Risk Tolerance and Investment Strategy for Public Pension Plans

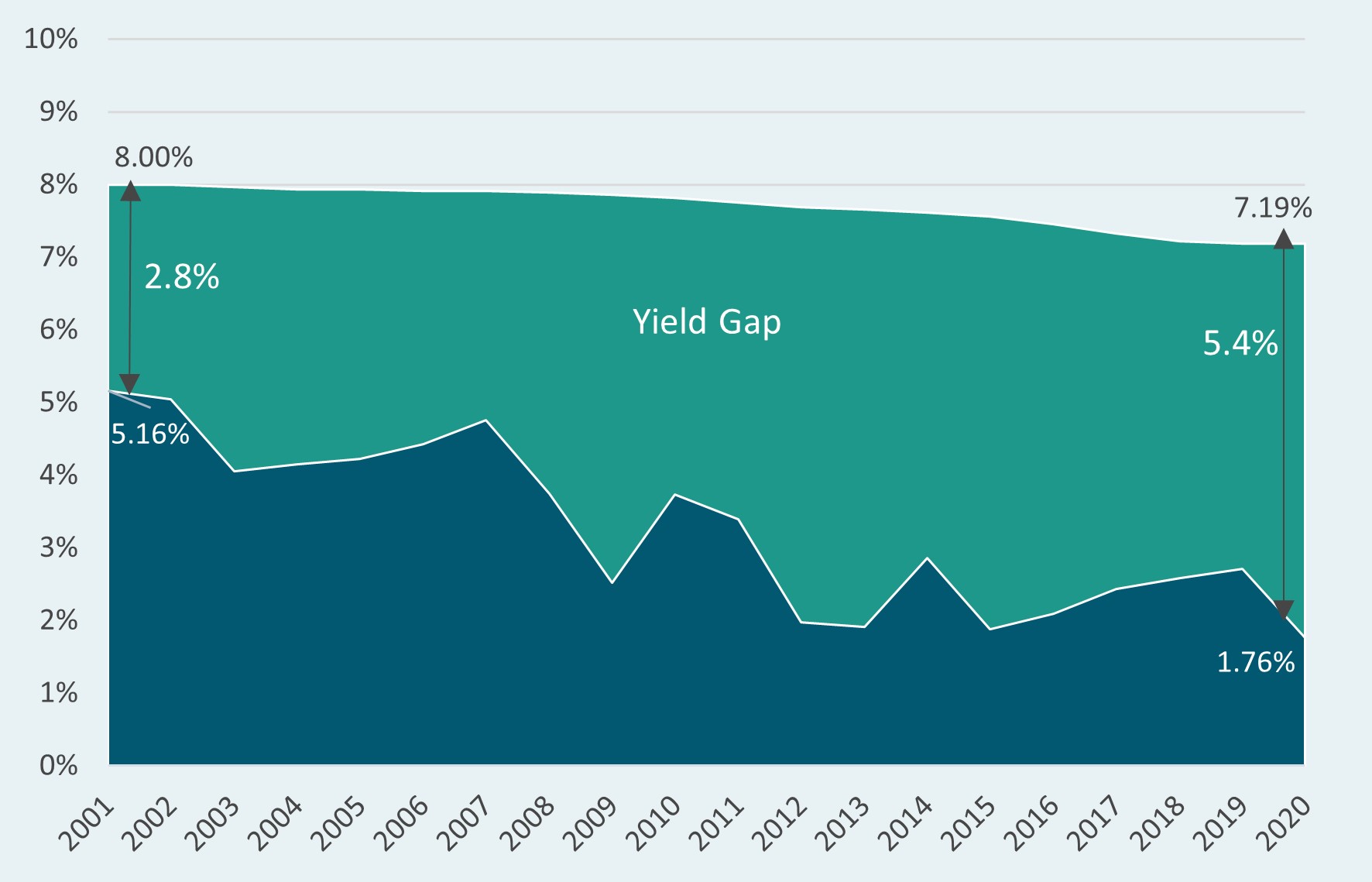

Interest rates have been on a secular decline since the early-1980s after Paul Volcker pushed short-term rates to nearly 20% to beat back inflation. Today, by comparison, the Fed Funds rate is targeted between 0.25% and 0.50%. Unfortunately, as interest rates fell, pension discount rates have barely budged, leading to a widening “yield gap” between what plan fiduciaries expect to receive from the market and what the market can realistically provide.

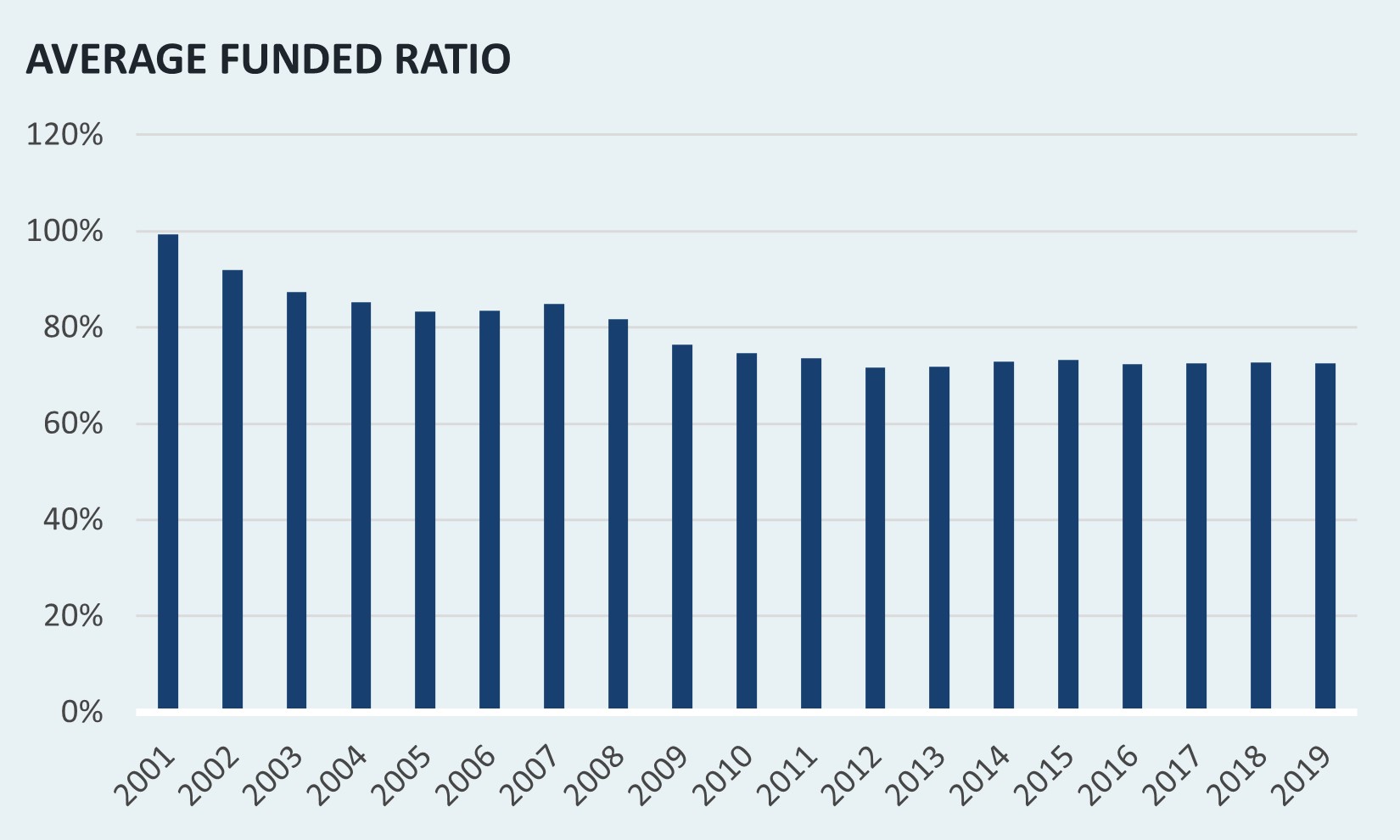

Funding levels deteriorated over the same period, resulting from two significant drawdown events (i.e., the bursting of the tech bubble and the mortgage meltdown), and they have remained stubbornly low for the past decade. The extremely difficult challenge faced by many Trustees under these circumstances is how to improve their plan’s impaired fiscal condition in an environment of low expected market returns.

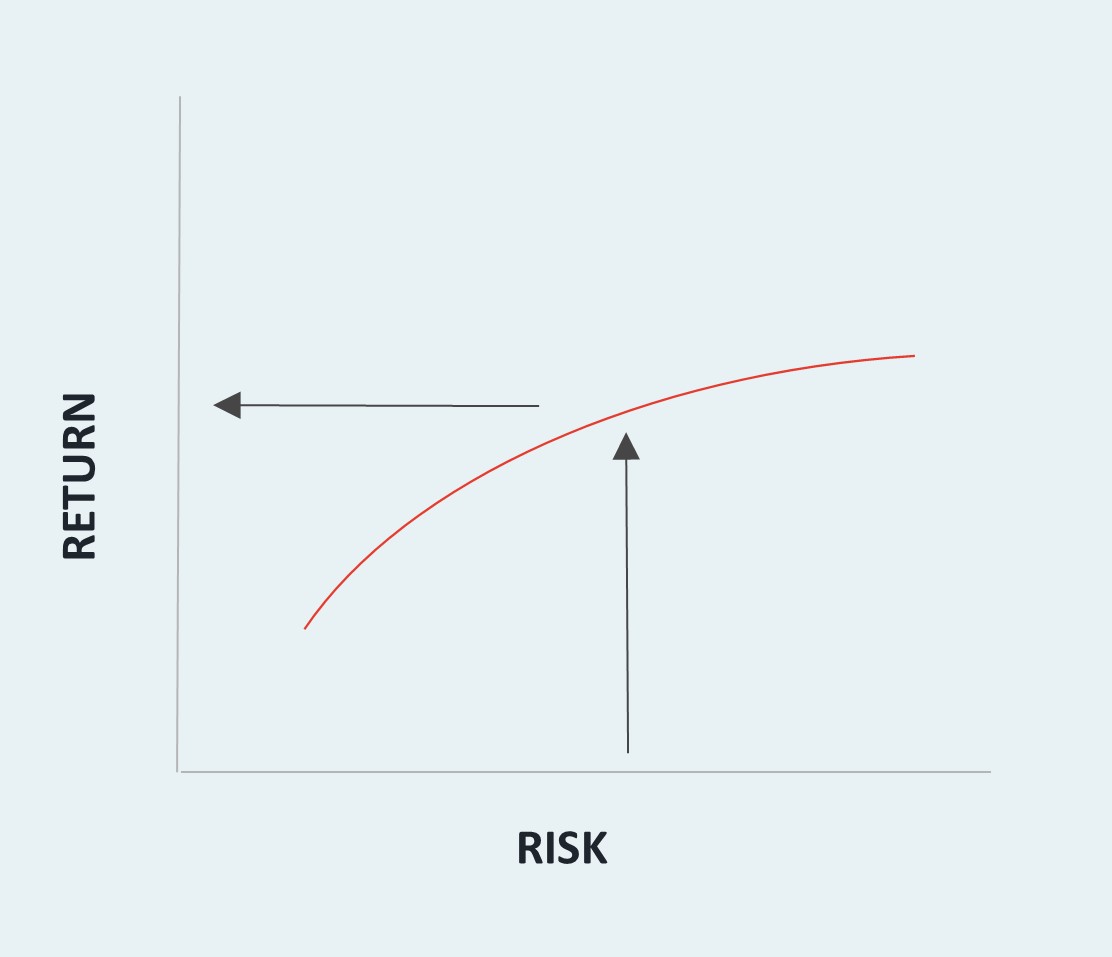

The natural response for many is to increase portfolio risk in order to drive higher expected returns. The obvious problem with this approach is that with higher risks come higher drawdowns, which can lead to a downward spiral of ever-increasing pension cost and crowding out of other budgetary priorities. This natural tendency has been broadly applied historically, as otherwise thoughtful plan fiduciaries have put the cart before the horse, i.e., considering return as the primary objective with risk as a residual output. Instead, they should be optimizing return for a pre-determined acceptable level of risk, while also considering the constraints introduced by the practical reality of the plan sponsor’s financial position.

Geddes et. al. of The Pension Practice Council advocate a similar approach in their Issue Brief entitled, Asset Allocation and the Investment Return Assumption[1]. They state the asset allocation and return assumption should be based on a thorough risk assessment that includes:

- size of the plan liability and asset pool, relative to plan sponsor resources;

- expected net cash flow;

- investment time horizon defined by expected benefit payments for current members;

- financial strength of the plan sponsor(s); and

- inflation sensitivity in the benefit promise.

Risk tolerance assessment

When assessing risk tolerance, one must consider both Willingness and Ability to incur risk.

Willingness can be described as the collective predisposition of the Board toward risk and can be attained through a disciplined process of surveying each Board member individually, followed by a facilitated session with the full Board to reconcile differences and develop consensus of where the Board stands as a group. Survey questions cover topics such as the depth of Trustee understanding of basic risk concepts, as well as individual perspectives on portfolio structure, governance and delegation of authority, appropriate response to severe drawdowns, and views on peer and headline risk, among others. Each question is designed to provide data to help assemble an overall sense of how much risk each individual is willing to take in the investment portfolio. Once individual risk tolerance is assessed, the data is compiled and aggregated into a general heuristic of the group’s willingness to incur risk, which must then be reconciled and refined through facilitated group discussion.

Ability to incur risk is more about plan and plan sponsor health and can be measured somewhat more quantitatively than Willingness. Insight into Ability is gained by evaluating plan metrics, e.g., funded status, cash flows, contributions as a percentage of pay. With respect to plan sponsor health, broad economic and financial analysis can yield important insights into the potential for support during difficult times. Economic growth, economic base and employment diversity, debt and debt servicing levels, credit ratings, and population growth all factor into the assessment.

The final step is to combine Willingness and Ability into an overall determination of risk tolerance, which is then used as the primary input in the process for developing an appropriate investment strategy.

Investment strategy development

Once risk tolerance is heuristically defined, it becomes an input into the investment strategy development process, using an asset/liability framework as the primary evaluation tool. Liquidity analysis is important as well to ensure any allocations to illiquid, private market investments are properly supported. Insights gained from Trustee interviews and the consensus-building exercise described above become guideposts for developing model portfolios. Deterministic and stochastic modeling techniques incorporate expected return outcomes and forecasted liability streams, which then provide forecasts for key metrics, such as plan funded ratio and contributions as a percent of pay. Geddes et. al. are instructive here as well and prescribe suggested evaluation criteria to include:

- The likelihood of the funded status dropping below x% during the next N years;

- The likelihood of the contribution as a percent of payroll increasing above y% during the next N years; and

- The likelihood of the contribution as a percent of payroll increasing by z% in a single year during the next N years.

Investment policy

In addition to helping with investment strategy development, results from the risk tolerance assessment also provide key insights into the development of an effective investment policy. Through the process, Board preference on topics such as leverage, illiquidity, complexity, active management, time horizon, and delegation of authority can be used to develop a clear investment philosophy, well-defined roles with appropriately defined decision-making authority, and guidelines for how to respond to challenging market conditions.

Conclusion

Plan fiduciaries face challenges on many fronts, including a rising yield gap and stagnating funded positions. In response, investment decision-makers may be tempted to increase risk in pursuit of higher investment returns. A more appropriate approach may be to conduct a thorough and realistic assessment of the plan’s risk tolerance, which incorporates both willingness and ability to incur risk and to then develop an investment strategy reflective of the pre-determined risk tolerance, while incorporating the practical realities of any constraints due to the financial condition of the plan sponsor.

REFERENCES:[1] Timothy Geddes et. al., Asset Allocation and the Investment Return Assumption, July 2020, American Academy of Actuaries, Washington D.C. ABOUT THE AUTHOR: Scott Whalen, CFA, CAIA, is an Executive Managing director and a Senior Consulstant at Verus Investments. He is primarily responsible for providing strategic investment advice to help ensure clients meet their long‐term investment objectives. Whalen is also a Verus shareholder and a key member of the Verus leadership team, in addition to sitting on the Verus OCIO investment committee. Prior to joining Verus in 2002, he built a distinguished career in management consulting at McKinsey & Company and Ernst & Young, where he led corporate and public sector institutions to increase efficiency and improve operational performance. Whalen has extensive experience working with multiple stakeholders across industries, where he has honed his ability to foster effective decision‐making in challenging environments. He is a recognized speaker at industry conferences, where he has presented on a broad range of topics, including asset allocation, alternative investing, manager oversight, attaining operational efficiencies in investment programs, the challenges and potential benefits of dynamic asset allocation, and the importance of maintaining a long‐term perspective. Whalen received a bachelor of arts degree in economics from Wake Forest University and a master's degree in business administration from the University of Southern California Marshall School. He has earned the right to use the CFA and CAIA designations and is a member of the CFA Institute, the CFA Society of Los Angeles, and the CAIA Association. DISCLAIMER:Verus Investments is a Consultant member of TEXPERS. This article is for informational purposes only, is not investment advice, and should not be considered a recommendation to buy or sell any security or to invest in any particular market or country. Actual future results or occurrences may differ significantly from those anticipated. For the full disclaimer and entire report, visit https://www.verusinvestments.com/risk-tolerance-for-public-pensions/.