While we are favorable on the overall outlook for emerging markets (EMs), there is a wide disparity in the pace and stage of their recoveries from economic disruptions caused by the COVID-19 pandemic. While gross domestic product (GDP) expectations for all EMs decreased significantly because of the pandemic, this delta is significantly smaller for countries such as China that were among the first to experience widespread infections and implement measures to control the pandemic.

China’s path to economic recovery provides somewhat of a roadmap for what recoveries in other EMs that are later in the outbreak/shutdown/recovery cycle could look like. As a result, we are seeing increasing opportunities in laggard countries such as India, Indonesia, and Brazil that are just now coming out of the pandemic and moving more significantly into their recovery phases.

Seeking Sustainable Growth Opportunities Amid the Evolution of EMs

While some EMs are still heavily dependent on commodities and exports, technology has become as central to EMs as it has to developed markets. This evolution underpins much of our portfolio positioning and where we are finding opportunities for sustainable value creation in EMs.

Growth and Asia Are More Prominent in EMs

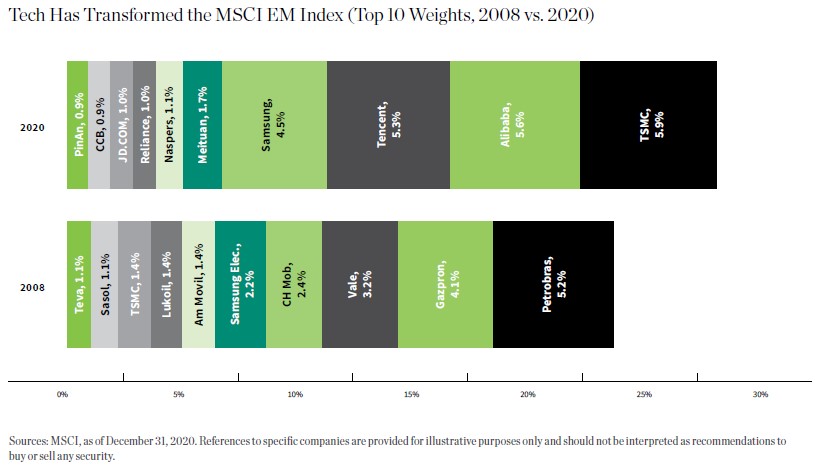

The drivers of value creation over the past decade have shifted, transforming the shape of EM equities as an asset class. The MSCI EM Index has gone from being highly dependent on energy and commodities to being driven by IT, media, and consumer companies.

This shift is reflected in the chart below, which shows that the four largest components of the index in 2020—Alibaba, Tencent, TSMC, and Samsung—account for nearly a quarter of the index weighting. We find that current valuations in EMs do not fully reflect the index’s shift toward higher-growth sectors.

The transformation of Reliance Industries is a microcosm of the shift in EMs broadly. Reliance was originally an oil and gas infrastructure and energy company, but in the past decade the company has invested heavily in telecommunications and other less commodity-driven areas. As part of that change, Reliance has built a wireless and fiber optic network in India and then moved to capitalize on e-commerce, fintech, and social media opportunities from the broad consumer base it built through that rollout.

Country weightings in the index have changed significantly as well, shifting toward Asia at the expense of Latin America and the Europe, Middle East, and Africa (EMEA) region.

In particular, China’s weighting is poised to increase. In addition to China’s strong economic recovery from the pandemic, companies such as Alibaba and Tencent continue to have significant potential room for expansion. China A-shares have become far more important and provide what we see as a massive opportunity for both fundamental and technical reasons. The inclusion of China A-shares in the MSCI EM Index should lead to additional inflows as both active and passive investors gain broader access to mainland Chinese stocks.

E-commerce, Healthcare, and FinTech Offer Compelling Opportunities

The increased importance of technology and rising consumer spending dominate the growth investing landscape in EMs. Looking beyond these mega-trends, we are particularly focused on the following sectors and themes in our search for high-quality companies offering sustainable growth.

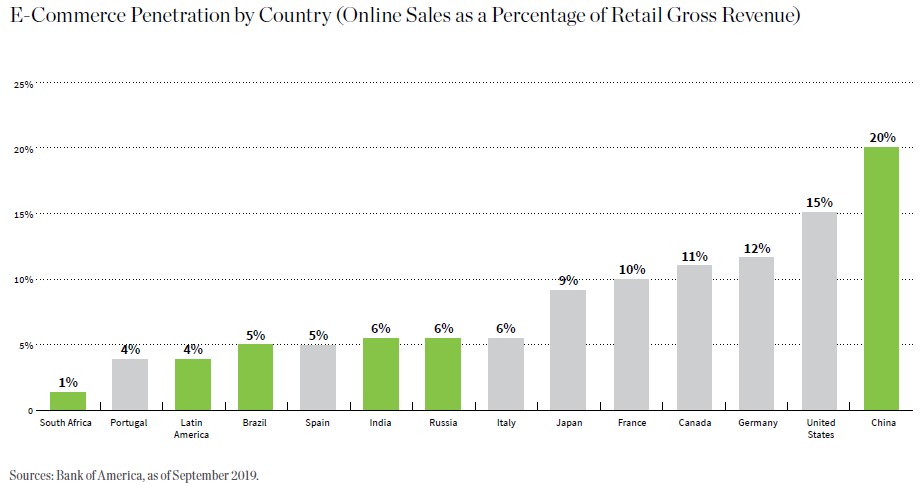

The first sector/theme is e-commerce, which is one of the most compelling trends shaping EMs. Fueled primarily by Alibaba, China shows the potential for e-commerce penetration in other EMs. As shown in the chart below, e-commerce penetration in non-China EMs significantly trails developed markets, but major investments in digital infrastructure have expanded mobile data coverage and increased smartphone adoption in EMs.

In addition to these longer-term drivers, the pandemic has spurred more consumers to purchase online in both emerging and developed markets. In our view, part of the appeal of investing in e-commerce companies in EMs is that many EM governments create barriers to Amazon and other foreign players; this reduces price competition and supports the development of “local champions,” such as Reliance Industries in India and Magazine Luiza in Brazil.

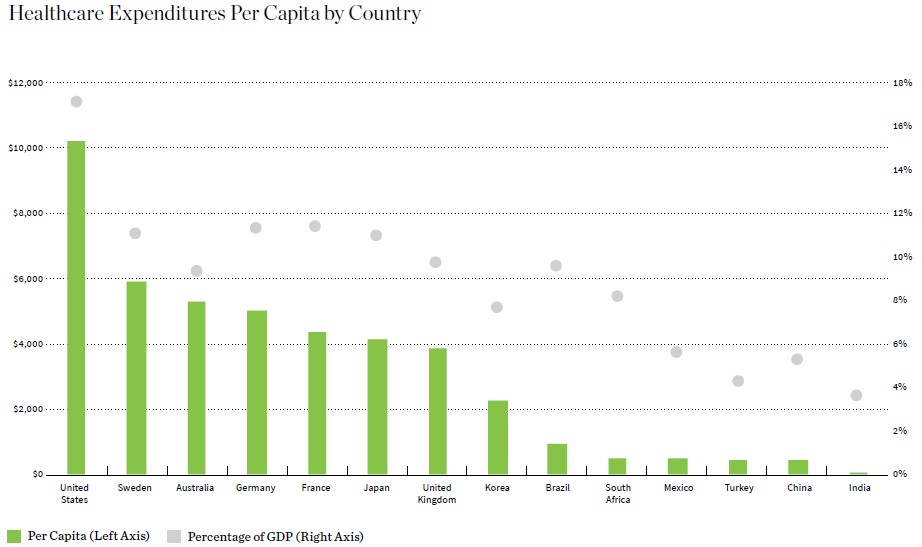

Another sector/theme is healthcare. We have found attractive investment opportunities in the healthcare sector for many years, and the pandemic has only enhanced our conviction in healthcare as a long-term quality growth sector in EMs.

We see healthcare expenditures as an extension of an overall increase in consumer spending in EMs. As shown in the chart below, healthcare spending per capita is still very low in EMs relative to developed markets. As disposable incomes grow, we expect to see significant increases in spending on health and wellness by consumers in EMs.

Lastly, we see opportunities in consumer and financial technology (fintech).We believe that the consumer sector will continue to experience structural growth, fueled by rising disposable incomes in EMs. We also like that the sector provides exposure to fintech, which we see as the most attractive aspect of financials.

Tapping into the tremendous potential of digital payments and other aspects of fintech are the only paths to sustainable growth in EM financials, in our view. We are selectively adding to our broader financials exposure in India as we seek to capitalize on the country’s improving economic conditions.

Expanding Opportunity Set for Quality Growth Investors

As we evaluate the longer-term landscape for EM equities, we see an expanding opportunity set full of leading companies with tremendous growth potential.

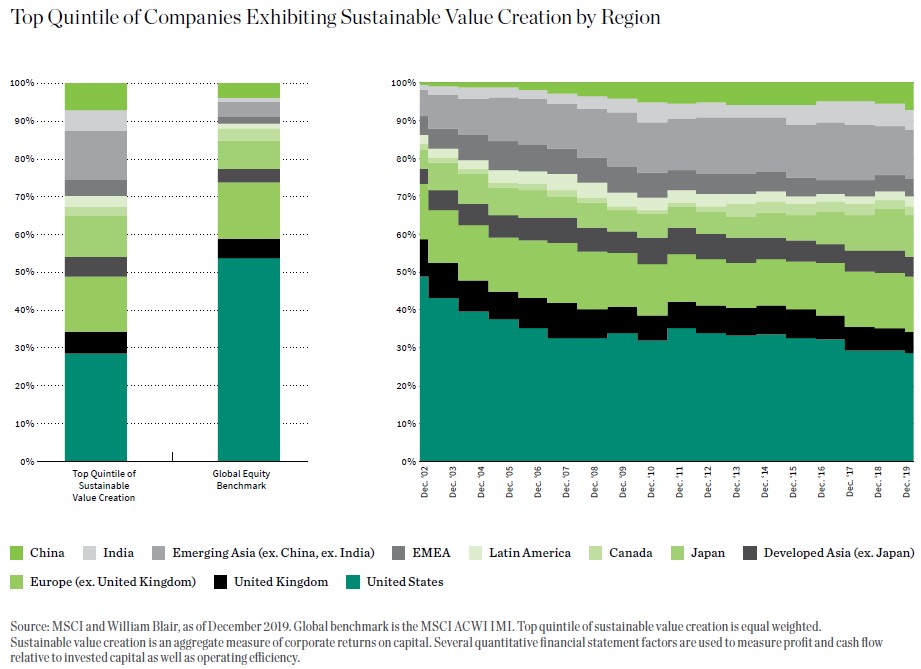

Our investment approach centers on identifying companies with sustainable value creation characteristics, including those with industry-leading return on invested capital (ROIC) profiles and durable competitive advantages.

The chart below shows that EMs include a disproportionate share of top-quintile companies in terms of sustainable value creation. Moreover, the share of top-quintile companies domiciled in EMs has increased over time—a trend that we expect to continue.

Given the widely diverging outlooks for sectors, countries, and companies in EMs, we believe active management is paramount. While the asset class as a whole appears attractive now, passive exposure would force investors to own the less attractive sectors, countries, and companies with more perilous economic growth prospects.

We believe the ability to successfully navigate EM equities requires extensive experience and bottom-up research to capitalize on the opportunities and manage risks in this dynamic asset class.

About Todd M. McClone, CFA

Todd McClone, CFA, partner, is a portfolio manager for William Blair’s emerging markets strategies. Before joining the firm in 2000, he was a senior research analyst specializing in international equity for Strong Capital Management. Previously, he was a corporate finance research analyst with Piper Jaffray, where he worked with the corporate banking financials team on a variety of transactions, including initial public offerings, mergers and acquisitions, and subordinated debt offerings. He also issued fairness opinions and conducted private company valuations. Todd received a B.B.A. and B.A. from the University of Wisconsin–Madison.

Todd McClone, CFA, partner, is a portfolio manager for William Blair’s emerging markets strategies. Before joining the firm in 2000, he was a senior research analyst specializing in international equity for Strong Capital Management. Previously, he was a corporate finance research analyst with Piper Jaffray, where he worked with the corporate banking financials team on a variety of transactions, including initial public offerings, mergers and acquisitions, and subordinated debt offerings. He also issued fairness opinions and conducted private company valuations. Todd received a B.B.A. and B.A. from the University of Wisconsin–Madison.

William Blair is an Associate Advisor member of TEXPERS. The views expressed in this article are those of the author and not necessarily of William Blair nor TEXPERS. Follow TEXPERS on Facebook, Twitter, and LinkedIn and visit its website for the latest news about the public pension industry in Texas.