The Texas Pension Review Board has put out requests for comment on the changes they will propose to the Texas Legislature for the Texas Local Fire Firefighters Retirement Act, also known as TLFFRA.

The Texas Pension Review Board (PRB) is a state agency that oversees all Texas public retirement systems, both state and local, regarding their actuarial soundness and compliance with state reporting requirements. The PRB provides pensioners and fund managers with news, education, and guidance. The next Texas Pension Review Board meeting is scheduled for 10 a.m. on Wednesday, March 6, 2024, at the William P. Clements Building in Austin, Texas.

Read More

Feb. 20 was World Day of Social Justice, a poignant moment for us at the Texas Association of Public Employee Retirement Systems (TEXPERS) to reflect on the profound impact of pension systems in fostering social and economic justice across the Lone Star State.

Read More

As the 2024 election cycle heats up, Texas voters will soon have the opportunity to cast their ballots in the March 5 primary elections. The primary elections are how Texas' political parties decide who ends up on the general election ballot in November. The results will have significant implications for the state's future of public policy, politics, and government.

Read More

A Comprehensive Look Into the Economic Well-Being and Retirement Preparedness of U.S. Workers

In an era defined by evolving workplace dynamics and a heightened focus on employee well-being, the 2023 Workplace Wellness Survey offers a comprehensive look into the well-being and retirement preparedness of employees in the United States. Employee Benefit Research Institute (EBRI) conducted this survey on financial well-being, employment-based health insurance, and retirement benefits in the workplace.

Read More

Government Shutdown: Why it Matters to Texas Public Employee Pension System Administrators

Good news. Congress is avoiding a government shutdown, at least through Nov. 17. As news of a government shutdown captures headlines nationwide, it might seem like a distant issue for those entrusted with managing Texas public employee pension systems. After all, the daily operations of pension systems are largely independent of federal politics, right? Well, not quite. In this blog post, we'll explore why any potential government shutdown should concern trustees and administrators of public employee pension systems and why staying informed is crucial for safeguarding the financial futures of countless retirees.

Read More

Government Watch

Congress raised the debt limit this year to prevent a government default. They are working to agree on next year's budget by Sept. 30.

Read More

Brief Finds State and Local Pensions Should Stabilize Debt as Share of Economy Instead of Fully Funding Them

The author of a new brief from the Center for Retirement Research at Boston College finds that state and local pension plans should focus on stabilizing their pension debt as a share of the economy rather than full funding. The alternative of fully prefunding state and local pensions to maintain fiscal sustainability will mean big contribution hikes.

Read More

Uncover How Lawmakers Could Impact Your Public Retirement System in the 88th Legislative Session

The 88th Texas Legislative Session is in full swing, with lawmakers proposing and debating bills that could significantly impact public employee pension plans.

Read More

UPDATE 1/10/23 - Texas' 88th legislative session adjourned on Jan. 10 after completing opening ceremonies during which Gov. Greg Abbott congratulated newly elected and re-elected members of the House and Senate as well as Rep. Dade Phelan, R-Beaumont, who was reelected today as House Speaker for the session.

Read More

Going Concern Uncertainties and Severe Financial Stress Disclosure Task Force Formed

The Governmental Accounting Standards Board has formed a task force to assist with a project to address disclosure issues related to going concerns, uncertainties, and severe financial stress plan sponsors may be facing.

Read More

Texas Pension Review Board Meets Thursday, Oct. 6 in Austin; Remote Participation Available

The Texas Pension Review Board meets at 10 a.m. CT on Thursday, Oct. 6, 2022, in Austin at the Capitol Extension, Room E2.028, located at 1100 Congress Avenue.

Read More

TEXPERS has a section on its website where it publishes requests for proposals, those public documents that announce a project and invite proposals from service providers.

Read More

There are 1.07 million minority-owned firms in the United States with 9.3 million employees and $344.5 billion in annual payroll, according to the 2019 Annual Business Survey.

Read More

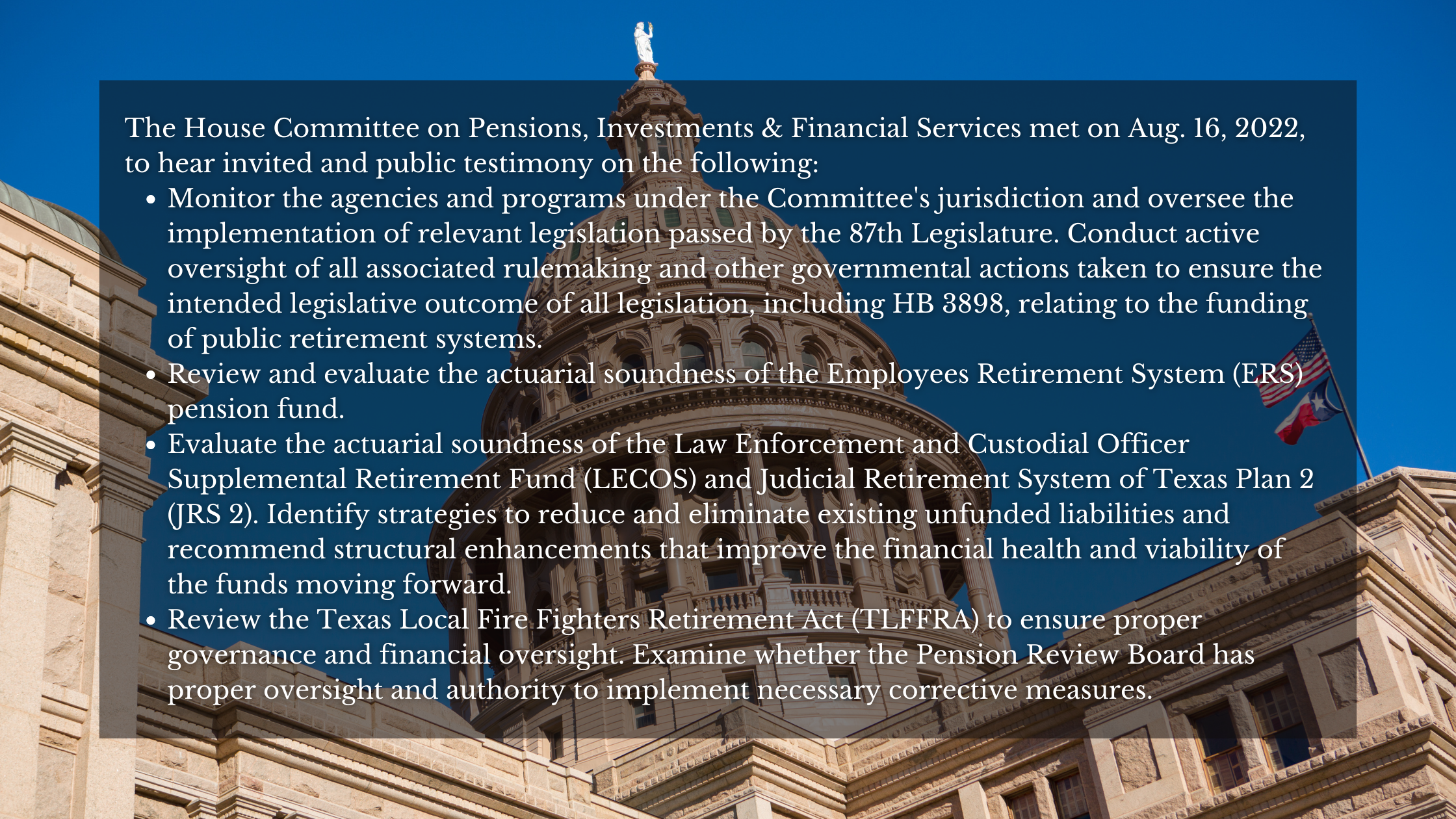

House Committee on Pensions, Investments & Financial Services Holds Aug. 16 Meeting

This report, compiled by TEXPERS legislative consultants and staff in attendance, is intended to give you an overview and highlight the discussions on the various topics taken up. It is not a verbatim transcript of the discussions but based on what was audible or understandable to the observer and the desire to get details out as quickly as possible with few errors or omissions.

Read More

PRB Posts Draft Rule Language and Board Policy Related to Funding Soundness Restoration Plans

The Texas Pension Review Board has posted the draft rule language and board policy related to Funding Soundness Restoration Plans to the state agency's website.

Read More

What do pension funds in Australia, France, Sweden and Texas have in common? Definitely not their asset allocation, level of transparency, governance system or cost structure.