space.

Read More

Investment Safari: Growth, Inflation, Interest Rates, Valuations, and Style Are The Top Game

In the world of safaris, “the big five” are highly prized among sightseers and photographers: the lion, leopard, black rhinoceros, elephant, and buffalo. But in investing, the big five could more aptly refer to the connected categories of growth, inflation, interest rates, valuations, and style.

Read More

In Economics, Hyperinflation is Problematic, and a Root Cause of Economic Uncertainty

True hyperinflation, marked by unfettered price increases and severe currency devaluation generally occurs during times of turmoil or war. This is a rare occurrence in developed countries. Regardless, growing inflation rates are an important dynamic to observe, and investors can smooth the yield curve by employing alternative investment strategies.

Read More

The latest updates on the special and primary elections compiled by TEXPERS' government affairs consultants:

Read More

Most of us are familiar with the term "powering up." We say it when we are charging up our tech, such as our smartphones, laptops, and electronic devices. The term generally refers to achieving a higher level. In our professional lives, we want to power up by gaining new experiences to take advantage of new skillsets. We invite you to our Annual Conference April 3-6 in Fort Worth, Texas, to plug into the minds of the pensions and investment industry's top thought leaders and power up your skills for the benefit of your pension system's annuitants.

Read More

The Texas Pension Review Board is developing rules to facilitate the state legislature's 2021 changes to the Funding Soundness Restoration Plan statute and is seeking stakeholder comments on the initial rule concepts.

Read More

Public employee retirement systems must manage and protect their data. Managing data involves creating and maintaining a framework for storing, mining, and archiving data. Cloud data management makes it possible to manage all phases of the information life cycle in one place - pushing it from paper to a digital format. And it could save pension funds time and money. A free webinar is offering details on how the federal government is currently undergoing its effort to go paperless by Dec. 31, 2022.

Read More

The Austin Police Retirement System has a job opening for an Accounting Associate.

Read More

The Austin Police Retirement System has a job opening for a Benefits Coordinator.

Read More

Houston Firefighters’ Relief and Retirement Fund Selects Government Expert Tim Schauer as Executive Director

Effective Feb. 1, 2022, Tim Schauer will step into the role of executive director of the Houston Firefighters’ Relief and Retirement Fund, according to a recent news release.

Effective Feb. 1, 2022, Tim Schauer will step into the role of executive director of the Houston Firefighters’ Relief and Retirement Fund, according to a recent news release.

Read More

In-person conferences are one of the best opportunities to take your professional development to the next level. And when it comes to the public pensions industry, no live event matches the niche learning you'll find to help you become a better trustee or administrator.

Read More

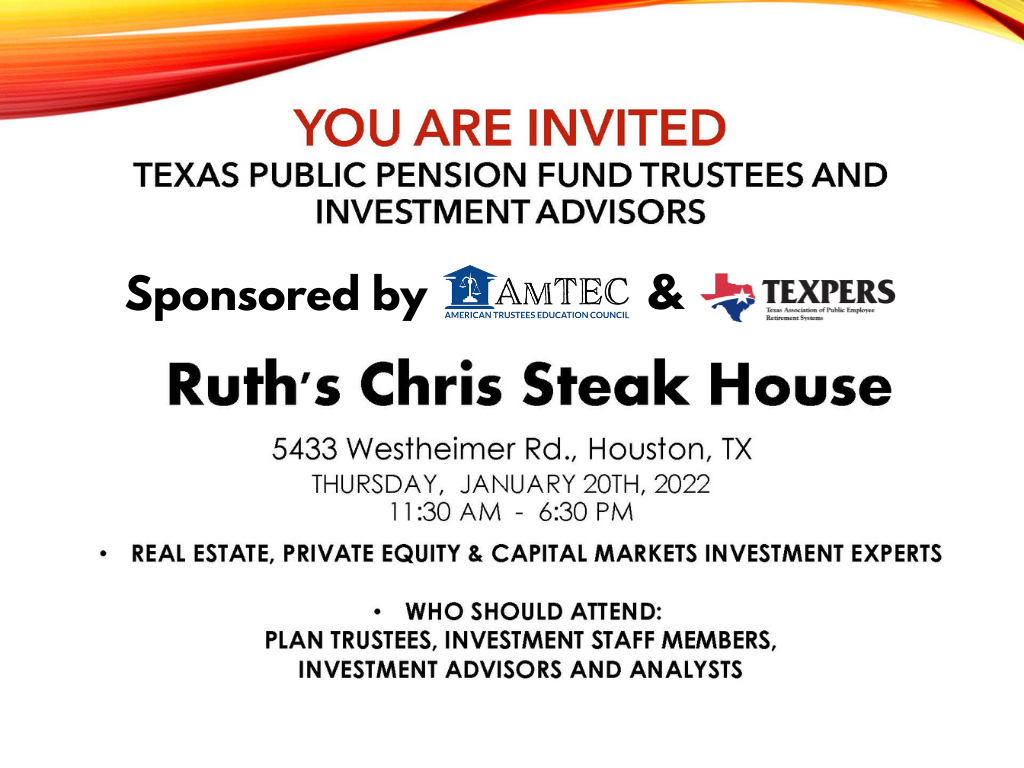

TEXPERS Members Won't Want to Miss This Houston-area Trustee Training Opportunity

The Texas Association of Public Employee Retirement Systems invites its members to attend a free luncheon and presentation on current investment strategies at Ruth's Chris Steak House, 5433 Westheimer, Houston. Register by Jan. 12 by clicking here.

Read More

Rising Inflation: What is the Impact on Real Estate Investments in Your Portfolio?

As inflation continues to increase, many things from grocery store items to alternative investment portfolio values will be affected. Here’s what you should be mindful of in the months ahead.