European Financial Services and the Macro Outlook: Misconceptions and Realities

Political and diplomatic turmoil in Europe have, perhaps inevitably, led to misconceptions about the economic landscape and the continent’s financial services industry. In reality, differences with the US market are far narrower than expected and a significant opportunity exists for an experienced control investor.

Let’s explore some myths:

Europe’s economy is coping worse than the US

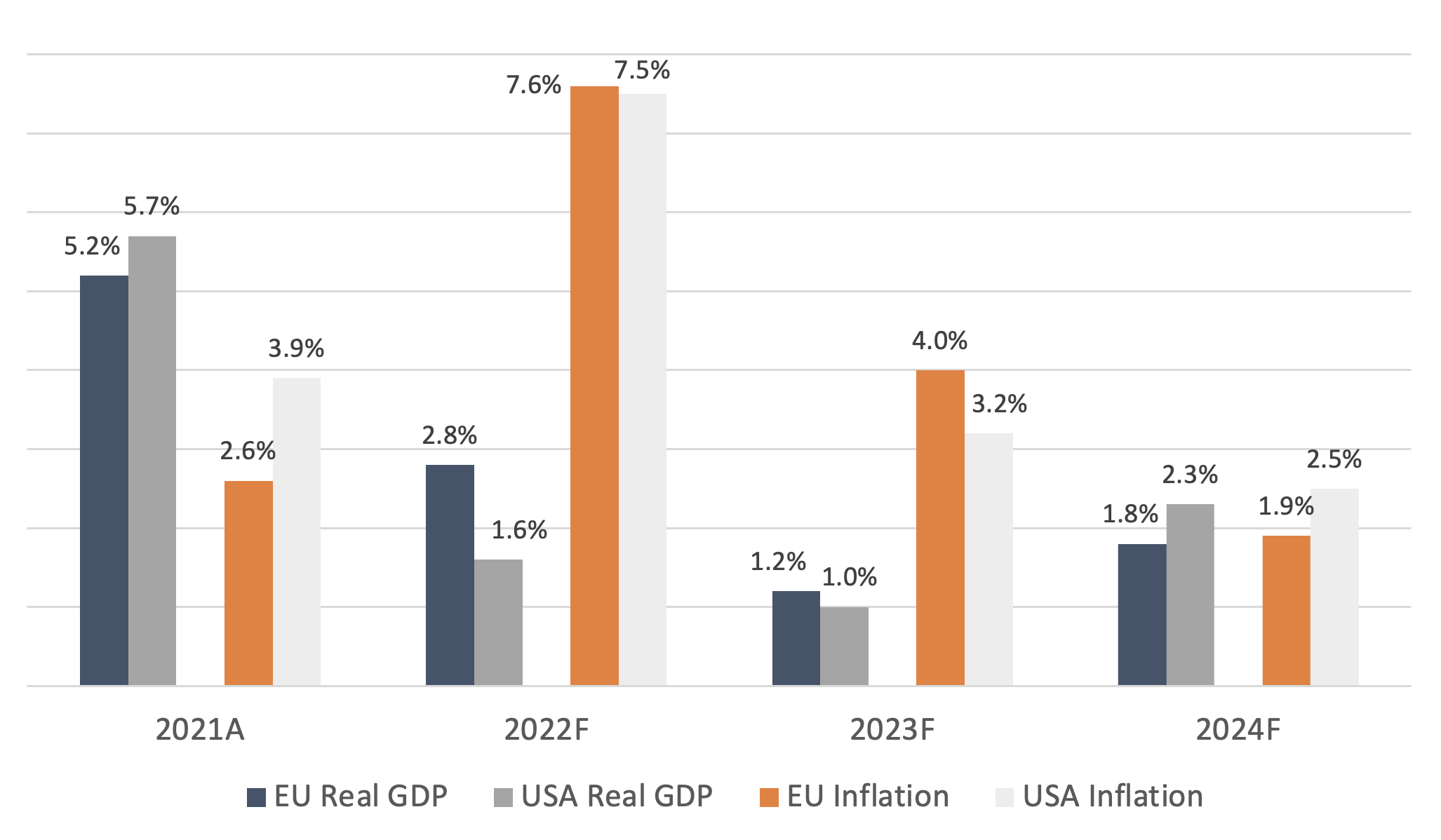

Estimates for Europe and the US are very similar for the medium term, with decelerating growth and mid-to-high single digit inflation. The major forecasting institutions on both sides of the Atlantic see EU and US differences as within 1% for both GDP growth and inflation. Although these forecasts are clearly subject to change, we expect material developments to affect both economies similarly. The fallout from COVID, state responses to the pandemic, and war uncertainty has been relatively uniform; it is therefore consistent that neither economy is outperforming the other. The US should not be seen as a refuge against European economic headwinds since these are largely shared globally.

Financial services is a highly cyclical sector

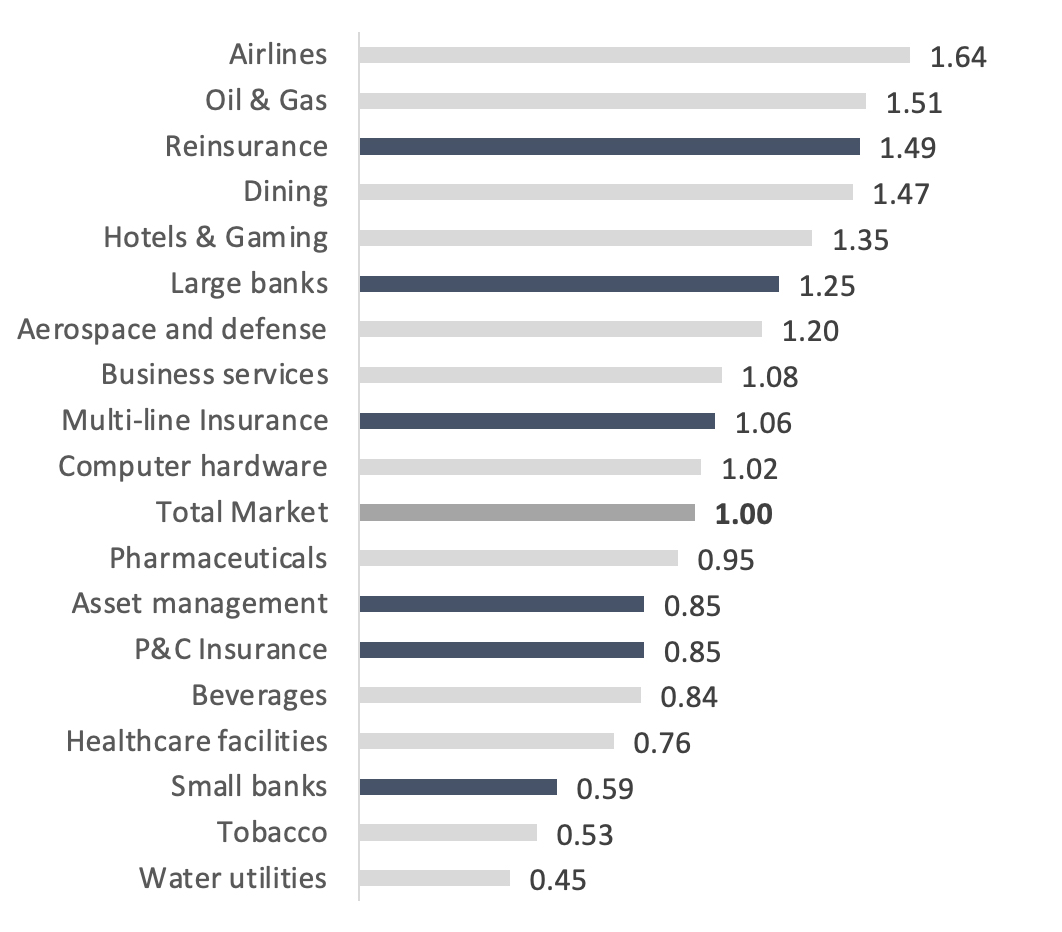

It’s a very diverse sector with individual subsectors spanning the entire spectrum of cyclicality. For example, large commercial banks can be cyclical (a beta of 1.25, comparable to hotels or gaming), because they can often grow balance sheets during periods of high GDP growth and benefit from lower provisions when unemployment is low. Conversely, property and casualty insurers can be cyclically low (beta of 0.85, similar to beverages) as they often sell products that are legally required, such as car insurance or directors liability. Reinsurers may be more cyclical because of their reliance on investing versus underwriting profits. Small, niche banks with focused products have a low cyclicality (beta of 0.59) comparable to water utilities. These, like other private, mid-market companies, often enjoy greater control of their own fate and are more driven by micro factors.

Financial services will fare worse than other sectors in facing macro headwinds

Financial services products skew towards non-discretionary and B2B, making many businesses in the sector relatively defensive to macro stress because their products are not easily cut out of family and corporate budgets. These go beyond mandatory insurance: secured, big-ticket lending such as mortgages may be very defensive; asset and wealth management, although linked to asset valuations, are defensive because personal investment is mission critical to capital growth, for retirement or otherwise. Equally, financial market infrastructure itself, although returns generally benefit from transaction volumes, also represents unavoidable spending.

Inflation is bad for financial services

Inflation matters a lot less than interest rates. While rate rises outpace inflation, the sector stands to gain more than virtually all others, where rates are only a cost and not an income. Bank valuations are at historically unprecedented lows, driven by low rates (and therefore low interest margins) in recent years. In recent decades, there has been a strong correlation between Price to Book Value multiples for European banks and higher interest rates. There remains significant potential upside and option value in bank ownership in an environment of continued rate rises.

Nonetheless, the interest rate background is only a sweetener in value creation from investing in the banking sector. The greatest upside for transformation arises from leveraging operational expertise and overdue adoption of relatively mature modern technology. Three fundamental areas in which major European financial services groups have been slow to change spring to mind: core banking systems, data-rich payment systems and modern functionality, such as ‘buy now, pay later.’

The problem - and therefore the opportunity - lies either at divisional level in larger groups or in smaller to mid-sized players: non-core subsidiaries of larger European banks; established, old-style regional banks; and under-developed speciality lenders. At the smaller end, some operations have simply been unable to attract the right talent to design and implement a successful transformation because they have lacked the capital to support this effort.

In an environment dominated by publicly listed players, financial services businesses have been focused on short term marginal improvements and not sustainable long term value creation. Can private equity accelerate a long overdue catch-up for financial institutions harnessing enabling technology and external operational expertise? Patient capital, leaner decision making and an arguably greater understanding of these systems at shareholder level all suggest that it can.

About the Author: Martin Rauchenwald is partner at Financial Services Capital. He joined FSC after a 20-year career in the financial services industry. Rauchenwald has held senior management roles in UniCredit Group, including a number of executive board positions, where he worked across Munich, London, Vienna and Moscow with a focus on growing and restructuring businesses. He co-founded Ithuba Capital AG, a financial markets advisory and technology-enabled portfolio wind-down specialist. After a successful exit, Rauchenwald joined Oliver Wyman as a Partner for financial services to drive the transformation of financial services companies. He graduated from the University of Santander, Spain, and has an MBA specializing in banking and insurance from the Karl Franzens University in Austria.

Disclaimer: Financial Services Capital Partners LLP (FRN: 845159) is an appointed representative of Kroll Securities Ltd. (FRN: 466588), which is authorized and regulated by the UK Financial Conduct Authority. Financial Services Capital is an Associate Member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Financial Services Capital Partners or TEXPERS. These views are subject to change.