What Does a Post-vaccine World Look Like For Real Estate Valuations?

The past year has been one of considerable disruption in the way we live, work and play. We have seen shifts in sentiment around the value of the real estate in which we conduct these daily activities. As we look to a post-vaccine world where a return to normal is in sight, we are asking ourselves: How much of the distress has been temporary and what has been permanently impaired? At CenterSquare we have found that when it comes to real estate valuations, the REIT market offers early insight into the direction of pricing, with the private market eventually catching up. As we look out over the next several years, the REIT tea leaves provide a great deal to consider.

Multifamily Housing and Single-Family Rentals in the Sunbelt

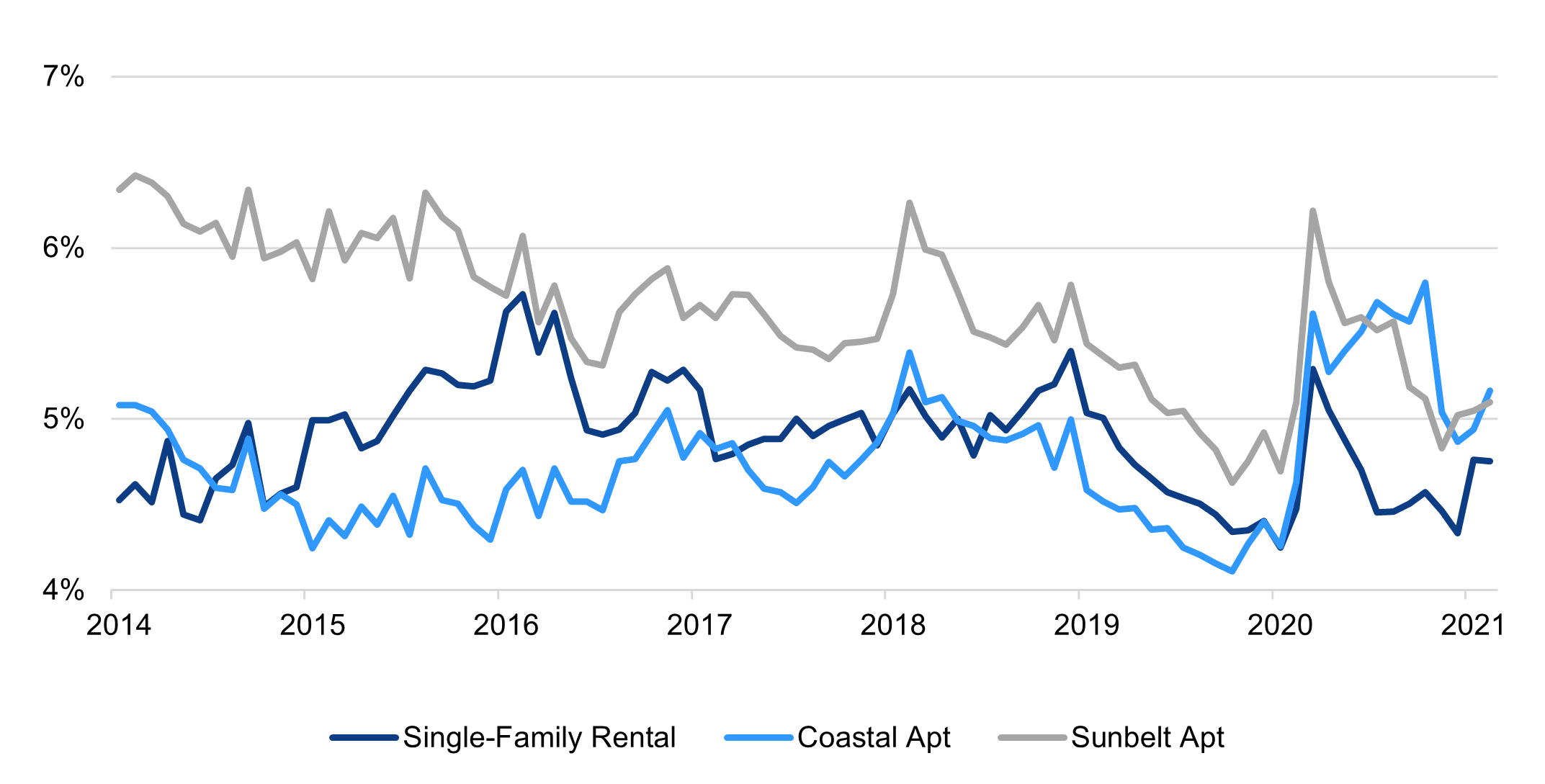

In the Residential sector, the implied cap rates (NOI divided by market value) for multifamily apartments vs. single family rentals (SFRs) offer an insightful story. Here, the REIT market - where early movers in the SFR space like Invitation Homes (INVH) and American Homes 4 Rent (AMH) - has priced in a premium for SFR assets, resulting in a lower cap rate than both the coastal and sunbelt Apartment sectors. The pricing accurately reflects the increased demand for affordable housing for growing families in the U.S. as well as migration patterns away from larger urban areas to small and medium sized cities in the south and southwest. These trends, which bode well for the Residential sector overall, were in play pre-COVID-19, accelerated during the pandemic, and are expected to continue to impact pricing and opportunity in both the public and private markets.

Implied Cap Rates:

Single-Family Rental vs. Coastal and Sunbelt Apartment

2015-2021

Source: REIT Company reports and CSIM as of February 28, 2021.

Industrial and the Last Mile Premium

The Industrial sector has experienced one of the most profound repricing phenomena in the last decade. During the pandemic, ecommerce consumption accelerated significantly, propelling the value proposition of industrial real estate – a critical link in the supply chain. This premium is especially pronounced in last mile, infill locations where limited supply and elevated demand fundamentals are pushing valuations upwards. Current supply and demand fundamentals for infill industrial assets have created an exponential relationship between rent growth and the distance to a city center. Assets in the urban cores are enjoying rents as much as 5.5x the rate for similar properties 30 miles away from the central business districts. Retailers and brands understand fully the need for on-time, no hassle delivery of their product and are willing to pay for locations that get them as close to their customers as possible. Consequently, the REIT market has priced in a meaningful spread between the implied cap rate for portfolios concentrated in secondary markets, compared to portfolios concentrated in urban infill markets. Given the projected continued growth of online shopping, industrial assets – and particularly those in infill areas - can be expected to sustain higher rent levels and market pricing over the next decade. Top quality retailers and investors with strong conviction in the space will benefit from the rising tide.

REIT Implied Cap Rates for Secondary and Urban Markets (2013-2021)

Surce: CenterSquare as of January 31, 2021

Surce: CenterSquare as of January 31, 2021 Infill Industrial represented by average of REXR and TRNO

Office is the “New” Retail

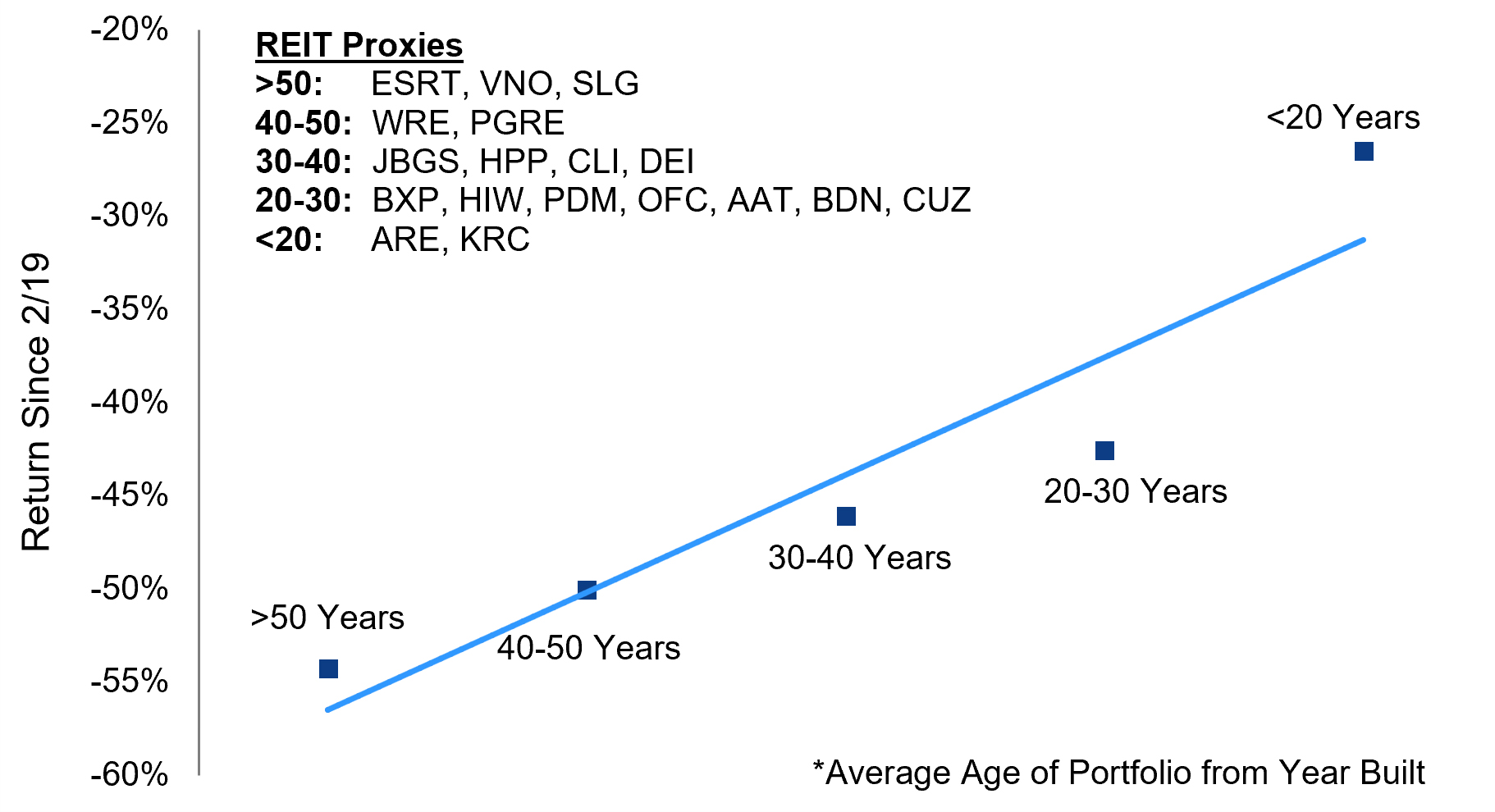

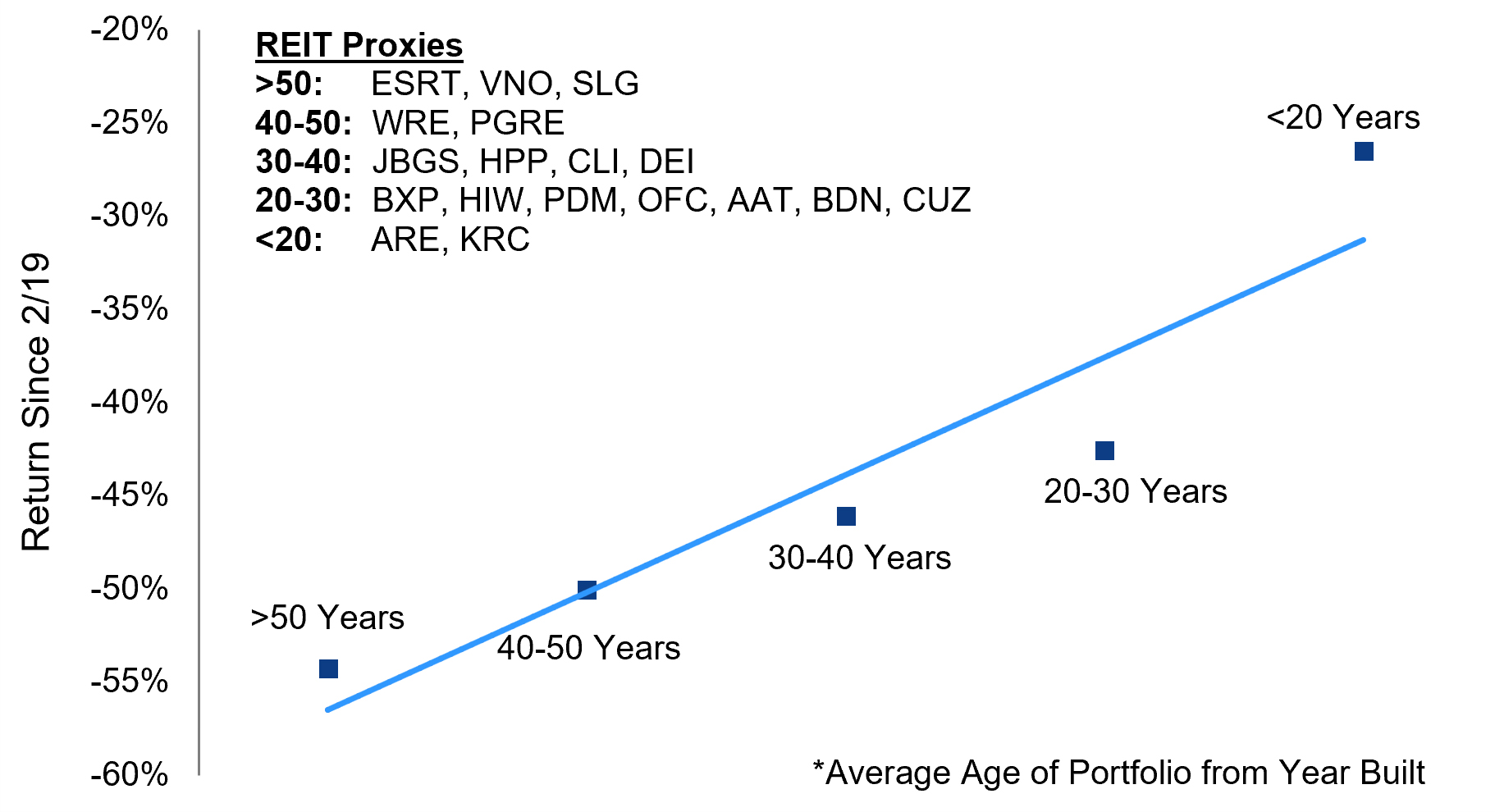

As we embrace a post-COVID world, there is another REIT indicator to watch closely - the Office sector. As more companies move to permanent flexible working arrangements post pandemic, we expect significant disruption in the Office space. While we do not believe the headlines that office is dead, we do believe there will be a shift in the way it is utilized. This shift is likely to mirror what the REIT market predicted in 2016 in the Retail sector, when malls and lower quality shopping centers began to show signs of impairment, while higher quality, grocery anchored shopping and neighborhood service centers were able to withstand the distress. Now in 2021, we anticipate that the Office sector will decline in value overall, but higher quality, newer buildings will emerge in a more stabilized manner. Companies will likely still want a place to foster culture and collaboration, but may choose to lease buildings that offer healthier, flexible spaces. There are already indications of this movement in the REIT market as companies with newer portfolios are outperforming those with older assets. If past predicts present, it can be assumed that the REIT market is forecasting opportunity within Office subsectors for astute investors.

Offices Returns vs. Building Age* During COVID

COVID Period returns are 2.29.20 – 12.31.20.

The above-mentioned examples provide just a few of many leading REIT market indicators. The only constant we can count on over the next decade is change. The COVID-19 pandemic accelerated behavioral shifts already in progress; some of these trends will continue to impact real estate in meaningful ways, others will fade. The REIT market has historically proven itself to reflect early where the market is going, across sectors and many market cycles. Asset managers should be well served by taking heed as they consider a real estate portfolio that is best positioned to take advantage of future opportunities driven by these secular trends and early indicators.

About Meghan Burke

Meghan Burke is a Director, Capital Markets at CenterSquare Investment Management with 16 years of experience in the financial services industry. She is responsible for investor relations and business development initiatives across the firm’s real assets platform. Prior to joining CenterSquare, Burke was a Vice President at BlackRock, where she focused on real asset product strategy and investor relations. She began her career with the Vanguard Group. Burke earned a bachelor's degree in International Business and Marketing from George Washington University and an MBA with a concentration in Finance from The Villanova School of Business. She is a Chartered Alternatives Investment Analyst.