Often an overlooked asset class, we believe that CLO equity deserves strong consideration as a strategic allocation given its attractive historical return profile, time-tested proven structure, and potential diversification benefits the asset class can provide a broader portfolio.

|

|

|

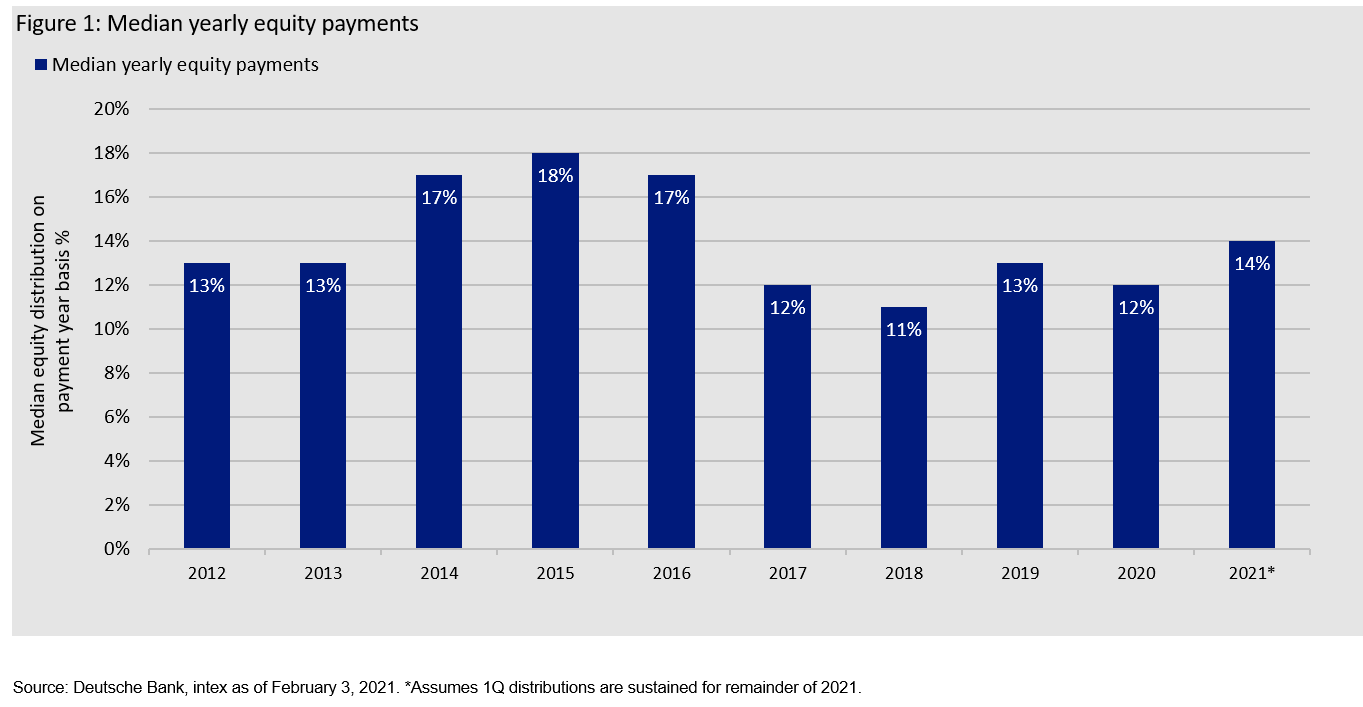

1. Strong historical return profile In simplified terms, CLO equity creates leveraged exposure to senior secured loans. Historically, the asset class has provided strong returns in the form of quarterly dividends, with relatively low credit loss. As shown below, the equity cashflow return of post-crisis CLOs has averaged 14%, illustrating the current income benefits the asset class can bring in today’s low rate environment.1 |

|

2. The CLO structure is time-tested and has successfully navigated numerous cyclesSince their inception in the late 1980s, CLOs have proven themselves by successfully navigating numerous economic cycles and demonstrating an ability to capitalize on market dislocations. Structural features of a CLO such as: active management of the underlying collateral, non-mark-to-market leverage and redeployment of principal proceeds has allowed CLOs to generate historically strong returns throughout economic cycles. This is evidenced by only 6% of CLO equity investments issued from 2004-2007 having negative returns, and over 70% of these issues had double digit IRRs, despite being launched on the eve of the Global Financial crisis.2 CLO equity again proved its resiliency during 2020, where equity distributions reached a median return of 12% on an annualized basis, while weathering the COVID-19 pandemic and the volatility that came with it.3 |

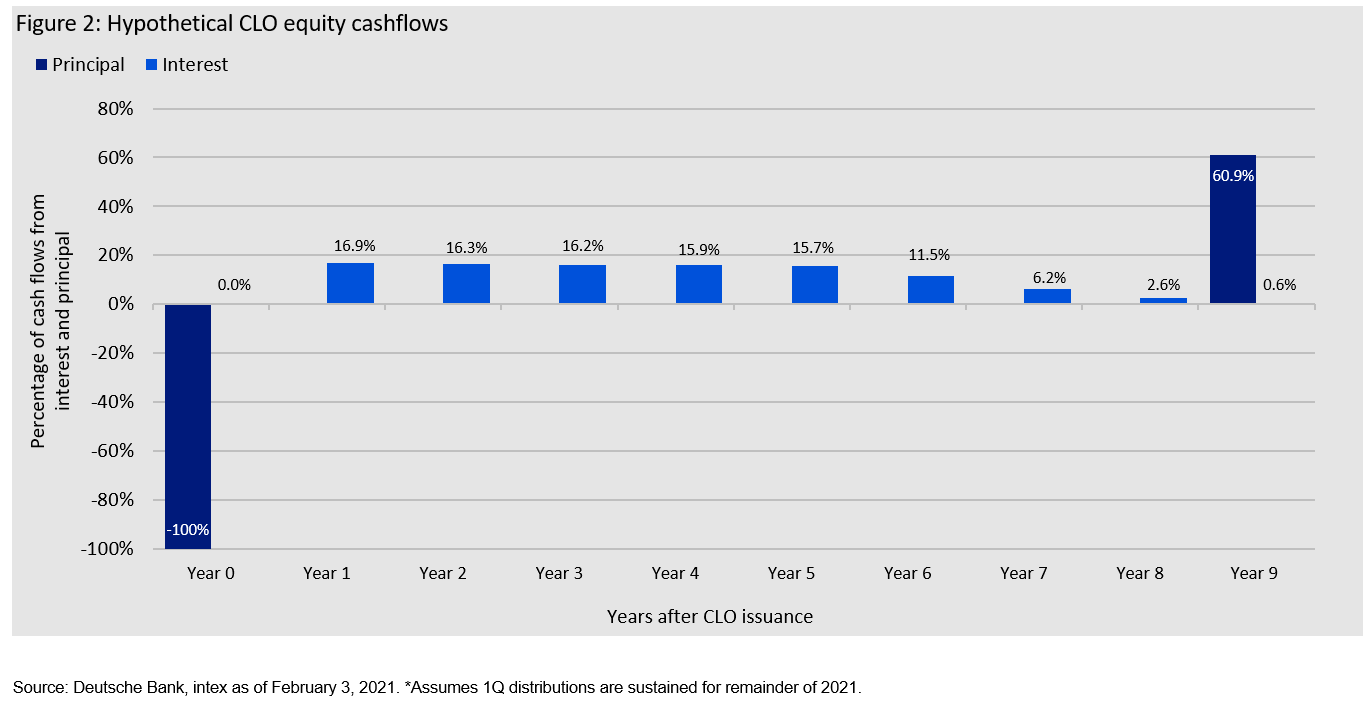

3. Diversification benefitsCLO equity has historically provided diversification benefits when combined with both traditional and alternative investments. The front-loaded return profile of CLO equity can make it a great complement to other alternative investments. As shown below, CLO equity’s front-loaded cash flow provides investors with current cash-on-cash return, reducing the cost basis early in the investment life cycle. This results in CLO equity complementing other long-term, lock-up alternative investments with a back ended return profile such as private equity or venture capital investments, and ultimately smooth out the return profile of a broader alternative allocation. |

|

|

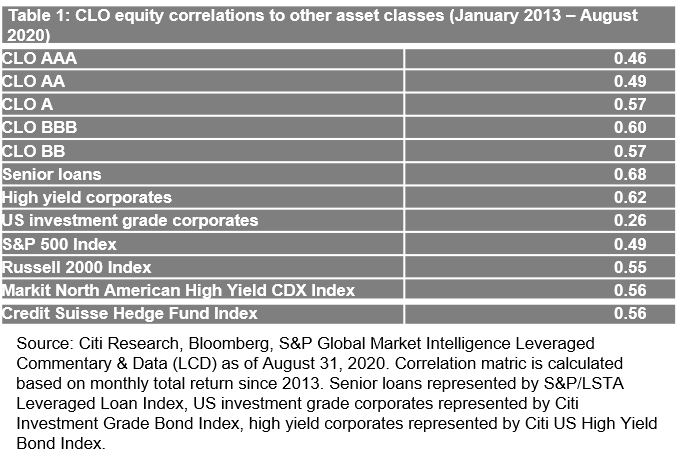

Additionally, CLO equity has had a relatively low correlation with both conservative and risk assets alike, as shown in the table below. |

|

ConclusionWhile the complexity and education associated with CLOs and CLO equity can prove daunting, we feel that the historically strong cash-on-cash return, time tested structure that has successfully navigated numerous cycles, and diversification benefits should lead investors to seriously consider CLO equity in today’s low yielding environment. |

Follow TEXPERS on Facebook, Twitter and LinkedIn as well as visit our website for the latest news about Texas' public pension industry. About risksThe value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. The investment undertakes special risks which may lead to substantial loss. Investors are advised to consider their own financial circumstances and the suitability of the investment as part of their investment portfolio, and investors are advised to obtain all information and professional advice before making the investment.Credit risk is the risk of loss on an investment due to the deterioration of an issuer’s financial health. Such a deterioration of financial health may result in a reduction of the credit rating of the issuer’s securities and may lead to the issuer’s inability to honor its contractual obligations, including making timely payment of interest and principal. Foreign securities have additional risks, including exchange rate changes, political and economic upheaval, relative lack of information, relatively low market liquidity, and the potential lack of strict financial and accounting controls and standards. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. A majority of the assets are likely to be invested in loans and securities that are less liquid than those rated on national exchanges. The prices of securities held may decline in response to market risks. Non-diversification increases the risk that the value of shares may vary more widely, and the investment may be subject to greater investment and credit risk than if it invested more broadly. The ability of an issuer of a floating rate loan or debt security to repay principal prior to maturity can limit the potential for gains. To the extent that there is concentration in securities of issuers in the banking and financial services industries, performance will depend to a greater extent on the overall condition of those industries. The value of these securities can be sensitive to changes in government regulation, interest rates and economic downturns in the US and abroad. May use enhanced investment techniques such as derivatives. The principal risk of derivatives is that the fluctuations in their values may not correlate perfectly with the overall securities markets. Derivatives are subject to counterparty risk — the risk that the other party will not complete the transaction.Leveraging entails risks such as magnifying changes in the value of the portfolio’s securities. Important information This document is intended only for Professional Clients in Continental Europe, Dubai, Guernsey, Ireland, the Isle of Man, Jersey and the UK; in Hong Kong for Professional Investors, in Japan for Qualified Institutional Investors; in Taiwan for Qualified Institutional Investors only; in Singapore for Institutional Investors, in New Zealand for wholesale investors (as defined in the Financial Markets Conduct Act), in Australia for Sophisticated and Professional Investors ;in the USA for Institutional Investors, and in Israel for Qualified Clients/Sophisticated Investors. In Canada, the document is intended only for accredited investors as defined under National Instrument 45-106. In Chile, Panama and Peru, the document is for one-to-one institutional investors only. It is not intended for and should not be distributed to, or relied upon, by the public. For the distribution of this document, Continental Europe is defined as Austria, Belgium, Denmark, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Norway, Spain, Switzerland, and Sweden. All data provided by Invesco unless otherwise noted. All data is US dollar and as of February 28, 2021, unless otherwise noted. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise. This document is written, unless otherwise stated, by Invesco professionals. The opinions expressed herein are based upon current market conditions and are subject to change without notice. This document does not form part of any prospectus. This document contains general information only and does not take into account individual objectives, taxation position or financial needs. Nor does this constitute a recommendation of the suitability of any investment strategy for a particular investor. Neither Invesco Ltd. nor any of its member companies guarantee the return of capital, distribution of income or the performance of any fund or strategy. Past performance is not a guide to future returns. This document is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. As with all investments, there are associated inherent risks. This document is by way of information only. Asset management services are provided by Invesco in accordance with appropriate local legislation and regulations. This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell financial instruments.Australia This document has been prepared only for those persons to whom Invesco has provided it. It should not be relied upon by anyone else. Information contained in this document may not have been prepared or tailored for an Australian audience and does not constitute an offer of a financial product in Australia. You may only reproduce, circulate and use this document (or any part of it) with the consent of Invesco. The information in this document has been prepared without taking into account any investor’s investment objectives, financial situation or particular needs. Before acting on the information the investor should consider its appropriateness having regard to their investment objectives, financial situation and needs.You should note that this information:

|

| Sources:1 Deutsche Bank, Intex as of February 3, 2021.2 Wells Fargo and Intex from 2004-2006. Past performance is not a guide to future returns.3 Deutsche Bank as of February 3, 2021. |