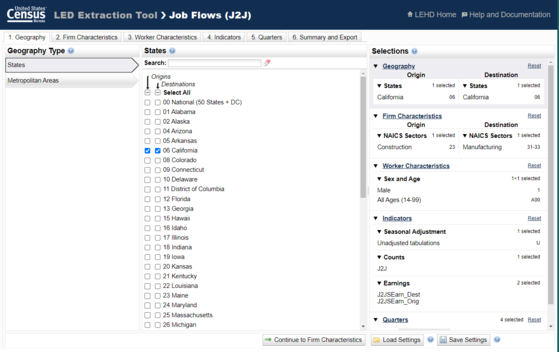

A newly revamped tool from the U.S. Census Bureau is available for TEXPERS members looking for job data.

Don't Forget to Celebrate Contributions of Our Hispanic Public Employees During National Observance

Hispanic Heritage Month in the United States runs from Sept. 15 to Oct. 15, celebrating the histories, cultures, and contributions of Hispanic citizens in the country.

Read More

On Sept. 20, 2022, Americans will celebrate National Voter Registration Day with a massive cross-country effort to register voters ahead of the midterm elections. Every eligible American voter should have the option to exercise their right to be heard at the ballot box. National Voter Registration Day is the right day to start by registering.

Read More

There are 1.07 million minority-owned firms in the United States with 9.3 million employees and $344.5 billion in annual payroll, according to the 2019 Annual Business Survey.

Read More

State Agency's Investments Committee Signals Intent to Request Funds to Report How Investment Portfolios are Structured

In its latest meeting, the Texas Pension Review Board's Investment Committee made it clear that it intends to request pension funds to report on how their investment portfolios are structured to meet real-time expectations for outflow benefit payments to retirees.

Read More

Pension Fund Administrator Accepts Executive Position With International Consulting Firm

Fort Worth Employees' Retirement Fund Executive Director Benita Falls Harper has announced her departure from the Fund to accept a new position. Her service with the Fund will conclude following the Board's monthly meeting on Sept. 28, 2022.

Read More

Tiffany White is the new executive director of the Texas Emergency Services Retirement System, according to an announcement on the state pension fund's website.

Read More

TEXPERS' office is closed in observance of Labor Day on Monday, Sept. 5, 2022. Labor Day is an annual celebration of American workers' social and economic achievements. Don't forget the impact of public employees on local communities.

Read More

Nearly 270 people attended TEXPERS' Summer Educational Forum, Aug. 21-23, 2022, in El Paso, located in the far western corner of the Lone Star State, bordering Mexico.

Read More

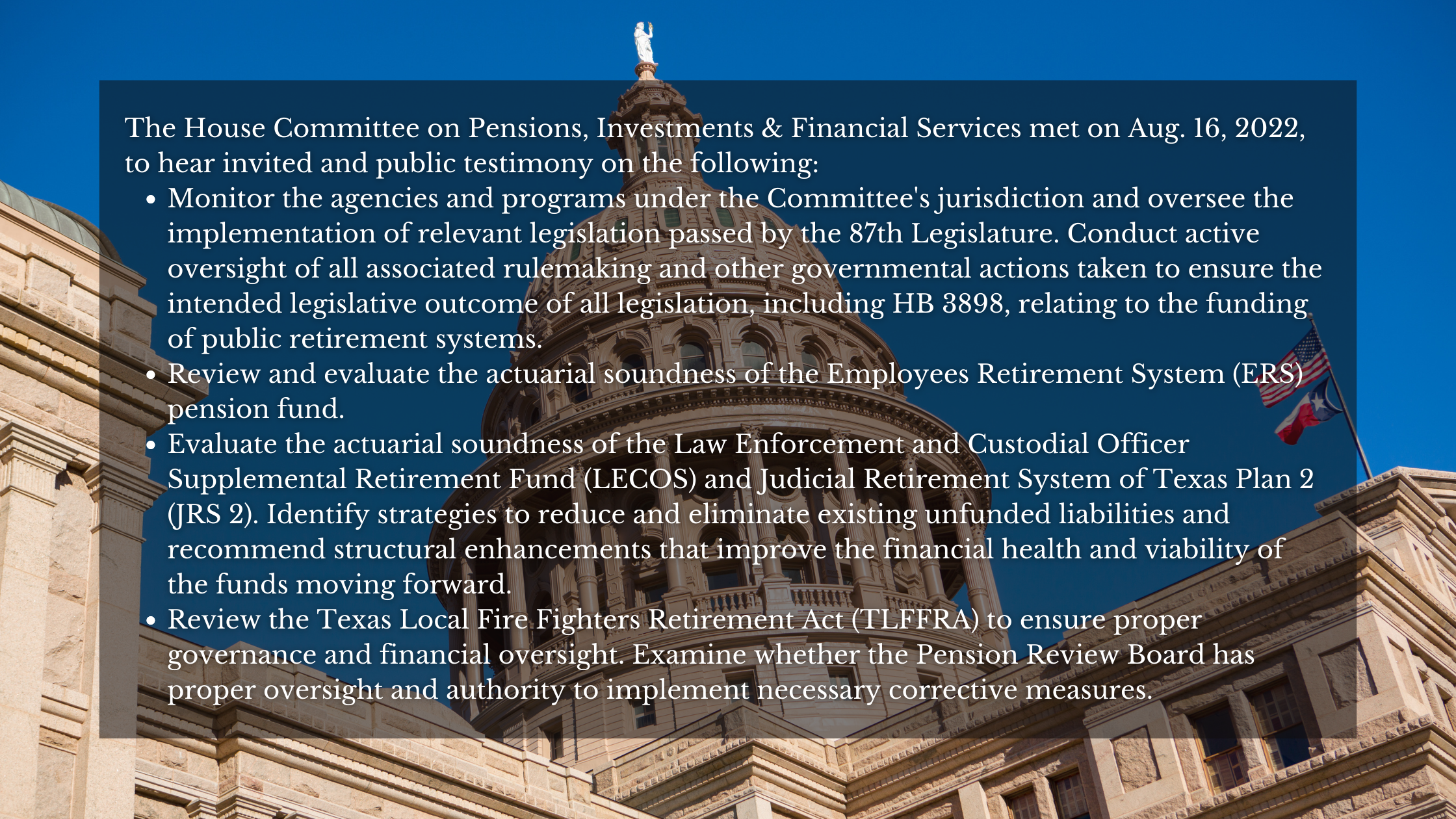

House Committee on Pensions, Investments & Financial Services Holds Aug. 16 Meeting

This report, compiled by TEXPERS legislative consultants and staff in attendance, is intended to give you an overview and highlight the discussions on the various topics taken up. It is not a verbatim transcript of the discussions but based on what was audible or understandable to the observer and the desire to get details out as quickly as possible with few errors or omissions.

Read More

Napier Park Global is Presenting as a Silver Sponsor During Upcoming Summer Forum

Napier Park Global is a Silver Sponsor of TEXPERS' 2022 Summer Educational Forum Aug. 21-23 in El Paso, Texas, and is sending Amit Sanghani, managing director and product specialist for the firm's global credit and real asset strategies.

Read More

Oxford Funds is Presenting as a Silver Sponsor During Summer Forum in El Paso,

As a Silver Sponsor of TEXPERS' 2022 Summer Educational Forum in El Paso, Texas, Oxford Funds, LLC will send Senior Portfolio Manager Deep Maji to present.

Read More

William Blair Investment Management is Presenting as a Silver Sponsor During Summer Forum in El Paso, Texas

William Blair Investment Management is a Silver Sponsor of TEXPERS' 2022 Summer Educational Forum Aug. 21-23 in El Paso, Texas, and is sending hard currency portfolio manager Jared Lou from the firm's emerging markets debt team to present.

Read More

The Economic Benefit of Public Pension Dollars in Small Towns and Rural Texas

In 2018, public pension benefit dollars represented between 0.4% and 1.1% on average of Gross Domestic Product (GDP) for each county type in Texas. New research indicates that public pension plans have a particularly positive economic impact on small towns and rural communities.

Read More

Save Money on Summer Forum Travel Expenses: Book Your Room at The Venue Hotel

Want to save on your travel expenses for TEXPERS' 2022 Summer Educational Forum in El Paso, Texas, Aug. 21-23, 2022? Reduce your costs by saving on your room, but do it quickly before the special rate ends on July 29!

Read More

The first glimpses of global economic growth, inflation trends, and monetary policy meetings have kept financial and investment professionals busy this week. Some interesting retirement data is also set to be released soon. Online presentations offered by thought leaders from various firms in the financial, investment, banking, and research industries can provide your retirement funds insights to manage the pensions of your annuitants.Here are four webinars offering fresh insights into the latest economic market conditions and retirement research.

Read More

Texas Association of Public Retirement Pension Systems, a statewide nonprofit organization providing education to trustees and administrators of public employee pension funds, is pleased to announce Federated Hermes, Wolf Popper, and Napier Park as sponsors of its upcoming conference in El Paso, Texas. The firms are Silver Sponsors of TEXPERS' 2022 Summer Educational Forum Aug. 21-23 at Hotel Paso Del Norte in El Paso, Texas.

Read More

Pension Review Board Creating New Rules for 'Plan-Friendly' FSRP Implementations

The Texas Pension Review Board committee creating rules for implementing House Bill 3898 accepted new, flexible proposals from the staff at its May meeting. The rules will be presented to the full Board on July 14 and the official public comment period will begin. Ultimate consideration of all comments and changes is planned for the October PRB meeting.

Read More

Law Firm Wolf Popper is Presenting as a Silver Sponsor During TEXPERS Educational Forum in El Paso

Wolf Popper LLP is a Silver Sponsor of TEXPERS' 2022 Summer Educational Forum Aug.21-23 in El Paso, Texas, and is sending securities and commercial litigation attorney Joshua Ruthizer as a presenter.

Read More

Texas Pension Review Board and Committee to Gather July 14 in Separate Meetings

The Texas Pension Review Board is holding a board meeting at 10 a.m. CST on Thursday, July 14, 2022. The Board's Investment Committee will gather later that afternoon.