|

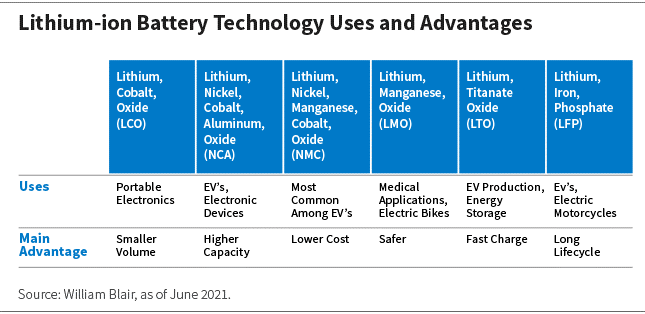

Demand drivers stemming from electric vehicles (EVs) and their infrastructure could impact the utilization of several metals and the countries from which they are sourced—many of them emerging markets (EMs). Specifically, the push toward EVs and their infrastructure supports the demand for a number of metals we call commodities of the future—lithium, nickel, aluminum, and copper. Lithium: Elemental for EV ProductionThe rise of EVs is likely a major reason for the surge in demand for lithium, a key component of lithium-ion batteries. Bloomberg estimates that lithium demand from batteries will increase fivefold from 2021 to 2030.1 S&P expects lithium demand from all uses to triple by 2025 to almost 1.5 million metric tons.2 More than 90% of lithium supply is mined as primary product in hard ores. Total global reserves are estimated at 21 million metric tons in 2020, 23.5% higher than they were in 2019 due to continuing exploration of the soft metal. As is the case with other metals, EMs play a pivotal supply role. Although about 50% of mined lithium currently comes from Australia, most known reserves are in Chile. In fact, more than 40% of world reserves are found in Chile. As the country continues to turn reserves into production, its lithium exports should increase, affecting its trade balances. This is already beginning to occur: Chilean lithium exports were almost four times higher in 2020 than they were a decade ago.3 Over the past few years, companies have invested in Chile given the country’s vast lithium reserves. In late 2018, China-based Tianqi Lithium, one of the largest hard rock lithium producers in the world, acquired roughly 24% of Sociedad Química y Minera de Chile (SQM). Moreover, companies in the sector have set aggressive targets to increase production to meet expected demand. Tianqi Lithium, for example, produced more than 70,000 metric tons of lithium carbonate, comprising about 21% of total global supply, in 2020, and its production is expected to grow 70% in 2021. SQM, another significant player in the market, increased lithium production by 43% in 2020 to 64,600 metric tons, comprising about 20% of global supply. Production is expected to increase by another 47% in 2021. SQM expects lithium carbonate demand to grow from 330,000 metric tons in 2020 to 900,000 to 1,000,000 metric tons in 2025. Lithium-ion battery technologies, such as the EVs themselves, are diverse. Depending on end-use, they are produced with a number of other metals and new technologies keep changing. Lithium, nickel, and cobalt are the most common elements of EV battery production, although they can also include manganese, titanate, and iron. The chart below illustrates. |

|

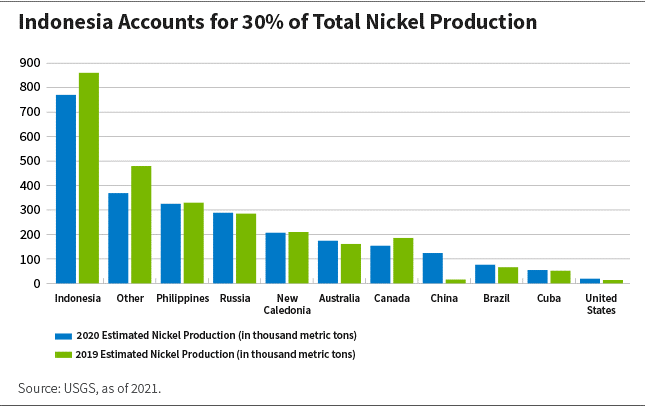

Nickel: High Grade, High DemandNickel is also experiencing demand from EV batteries because it helps deliver higher energy density and greater storage capacity. The very common NCA batteries for EVs, for example, are 80% nickel. Indonesia is the world’s largest producer of nickel, comprising up to 30% of global nickel supply in 2020, according to USGS estimates.4 In January 2020, Indonesia enacted a two-year nickel export ban to help accelerate the construction of new smelters and preserve nickel resources. The decision will allow Indonesia to process nickel domestically and potentially benefit from an upcoming demand surge in the metal. The second and third largest nickel producers are the Philippines and Russia, with approximately 13% and 11% of total global nickel supply, respectively. As with all metals, nickel quality (grade) varies. In the construction of EV batteries only high-grade nickel is used. But the high-grade nickel market is very concentrated: seven companies accounted for 83% of total supply in 2020.5 The largest high-grade nickel supplier in the world is Russia’s Norilsk Nickel, which had a 22% market share in 2020, followed by the Chinese Jinchuan Group, with 17% market share in the same year. Brazil’s Vale accounted for 12% of total market share in 2020. Companies have long recognized the potential demand surge for nickel due to EVs and related infrastructure and are committed to increasing supply to the market. Norilsk Nickel, for example, has a strategic ambition to increase nickel production up to 17% from 2020 to 2030. Vale, meanwhile, plans to boost nickel production 20% from current production levels by 2025. |

|

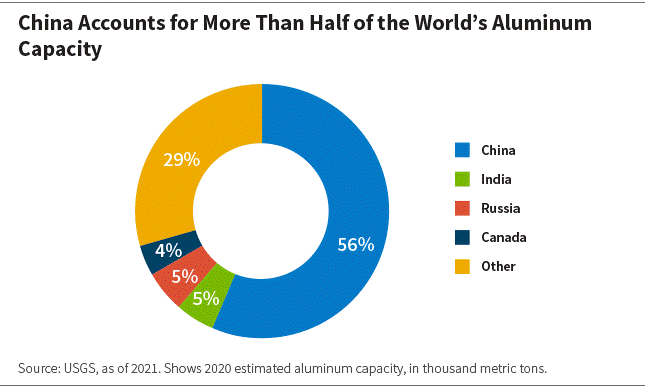

Aluminum: Solving the Weight ProblemWhile battery technology certainly differentiates EVs from conventional vehicles, it also makes vehicles heavier. Replacing steel parts is one way to reduce vehicle weight and improve energy efficiency. Aluminum, a lightweight but strong and malleable metal, is a good substitute for certain steel components and can help reduce the vehicle’s overall weight. Although aluminum is more expensive than steel per metric ton, EV automakers have been increasingly using the metal, particularly for battery, motor housings, and body structural components, as they transition to multi-metal vehicles. Mexico is the fifth largest producer of auto parts in the world, primarily serving the all-important U.S. auto market. We believe its auto components industry is well poised to benefit from the rise in lightweight auto parts. China dominates both the supply and demand of aluminum. In 2019, China produced about 37 million metric tons, according to USGS estimates, which is about half of the total global aluminum supply. China has also increased its share of global aluminum production capacity from 11% in 2000 to almost 60% currently. This increase has at times created oversupply and depressed prices. However, Chinese consumption has also grown due to urbanization, economic growth, investments in infrastructure and real estate, and, most recently, the focus on EVs. The largest aluminum producers in the world are based in China. Aluminum Corporation of China Limited (Chalco) and Hongqiao Group are the largest producers of primary aluminum globally. Chalco is 39% owned by Aluminum Corporation of China, which is a state-owned and strategic company for China. Russia’s United Company Rusal is the third largest primary aluminum producer globally, accounting for 6% of global production in 2020. It believes aluminum is the way to more sustainable industries and sees demand spiking in the coming years. |

|

Next Up: CopperRegardless of the type of EV or its components, all EVs need charging stations, and the growth of EVs on the roads requires proportionate growth in infrastructure. In our next post, we will look at the growth in charging stations and the related increase in demand for copper. |

| Sources:1 USGS, 2021.2 Nornickel annual report, December 2020.3 BloombergNEF.4 “Lithium Supply Is Set to Triple by 2025. Will it be Enough?” S&P Global Platts, October 2019.5 Banco Central de Chile. |

About the Authors: Alexandra Symeonidi, CFA, is a corporate credit analyst on William Blair’s emerging markets debt (EMD) team. In this role, she covers the Europe, Middle East and Africa (EMEA)oil and gas, metals and mining, industrials, and utilities sectors. Before joining William Blair, she was a credit analyst on NN Investment Partners’ EMD team. Before joining NN Investment Partners’ EMD team in 2018, she worked on the firm’s multi-asset and performance measurement teams. Alexandra received a B.S. in economics from Athens University of Economics and Business and an M.Sc. (cum laude) in finance and investments from Erasmus University’s Rotterdam School of Management. Alexandra Symeonidi, CFA, is a corporate credit analyst on William Blair’s emerging markets debt (EMD) team. In this role, she covers the Europe, Middle East and Africa (EMEA)oil and gas, metals and mining, industrials, and utilities sectors. Before joining William Blair, she was a credit analyst on NN Investment Partners’ EMD team. Before joining NN Investment Partners’ EMD team in 2018, she worked on the firm’s multi-asset and performance measurement teams. Alexandra received a B.S. in economics from Athens University of Economics and Business and an M.Sc. (cum laude) in finance and investments from Erasmus University’s Rotterdam School of Management.  Luis Olguin, CFA, is an emerging markets corporate portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, he was a senior portfolio manager on NN Investment Partners’ EMD team. In that role, he had global portfolio management responsibilities for emerging markets corporate credit as well as analyst duties across the Latin American oil and gas, metals and mining, and industrials sectors. Previously, he was head of equities for AFP Habitat, a pension fund in Peru. During this time, he was also a professor at the University of Lima, where he taught several courses on investment management. Before that, he was a director with financial and managerial responsibilities for a family-owned conglomerate in Peru. He also spent eight years in fixed-income research and portfolio management roles at ING Investment Management (NN Investment Partners’ predecessor). Luis received a B.B.A. from Emory University’s Goizueta Business School. Luis Olguin, CFA, is an emerging markets corporate portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, he was a senior portfolio manager on NN Investment Partners’ EMD team. In that role, he had global portfolio management responsibilities for emerging markets corporate credit as well as analyst duties across the Latin American oil and gas, metals and mining, and industrials sectors. Previously, he was head of equities for AFP Habitat, a pension fund in Peru. During this time, he was also a professor at the University of Lima, where he taught several courses on investment management. Before that, he was a director with financial and managerial responsibilities for a family-owned conglomerate in Peru. He also spent eight years in fixed-income research and portfolio management roles at ING Investment Management (NN Investment Partners’ predecessor). Luis received a B.B.A. from Emory University’s Goizueta Business School. |

| WilliamBlair is an Associate Advisor Member of TEXPERS. The views and opinions contained herein are those of the authors, and do not necessarily represent the views of WilliamBlair nor TEXPERS. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect. |

| Follow TEXPERS on Facebook, Twitter and LinkedIn as well as visit our website for the latest news about Texas' public pension industry. |

Oct

26

Share this post: