Public defined benefit (DB) plans face intensifying pressure as modest expectations for future investment returns continue to fall short of actuarial discount rates. Post-pandemic market conditions have magnified the challenge as investment consultants continue to lower their capital markets assumptions in the face of low interest rates and rising equity market valuations, which both point to leaner future returns.

These lower expectations are pressuring public pension fiduciaries to reduce their actuarial investment return assumptions, but that typically translates to higher projected plan liabilities, a lower funded status, and ultimately higher contributions from employers and employees.

As a result, decision-makers at public DB plans face a critical dilemma affecting the plan’s future financial health: How to distinguish between the actuarial discount rates used to measure plan benefit obligations and the return expectations used to inform decisions on long-term strategic asset allocation.

In this blog post, which is an excerpt from our paper on this subject, we note that it is important for decision-makers to understand that actuaries and investment consultants offer assumptions on expected returns that are inherently different: Actuarial discount rates assume a static return over time with no variability, whereas investment consultants estimate a median and a range of expected returns based on expected risk.

Comparing Actuarial and Consultant Expected Rates of Return

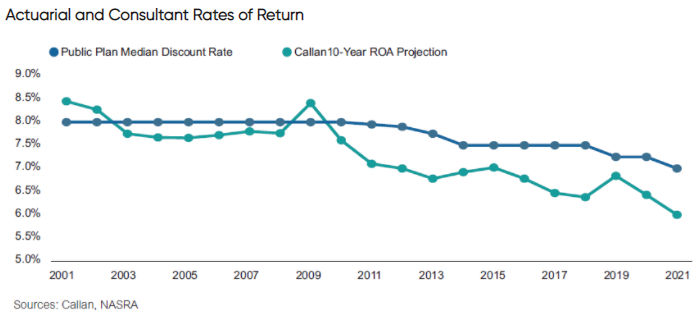

Actuarial discount rates and consultant projected return expectations rarely match. We compare these two rates over the past two decades to more fully understand the dynamics that cause them to change. In this chart, the actuarial rate of return is represented by the median public plan ROA provided by the National Association of State Retirement Administrators (NASRA), and the consultant rate of return is represented by Callan’s 10-year expected return for a consensus public plan asset allocation (modeled as 60% global equity/30% fixed income/10% real estate from 2001-2011, and 60% global equity/25% fixed income/10% real estate/5% private equity for 2012-2021 to reflect the shift to more aggressive asset mixes over the past decade). Each dataset is updated annually, facilitating apples-to-apples comparisons.

For the first decade, public plan median actuarial discount rates were stable at 8%, and consultant return projections were quite similar. After the 2008 Global Financial Crisis (GFC), consultant return projections for fixed income were drastically lowered, materially reducing consultant expected returns at the total portfolio level. That led to a lowering of median actuarial discount rates from 8.0% to 7.5%.

Now, due to the pandemic response by the Fed, interest rates are at all-time lows, which has reduced consultant return expectations to all-time lows as well. That will likely drive median actuarial expectations down from their current 7.0% level.

Conclusion

When setting both actuarial discount rates and long-term asset-allocation strategies, public pension fiduciaries should be aware of what drives the differences between their actuarial discount rate and consultant’s capital markets assumptions. Callan recommends boards consider the following factors when confronting these differences:

- Differences in time horizon: Investment consultant forecasts generally cover a shorter period than actuarial discount rates do.

- Long-term actual results: How has a plan performed relative to both current assumptions as well as potential new discount rates being considered?

- Inflation expectations: In addition to nominal comparisons, compare real (after inflation) investment return expectations from their consultants to the real actuarial discount rate to understand what portion is driven by differences in inflation expectations.

- Discount rate changes: Consider the timing and magnitude of the last discount rate change. How often are these inputs evaluated?

- Active management: Evaluate the plan’s success in achieving value-added from active management for traditional asset classes and consider the prospects for continuing to do so.

Setting asset allocation is more complex than just solving for the portfolio that provides the expected return equal to the actuarial discount rate. Changes to actuarial assumptions should be done infrequently and based on expert advice and recommendations because these changes can have major impacts on a plan’s funded status and overall health.

In a lower expected return environment, selecting a portfolio to hit an overly aggressive return target can lead to adverse financial outcomes in the event of a material market correction. Fiduciaries should be very cautious about simply taking on more investment risk to achieve a higher return. Investment consultants projecting modest returns for the coming 10 years need to direct fiduciaries’ attention to the task of investing through the coming 10-year period so that the pension plan maintains solvency until a future environment offers more favorable investment expectations. Fiduciaries may need to lower their actuarial discount rates to reflect the direction of expected asset return projections from investment consultants, but these two numbers are different and need not match.

About the Authors:Brady O’Connell, CFA, CAIA, is a senior vice president in Callan’s Chicago consulting office. Brady has consulted with a variety of clients, including corporate and public defined benefit plans, defined contribution plans, endowments and foundations. He is a member of Callan’s Client Policy Review and Alternatives Review committees and is a shareholder of the firm. John Pirone, CFA, FRM, CAIA, is a senior vice president and a consultant in the Capital Markets Research group, based in Callan’s San Francisco headquarters. He is responsible for assisting clients with their strategic investment planning, conducting asset allocation studies, developing optimal investment manager structures, and providing custom research on a variety of investment topics. John is a member of Callan’s Alternatives Review Committee and a shareholder of the firm.Callan is a Consultant member of TEXPERS. The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of Callan nor TEXPERS, and are subject to revision over time. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about Texas' public pension industry.