2020 was an incredible year in the capital markets. However, in the wake of very strong performance for both stocks and bonds over the past 12-months, as well as the past decade, most traditional assets are looking expensive. At the same time, concerns over inflation continue to build, and questions about the trajectory of Fed policy dominate investment conversations.

Given this backdrop, how should investors be thinking about portfolio construction? Are there levers that they can pull to enhance their expected rate of return in light of elevated valuations and uncertainty?

Long-term investors tend to focus on the relationship between valuation and return, as buying assets that are attractively priced tends to lead to superior returns over time. In fact, as shown on page 6 of the Guide to the Markets, the forward P/E ratio of the S&P 500 has explained more than 40% of 5-year forward returns over the past twenty-five years. Can this same thought process be applied at the portfolio level? We think it can.

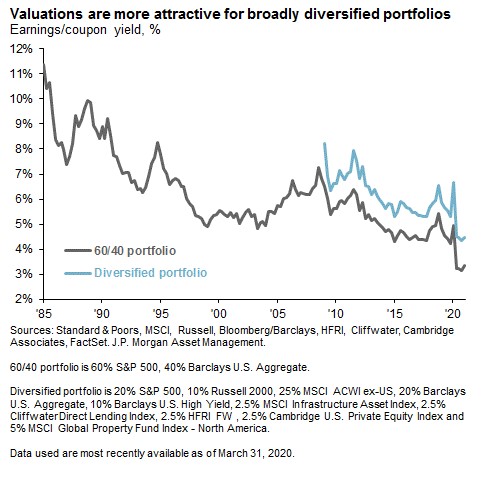

It is possible to think about the valuation of a portfolio as a weighted sum of the underlying asset yields, and then use that valuation to predict future returns. As shown in the chart below, and on page 77 of the Guide, the “earnings/coupon yield” on a traditional 60/40 portfolio is near its lowest level in decades, and nearly 2 standard deviations below its long-term average. However, if we look at the valuation of a more diversified portfolio – which includes international equities, small cap stocks, high yield bonds, and a basket of alternative assets – the earnings/coupon yield is nearly 1%-pt higher. Put differently, this broadly diversified portfolio is more attractively valued, and therefore can be expected to generate more robust returns than the “plain vanilla” option going forward.

Not only is the valuation of the more diversified portfolio more favorable, it can also provide protection against some of the risks on the horizon. As was noted in a previous blog, international equities can provide some protection against rising inflation, as can things like real estate and infrastructure. Furthermore, non-core fixed income can provide more robust yields with less sensitivity to rising rates, while hedge funds can act as an alternative source of diversification.

Much like my young daughter prefers to color with a box of 24 crayons, rather than 12, investors should look to leverage the variety of assets and investment strategies that exist today. A simple approach to portfolio construction may have worked in the past, but it may not work as well in the future.

About David M. Lebovitz

David M. Lebovitz, executive director, is a Global Market Strategist on the J.P. Morgan Asset Management Global Market Insights Strategy Team. In this role, Lebovitz is responsible for delivering timely market and economic insights to clients across the country. He helped build the Market Insights program in the United Kingdom and Europe, has appeared on both Bloomberg TV and CNBC, and is often quoted in the financial press. Lebovitz first joined J.P. Morgan in 2010. Prior to joining the firm, he was a research analyst at Kobren Insight Management. He obtained a bachelor's degree in Political Science and Philosophy, with a concentration in Leadership Studies, from Williams College in 2009. He earned a dual-MBA degree from Columbia University and London Business School in 2015.

M. Lebovitz, executive director, is a Global Market Strategist on the J.P. Morgan Asset Management Global Market Insights Strategy Team. In this role, Lebovitz is responsible for delivering timely market and economic insights to clients across the country. He helped build the Market Insights program in the United Kingdom and Europe, has appeared on both Bloomberg TV and CNBC, and is often quoted in the financial press. Lebovitz first joined J.P. Morgan in 2010. Prior to joining the firm, he was a research analyst at Kobren Insight Management. He obtained a bachelor's degree in Political Science and Philosophy, with a concentration in Leadership Studies, from Williams College in 2009. He earned a dual-MBA degree from Columbia University and London Business School in 2015.

J.P. Morgan Asset Management is an Associate Advisor member of TEXPERS. The views expressed in this article are those of the author and not necessarily J.P. Morgan nor TEXPERS. Follow TEXPERS on Facebook, Twitter, and LinkedIn and visit its website for the latest news about the public pension industry in Texas.