Venture Capital’s Unique Ability to Navigate Volatile Markets

Venture capital (VC) has performed extremely well over the last 5, 10, and 15 years, beating the S&P 500 by more than 700 basis points on average.1 Across market cycles, we have witnessed certain vintages reward investors with truly outsize returns, and we feel confident that current conditions could lead to similarly high-returning vintages. As we enter a period that we believe will be defined by less capital raised, smaller fund sizes, slower investment pacing, fewer market participants, and lower valuations, perhaps the time to overweight is now.

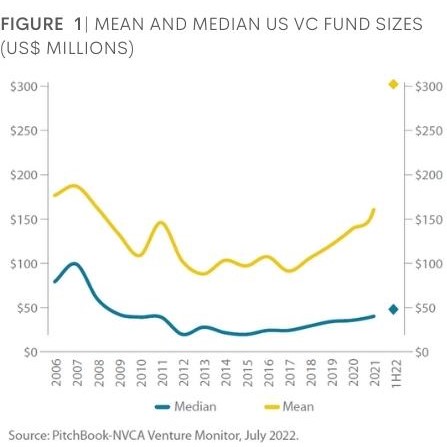

While we expect well-known VC brands to continue to complete oversubscribed fundraises larger than $1 billion, we believe several economic factors will converge to create a more challenging fundraising environment in the coming quarters. In general, performance in other, more liquid asset classes has declined more rapidly and materially than in VC which decreases the available pool of capital from which VC firms can raise. Additionally, due to current market conditions which have temporarily closed the IPO window, it is expected that average time to liquidity for venture-backed companies will extend in the coming years. Given this current environment, most venture-backed companies are delaying capital raises to focus on execution. They have the cash to do it, and in 2021 alone, $340B was invested into venture-backed companies, leaving companies with healthy balance sheets and long cash runaways. Rather than deploying a fund in 18 months, we expect most VC firms to return to a two-to-three-year average cadence. Additionally, when less capital is available, we have found it disproportionally harder for smaller, less established managers to raise funds. When venture fundraising totals fell below pre-GFC levels between 2009 and 2013, the median fund size for the industry declined even more rapidly (Figure 1). Given these conditions, a slowdown like that of the GFC could be on the horizon. There is good news in all this noise: In general, when capital is scarcer, the asset class tends to perform better.

Recessions have not historically impeded startup activity. In 2006, fewer than 1,000 companies raised capital in seed and angel rounds.2 In 2012, during the aftermath of the GFC, more than 3,500 companies were financed by institutional angel and seed investors. Fast forward to the current market: In the past 24 months, we have witnessed the most rapid acceleration of technology adoption and digital transformation in history, particularly in the areas of supply chain disruption, health care, cybersecurity, artificial intelligence, ecommerce, Web3, blockchain and web infrastructure. We firmly believe that the supply of high-quality companies seeking to raise capital will grow irrespective of market conditions. This, coupled with less capital available for investment, may bode well for VC.

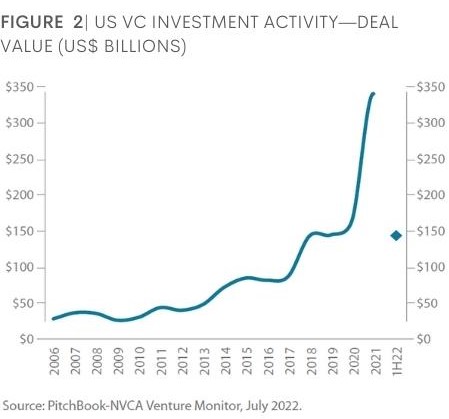

In the first half of 2022, firms were reluctant to aggressively deploy capital into a rapidly evolving (and potentially improving) valuation environment, while entrepreneurs found it less necessary to pursue financing founds with already healthy balance sheets. Apart from a few large outliers, we expect to see fewer rounds raised with less capital invested in the medium term (Figure 2). We believe the investment pace slowdown will be underpinned by the factors outlined below.

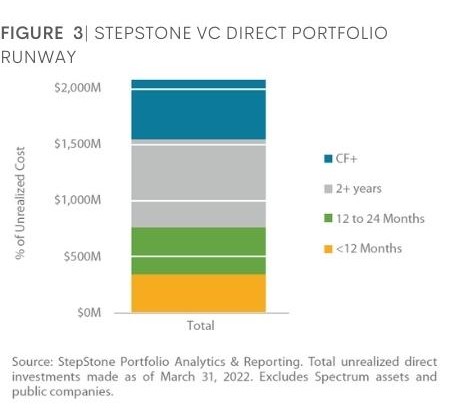

Private company financing over the past 24 months has resulted in well-capitalized businesses with strong balance sheets. Drawing on data from our portfolio companies as a proxy for the broader market, over 60% either are cash flow positive or have two or more years of runway (Figure 3). With fewer companies in need of capital infusions, its unsurprising to see fewer round of financing.

Like the supply side of the equation, the demand side is waning as nontraditional VC investors are participating in far fewer deals than in years past.3 Seasoned VCs pejoratively refer to these groups as “tourists” for a reason—they are sporadic participants in VC driven by short-term upside rather than developing all-weather strategies to invest across multiple market cycles. With the IPO window temporarily closed and the public markets no longer rewarding high-growth businesses, fewer tourists are looking to VC for arbitrage opportunities. We expect to see this trend continue in years to come as “tourists” retreat to core competencies.

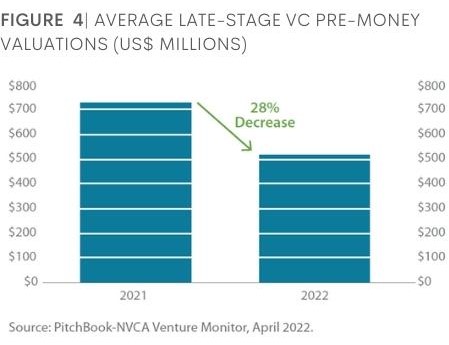

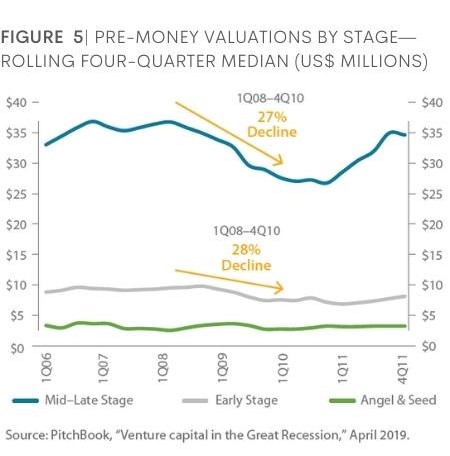

Historical data suggest that VC tends to absorb the impact of public market dislocation at a lag. While private market company valuations have declined materially (see Figure 4) we believe we are in the first stages of a private market valuation reset, best presaged by the aforementioned slowdown in investment pacing and grounded in data from post-GFC impacts to private market valuations (Figure 5).

|

|

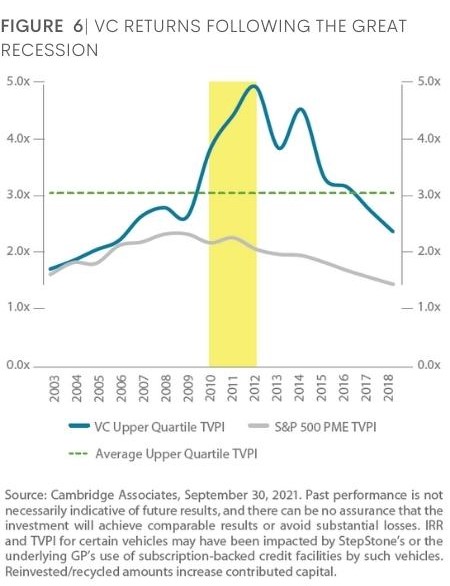

We believe the market correction we’re witnessing will be a healthy recalibration of the venture ecosystem that will reward skilled VC investors. As pacing slows, valuations reset and nontraditional VC entrants retreat to their comfort zones, we expect the next 12 to 24 months to present a prime window for top VCs to enter high-quality companies—of difference stages—at very attractive prices. Historical precedent (Figure 6) suggests vintages that coincide with recessionary periods often outperform. We believe current conditions match the factors that created the foundation for those outperforming vintages; likewise, we expect the coming years to be high-performing VC vintages.

The years emerging from the GFC were some of the best vintages in VC history. The current market correction is a healthy recalibration for the venture ecosystem, and we believe it presents a compelling opportunity for experienced VCs. The nature of the market has fundamentally changed, and we believe now is an opportune time for investors to get off the sidelines and into the game.

Sources:[1] Cambridge Associates, PME S&P 500 Index, March 31, 2022.[2] PitchBook-NVCA Venture Monitor, July 2022.[3] We define non-traditional investors as hedge funds, crossover funds, mutual funds, traditional private equity firms, sovereign wealth funds and corporate venture capital. About the Author Eden Lawrence is a vice president on the investor relations team at StepStone Group. Prior to joining StepStone, Lawrence was a client service manager with Greenspring Associates, a venture capital and growth equity investment firm that merged with StepStone in 2021. Before that she worked in the QIC Global Private Equity team where she ran and managed a local venture fund and was the ESG champion for the broader investment team. Lawrence graduated from Queensland University of Technology with a dual degree in law and business economics and is an admitted solicitor under the Supreme Court of Queensland, Australia. Disclosure StepStone is an Associate Member of TEXPERS. This document is for information purposes only and has been compiled with publicly available information. StepStone makes no guarantees of the accuracy of the information provided. This information is for the use of StepStone’s clients and contacts only. This report is only provided for informational purposes. This report may include information that is based, in part or in full, on assumptions, models and/or other analysis (not all of which may be described herein). StepStone makes no representation or warranty as to the reasonableness of such assumptions, models or analysis or the conclusions drawn. Any opinions expressed herein are current opinions as of the date hereof and are subject to change at any time. StepStone is not intending to provide investment, tax or other advice to you or any other party, and no information in this document is to be relied upon for the purpose of making or communicating investments or other decisions. Neither the information nor any opinion expressed in this report constitutes a solicitation, an offer or a recommendation to buy, sell or dispose of any investment, to engage in any other transaction or to provide any investment advice or service.

Eden Lawrence is a vice president on the investor relations team at StepStone Group. Prior to joining StepStone, Lawrence was a client service manager with Greenspring Associates, a venture capital and growth equity investment firm that merged with StepStone in 2021. Before that she worked in the QIC Global Private Equity team where she ran and managed a local venture fund and was the ESG champion for the broader investment team. Lawrence graduated from Queensland University of Technology with a dual degree in law and business economics and is an admitted solicitor under the Supreme Court of Queensland, Australia. Disclosure StepStone is an Associate Member of TEXPERS. This document is for information purposes only and has been compiled with publicly available information. StepStone makes no guarantees of the accuracy of the information provided. This information is for the use of StepStone’s clients and contacts only. This report is only provided for informational purposes. This report may include information that is based, in part or in full, on assumptions, models and/or other analysis (not all of which may be described herein). StepStone makes no representation or warranty as to the reasonableness of such assumptions, models or analysis or the conclusions drawn. Any opinions expressed herein are current opinions as of the date hereof and are subject to change at any time. StepStone is not intending to provide investment, tax or other advice to you or any other party, and no information in this document is to be relied upon for the purpose of making or communicating investments or other decisions. Neither the information nor any opinion expressed in this report constitutes a solicitation, an offer or a recommendation to buy, sell or dispose of any investment, to engage in any other transaction or to provide any investment advice or service.

Past performance is not a guarantee of future results. Actual results may vary.

On September 20, 2021, StepStone Group Inc. acquired Greenspring Associates, Inc. (“Greenspring”). Upon the completion of this acquisition, the management agreement of each Greenspring vehicle was assigned to StepStone Group LP. Each of StepStone Group LP, StepStone Group Real Assets LP, StepStone Group Real Estate LP and StepStone Conversus LLC is an investment adviser registered with the Securities and Exchange Commission (“SEC”). StepStone Group Europe LLP is authorized and regulated by the Financial Conduct Authority, firm reference number 551580. StepStone Group Europe Alternative Investments Limited (“SGEAIL”) is an SEC Registered Investment Advisor and an Alternative Investment Fund Manager authorized by the Central Bank of Ireland and Swiss Capital Alternative Investments AG (“SCAI”) is an SEC Exempt Reporting Adviser and is licensed in Switzerland as an Asset Manager for Collective Investment Schemes by the Swiss Financial Markets Authority FINMA. Such registrations do not imply a certain level of skill or training and no inference to the contrary should be made.

In relation to Switzerland only, this document may qualify as “advertising” in terms of Art. 68 of the Swiss Financial Services Act (FinSA). To the extent that financial instruments mentioned herein are offered to investors by SCAI, the prospectus/offering document and key information document (if applicable) of such financial instrument(s) can be obtained free of charge from SCAI or from the GP or investment manager of the relevant collective investment scheme(s). Further information about SCAI is available in the SCAI Information Booklet which is available from SCAI free of charge. Manager references herein are for illustrative purposes only and do not constitute investment recommendations.