The Texas Pension Review Board has put out requests for comment on the changes they will propose to the Texas Legislature for the Texas Local Fire Firefighters Retirement Act, also known as TLFFRA.

Celebrating Older Americans: Uncovering the Contributions of America's Aging Population in May 2023

In May 2023, Americans are invited to join in celebrating Older Americans Month – a time dedicated to recognizing the contributions of older Americans to our nation’s culture and society. U.S. population statistics show that the number of Americans age 65 and older is expected to double over the next 25 years – making it more important than ever for TEXPERS members to appreciate and value the contributions of this segment of our population. Join us as we explore why celebrating Older Americans Month is so important for all of us!

Read More

'The Gentle Art of Swedish Death Cleaning' is Looking for TEXPERS Pension System Members to Apply for Its Next Season in Austin

Read More

Brief Finds State and Local Pensions Should Stabilize Debt as Share of Economy Instead of Fully Funding Them

The author of a new brief from the Center for Retirement Research at Boston College finds that state and local pension plans should focus on stabilizing their pension debt as a share of the economy rather than full funding. The alternative of fully prefunding state and local pensions to maintain fiscal sustainability will mean big contribution hikes.

Read More

On Saturday, Feb. 4, a specific group of U.S. Postal Service workers will get some much-needed love.

Read More

Pension Review Board Creates New Website for Minimum Educational Training

The Pension Review Board recently launched a new Minimum Educational Training website, according to a memo the state agency distributed to Texas public pension trustees and administrators on Jan. 9.

Read More

People 65 and older experienced an increase in poverty in 2021, according to the official poverty measure from the U.S. Census Bureau. The Bureau recently highlighted data from its Poverty in the United States: 2021 report originally released in September 2022 as the nation prepares to observe Poverty Awareness Month in the United States this January 2023.

Read More

Spending Bill Vote Likely to Push Through Secure Act 2.0 Before Christmas

Legislation that includes retirement provisions affecting public safety employees and state and local government retirement plans is nearing passage on Capitol Hill as part of an end-of-year omnibus spending bill.

Read More

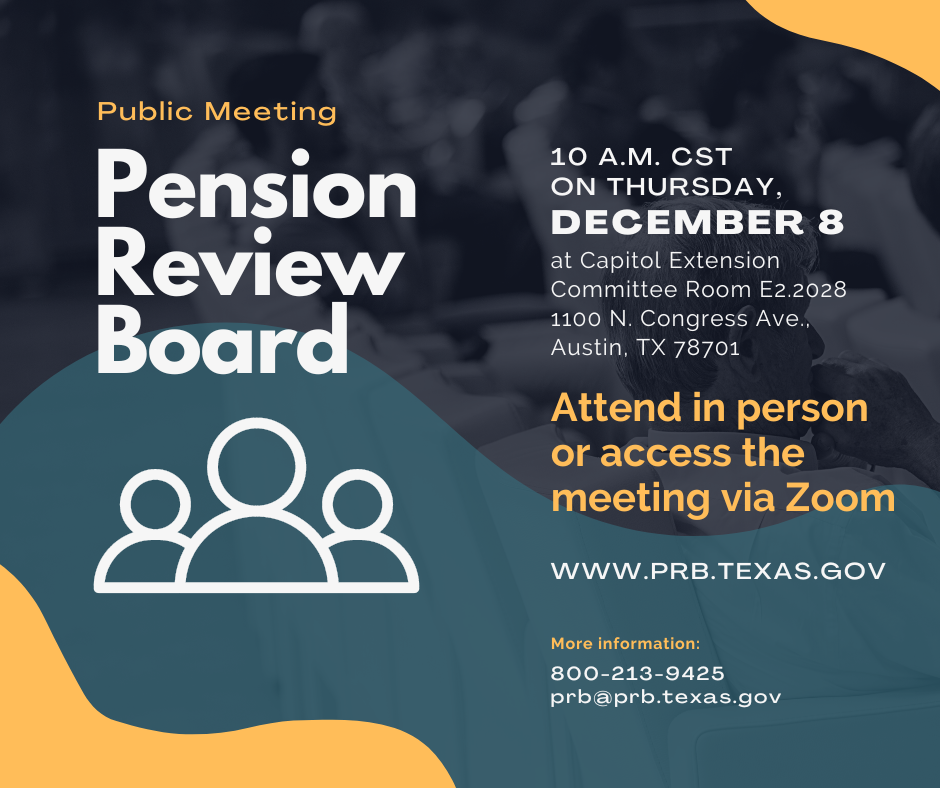

Actuarial Valuation Report, Funding Soundness Restoration Plan on Agenda for Dec. 8 PRB Meeting

At 10 a.m. CST on Thursday, Dec. 8, the Texas Pension Review Board will meet to review the actuarial soundness and compliance of state and local government public retirement systems. Those interested in managing public employee pension systems may attend in person or via videoconference.

Read More

IRS Releases Updated Retirement Plan Contribution Limits for Defined Benefit Plans

The federal tax provision that limits the amount of an "annual benefit" that an individual can receive from a tax-qualified defined benefit pension plan will increase from $245,000 in 2022 to $265,000 in 2023.

Read More

The Economic Benefit of Public Pension Dollars in Small Towns and Rural Texas

In 2018, public pension benefit dollars represented between 0.4% and 1.1% on average of Gross Domestic Product (GDP) for each county type in Texas. New research indicates that public pension plans have a particularly positive economic impact on small towns and rural communities.

Read More

The Institutional Limited Partners Association's ILPA Institute will be in Austin May 11-12, 2022, offering its executive education programming for trustees. The Private Equity for Trustee course explores the basic aspects of the private equity asset class, the economics of a private equity investment, the current state of the market, and its external perception. The program fee is $1499 and will run from 9 a.m. to 5 p.m. each day at the DLA Piper Austin Office, 303 Colorado St., Suite 3000, in Austin. For more information and to register, contact Mandy Ilk at [email protected].

Read More

|

In 2020, assets (cash and investments) for state- and local-administered defined-benefit public pensions systems totaled $4.6 trillion, an increase from the 2019 level of $4.4 trillion, according to an annual survey of public pensions released by the U.S. Census Bureau in July 2021. |