Public Fixed Income: 2021 Was A Strong Year But Had Its Ups and Downs

Note: This piece was adapted from a roundtable discussion. -- What do corporate fundamentals look like in a year where inflation and rates are taking center stage? Developed and emerging market (EM) corporates look fairly well-positioned, supported by the continued re-opening of economies and largely successful vaccine rollouts around the world. Earnings have also improved across the board, and defaults are expected to remain low going forward. That said, there are ongoing concerns around inflation amid rising raw material costs and supply-side disruptions. Although many companies have been able to pass higher costs through to consumers, the longer-term casualties from the tangled supply chain will have repercussions for some time to come—and we have likely not yet seen the full effects of wage inflation. These factors raise questions around how much margin compression may result from continued inflationary pressures going forward and the ultimate impact of inflation on consumer demand. On the positive side, for both developed and EM companies, we've seen a significant amount of refinancing in 2020 and 2021, meaning many companies have locked in lower funding costs and now have a stronger buffer against these pressures. This should help keep corporate fundamentals relatively stable.

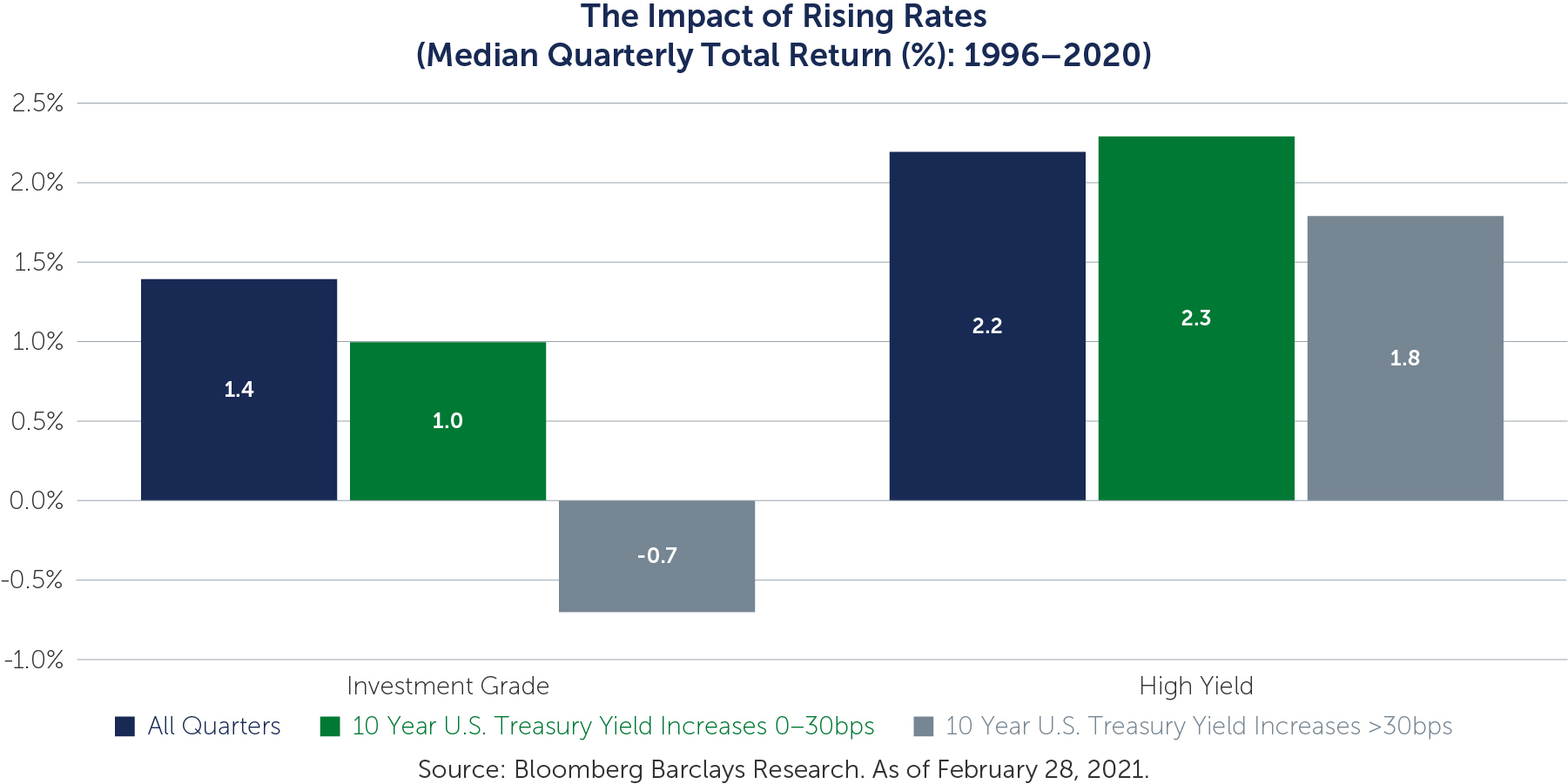

As you look across the fixed income markets, how worried are you about higher rates? Dating back to the global financial crisis, central bankers have made it a priority to over-communicate with markets, and that’s what we’re seeing today. This suggests that any forthcoming rate increases will be widely telegraphed, and less likely to surprise the markets. That said, rates will rise—and while this will pose a challenge for some fixed income asset classes, there are others that can provide protection against interest rate moves. Shorter-duration investment grade strategies are an example, as are high yield bonds, which are shorter in duration relative to some traditional fixed income products. There are also benefits to considering variable or floating rate asset classes such as CLOs, public and private loans, as well as certain securitized instruments.

China has dominated headlines lately. Do you see the potential for contagion into developed markets? China has certainly been one of the most topical markets recently, with the Chinese government implementing sweeping regulatory changes across sectors like real estate, tech and education. While these measures have created significant volatility and spread widening, we think the likelihood of contagion outside of China is very low. For one, in order for contagion to occur, there needs to be a cross-border mechanism. Looking at the real estate sector as an example, most of the lending comes from Chinese banks, rather than international banks. There are also very few international investors with exposure to Chinese real estate sector bonds, suggesting the volatility and losses within the sector will not necessarily translate into outflows or contagion outside of the region. That said, for the EM corporate debt market in particular, one of the biggest possible risks going forward is that the Chinese government takes the regulatory changes too far, and causes a pronounced slowdown in the Chinese economy—which could create a significant headwind for the wider EM asset class.

How is ESG changing the industry today, and/or influencing the way your fixed income teams are investing? At a high level, fixed income issuers have made tremendous strides in recent years—but there is progress still to be made. In particular, data and disclosures, including coverage by third-party providers, can be quite limited across the market. In the European loan market, for instance, only about 20% of companies are transparent with their carbon data. [1] But with climate change a mainstay in conversation and government policy around the globe, investors are increasingly putting pressure on managers to quantify—and ultimately reduce—the impacts of their portfolios associated with carbon emissions. As a result, there are a number of ongoing initiatives across the industry that seek to improve the data that is available to investors. At the same time, many companies have started to realize that a stronger ESG profile can result in improved funding costs, which is further driving the momentum for better data and disclosures on ESG issues. We expect these efforts to continue to accelerate.

Where do you see the most compelling opportunities across the market? There is a variety of credit asset classes to choose from depending on an investor’s risk/return objectives. Liquid loans may look attractive to some, for instance, as they tend to be relatively stable and typically return to par pretty quickly after big market events. EM corporate debt is another area worth considering. Within the high yield segment of the market, in particular, we have continued to see opportunities arise on the back of volatility in countries like Brazil and Turkey. Often, these pockets of volatility cause corporate spreads to widen beyond what fundamentals would suggest, creating opportunities to identify solid, globally diverse issuers at attractive prices.

That said, there is also value in having a flexible mandate. The world has shown us that opportunity sets between credit asset classes can change very quickly, underscoring the importance of investing with a manager that can monitor events in real time and dynamically allocate into opportunities as they present themselves, through 2022 and beyond.

Martin Horne, is Barings' Head of Global Public Fixed Income, a group that incorporates the Global High Yield, Investment Grade, Structured Credit and Emerging Markets currency, rates, sovereign and corporate debt investment teams. Horne is also Chairman of the European High Yield Investment Committee, Chairman of the Global High Yield Allocation Committee, a member of the European Management Team and a member of Barings’ Senior Leadership Team. He is also an Executive Sponsor of the Barings Black Talent Network employee resource group, as well as the Charter for Black Talent in Finance and the Professions in the U.K. Horne has worked in the industry since 1993 and his experience has encompassed the mid cap, structured credit, investment grade and leveraged finance markets. His roles at Barings also incorporated roles as senior portfolio manager in cornerstone strategies, and head of research for the European High Yield Group. Prior to joining the firm in 2002, Horne was a member of the European Leverage Team at Dresdner Kleinwort Wasserstein where he focused on lead arranging and underwriting senior, mezzanine and high yield for financial sponsor-driven leverage buyouts throughout Europe. He has also held positions at KPMG Corporate Finance, where he advised on complex debt transactions, National Australia Bank, in their corporate and structured credit team and National Westminster Bank’s corporate banking unit. Martin previously served on the board of directors of the Loan Market Association and holds a bachelor's degree in Economics from Reading University.

Martin Horne, is Barings' Head of Global Public Fixed Income, a group that incorporates the Global High Yield, Investment Grade, Structured Credit and Emerging Markets currency, rates, sovereign and corporate debt investment teams. Horne is also Chairman of the European High Yield Investment Committee, Chairman of the Global High Yield Allocation Committee, a member of the European Management Team and a member of Barings’ Senior Leadership Team. He is also an Executive Sponsor of the Barings Black Talent Network employee resource group, as well as the Charter for Black Talent in Finance and the Professions in the U.K. Horne has worked in the industry since 1993 and his experience has encompassed the mid cap, structured credit, investment grade and leveraged finance markets. His roles at Barings also incorporated roles as senior portfolio manager in cornerstone strategies, and head of research for the European High Yield Group. Prior to joining the firm in 2002, Horne was a member of the European Leverage Team at Dresdner Kleinwort Wasserstein where he focused on lead arranging and underwriting senior, mezzanine and high yield for financial sponsor-driven leverage buyouts throughout Europe. He has also held positions at KPMG Corporate Finance, where he advised on complex debt transactions, National Australia Bank, in their corporate and structured credit team and National Westminster Bank’s corporate banking unit. Martin previously served on the board of directors of the Loan Market Association and holds a bachelor's degree in Economics from Reading University.  Omotunde Lawal, CFA, is Head of Emerging Markets Corporate Debt and the lead portfolio manager for the Emerging Markets Corporate Debt and Emerging Markets Short Duration strategies at Barings. She chairs the Emerging Markets Corporate Investment Committee, and is also a member of the Global High Yield Allocation Committee and Global Investment Grade Allocation Committee. Prior to her current role, Lawal was the Head of Barings EM Corporate Credit Research, with research coverage responsibilities for various sectors such as Real Estate, LATAM Energy, and LATAM Infrastructure. She has worked in the industry since 2000. Prior to joining the firm in 2014, Lawal was a portfolio manager at Cosford Capital Management, focusing on high yield and distressed LATAM and CEEMEA corporates. Prior to this, she was at Standard Bank, where she traded and invested in distressed and stressed emerging markets corporates in LATAM and CEEMEA for the Principal Trading Team. Earlier, Lawal worked at Barclays Capital and Deloitte & Touche/Arthur Andersen. She holds a bachelor's degree in Accounting & Finance from University of Warwick, is a Fellow of the Chartered Institute of Accountants in England and Wales, and is a member of the CFA Institute. DISCLAIMER:Barings is an Associate member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Barings nor TEXPERS. These views are subject to change. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about Texas' public pension industry.

Omotunde Lawal, CFA, is Head of Emerging Markets Corporate Debt and the lead portfolio manager for the Emerging Markets Corporate Debt and Emerging Markets Short Duration strategies at Barings. She chairs the Emerging Markets Corporate Investment Committee, and is also a member of the Global High Yield Allocation Committee and Global Investment Grade Allocation Committee. Prior to her current role, Lawal was the Head of Barings EM Corporate Credit Research, with research coverage responsibilities for various sectors such as Real Estate, LATAM Energy, and LATAM Infrastructure. She has worked in the industry since 2000. Prior to joining the firm in 2014, Lawal was a portfolio manager at Cosford Capital Management, focusing on high yield and distressed LATAM and CEEMEA corporates. Prior to this, she was at Standard Bank, where she traded and invested in distressed and stressed emerging markets corporates in LATAM and CEEMEA for the Principal Trading Team. Earlier, Lawal worked at Barclays Capital and Deloitte & Touche/Arthur Andersen. She holds a bachelor's degree in Accounting & Finance from University of Warwick, is a Fellow of the Chartered Institute of Accountants in England and Wales, and is a member of the CFA Institute. DISCLAIMER:Barings is an Associate member of TEXPERS. The views and opinions contained herein are those of the author and do not necessarily represent the views of Barings nor TEXPERS. These views are subject to change. Follow TEXPERS on Facebook, Twitter, and LinkedIn for the latest news about Texas' public pension industry.