The Future of the Service Provider Evaluation Might Already Be Here

The process of evaluating investment managers has evolved in the last several decades. In addition to comparing a manager to its benchmark, investors can compare peer groups, other investment products, and even factor-based funds to see how their manager “stacks up.”

While the tools and processes to evaluate investment managers and their products have advanced, similar advancements have been slower to occur in evaluation of your Consultant or Outsourced Chief Investment Officer (OCIO) (the “Advisor”). This piece will touch upon the quantitative and qualitative elements of evaluation and will highlight the changes in evaluation of consultants and OCIO providers.

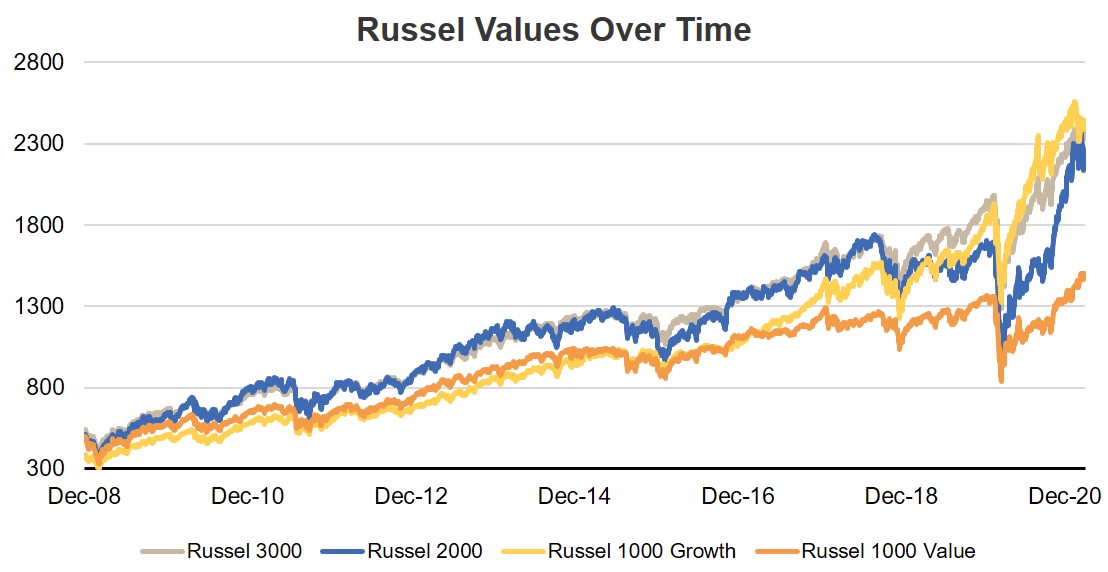

From a quantitative aspect, the primary way to judge investment performance is to compare how the Advisor performed against the Investment Policy benchmark, which is dictated by the investor. This is an easy way to check the box and move on. However, just like the box score from a sports game, this method doesn’t provide any details beyond a simple pass or fail. PFM believes our clients need more information. For example, during strong equity markets, which we have seen domestically since the Global Financial Crisis, if your Advisor lacked a heavy tilt towards growth stocks or a significant exposure to large-cap passive investments, they may have struggled to outperform in the last decade. By reviewing only, the performance numbers, investors can miss out on the full story. When investors must allocate more into equites, understanding how and why a portfolio performed is crucial to fulfill their fiduciary obligations.

In addition to comparing how a portfolio performed against its pre-determined benchmark, investors can compare the manager of any of the investment vehicles within the portfolio against a similar investment vehicle, or peer group. At a manager level, peer groups give investors a way to compare how other managers handled a similar mandate.

Up until recently, investors were able to compare their performance and their investment managers, but there were no formal ways to compare their Advisor. It has been hard to compile because of the lack of compliance with GIPS standards in this area, few firms maintaining composites, and the notion that customizing clients is relative. Last Year, Alpha Capital and NASDAQ teamed up to create the first OCIO composite to compare firms against each other. The Alpha Nasdaq OCIO Index goes beyond returns and creates universe based on risk profiles, asset allocation, and client or plan types. Their report, which compares 32 advisory firms, helps create a solid foundation for investors to review their existing and future relationships.

We have spent a fair amount of time on the quantitative aspect, but qualitative assessments matter as well. As a board member, from an investment perspective, primary responsibilities are setting the investment strategy, overseeing/implementing the investment strategy, and evaluating the investment manager(s).

While evaluation is often centered on performance, the Advisor should add value to the board in other ways. Other ways the Advisor can add value is through formal education, insight on trends among other boards, or best practices for governance/operations. Unfortunately, unless board members are actively engaging in conversations with outside boards, they are isolated from what other Advisors offer. PFM sees this knowledge gap in RFPs. Boards focus heavily on performance measurements, but may miss out on the full suite of an Advisor’s offerings. This gap leads to boards making decisions based on just part of the picture. Trying to grasp the full scope of services, speaking to other boards, in addition to comparing your Advisor to their peers, will help the board make a better long term decision.

In closing, evaluating a service provider has advanced in recent decades. The creation of the peer universe and more board networks should help provide asset owners a better understanding of their service providers and help evaluate which provider is the best choice for them. The advancement within the peer benchmarks, such as the one created by Alpha Capital and NASDAQ, can standardize performance measurement, which should give boards and trustees an easier way to compare different managers to make better-informed decisions. With the upcoming conference season upon us, this provides board members an opportunity to have better discussions on how providers added value during the past downturn and those who didn’t.

Resources

Information provided via Bloomberg. The referenced index ETFs are: RAY (Russell 3000), RTY (Russell 2000), RLG (Russell 1000 Growth) and RLV (Russell 1000 Value)

About Mallory Sampson & Floyd Simpson III

Mallory Sampson is a Senior Managing Consultant at PFM. She develops and implements investment strategy and recommends asset class and investment manager decisions for implementation. She works with a select number of the firm’s institutional multi-asset class relationships in the South region, with a focus on OPEB trusts, endowments, foundations and higher education. Sampson serves as a member of PFM’s National Endowment and Foundation team and the PFM Foundation Committee.

Mallory Sampson is a Senior Managing Consultant at PFM. She develops and implements investment strategy and recommends asset class and investment manager decisions for implementation. She works with a select number of the firm’s institutional multi-asset class relationships in the South region, with a focus on OPEB trusts, endowments, foundations and higher education. Sampson serves as a member of PFM’s National Endowment and Foundation team and the PFM Foundation Committee.

Floyd Simpson III is a Senior Managing Consultant at PFM. He works with institutional clients to develop and implement multi-asset class strategies for their portfolios. He serves on PFM’s Multi-Asset Class Investment Committee, as well as on the board of the CFA Society of Philadelphia.

Floyd Simpson III is a Senior Managing Consultant at PFM. He works with institutional clients to develop and implement multi-asset class strategies for their portfolios. He serves on PFM’s Multi-Asset Class Investment Committee, as well as on the board of the CFA Society of Philadelphia.

PFM is the marketing name for a group of affiliated companies providing a range of services. All services are provided through separate agreements with each company. This material is for general information purposes only and is not intended to provide specific advice or a specific recommendation. Financial advisory services are provided by PFM Financial Advisors LLC and Public Financial Management, Inc. Both are registered municipal advisors with the Securities and Exchange Commission (“SEC”) and the Municipal Securities Rulemaking Board (“MSRB”) under the Dodd-Frank Act of 2010. Investment advisory services are provided by PFM Asset Management LLC which is registered with the SEC under the Investment Advisers Act of 1940. Swap advisory services are provided by PFM Swap Advisors LLC which is registered as a municipal advisor with both the MSRB and SEC under the Dodd-Frank Act of 2010, and as a commodity trading advisor with the Commodity Futures Trading Commission. Additional applicable regulatory information is available upon request. Consulting services are provided through PFM Group Consulting LLC. Institutional purchasing card services are provided through PFM Financial Services LLC. PFM’s financial modeling platform for strategic forecasting is provided through PFM Solutions LLC.

PFM is an Associate member of TEXPERS. The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of TEXPERS. Views are subject to change over time. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about the public pension industry in Texas.