Recessions and Midstream Energy Infrastructure: Why Its Better Today Than Previous Years

The Federal Reserve (The Fed) is fighting decades-high inflation with aggressive monetary policy. Many market watchers now expect at least a mild recession in response. The S&P 500 Index's 17.3% loss and the NASDAQ's 25.5% loss year-to-date through 6/24/2022 would suggest equity investors share this concern (year to date, the Alerian MLP Index (AMZ), a midstream energy focused index, is up 9.2%). To understand how midstream might perform through such an environment, we thought a look at history could be helpful.

Prior to the COVID-induced recession just experienced, which is still likely fresh in investor's minds, the two most recent recessionary periods were 2001 ("the Dot Com bubble") and 2008 ("the Great Recession"). As will be discussed in more detail below, over both periods midstream equities performed relatively well when compared to broader equities. Further, we note that the drivers of economic concern today are primarily high commodity pricing, inflation, and rising rates, each of which, we believe, may favor the midstream sector (please see our recent blogs "Why Inflation can be a tailwind for midstream energy" and "A review of midstream equities and interest rates"). Therefore, we are hopeful the sector may provide good relative performance this time around for a variety of reasons. But first the history.

The Dot Com bubble

First, let's consider the Dot Com bubble driven recession of 2001. The parallels to today's circumstances appear manifold.

Like today, the market was exiting a multi-year, tech-led market rally. The S&P 500 Index had tripled over the preceding four years and the Nasdaq had more than quintupled.

The Federal Reserve was beginning a cycle of lifting interest rates after a period of accommodation. Heading into 2000, the Fed had already raised rates three times (25 bps each, beginning in June 1999) and would raise three times during 2000 (25 bps, 25 bps, and then 50 bps).

The oil and gas sector had endured a period of underperformance from weak commodity pricing and a lack of investor interest, which had, of course, been focused on dot coms. Specifically, crude oil declined 32% in 1998 and then more than recovered in 1999, exiting the year at multi-year highs; again, similar to today.

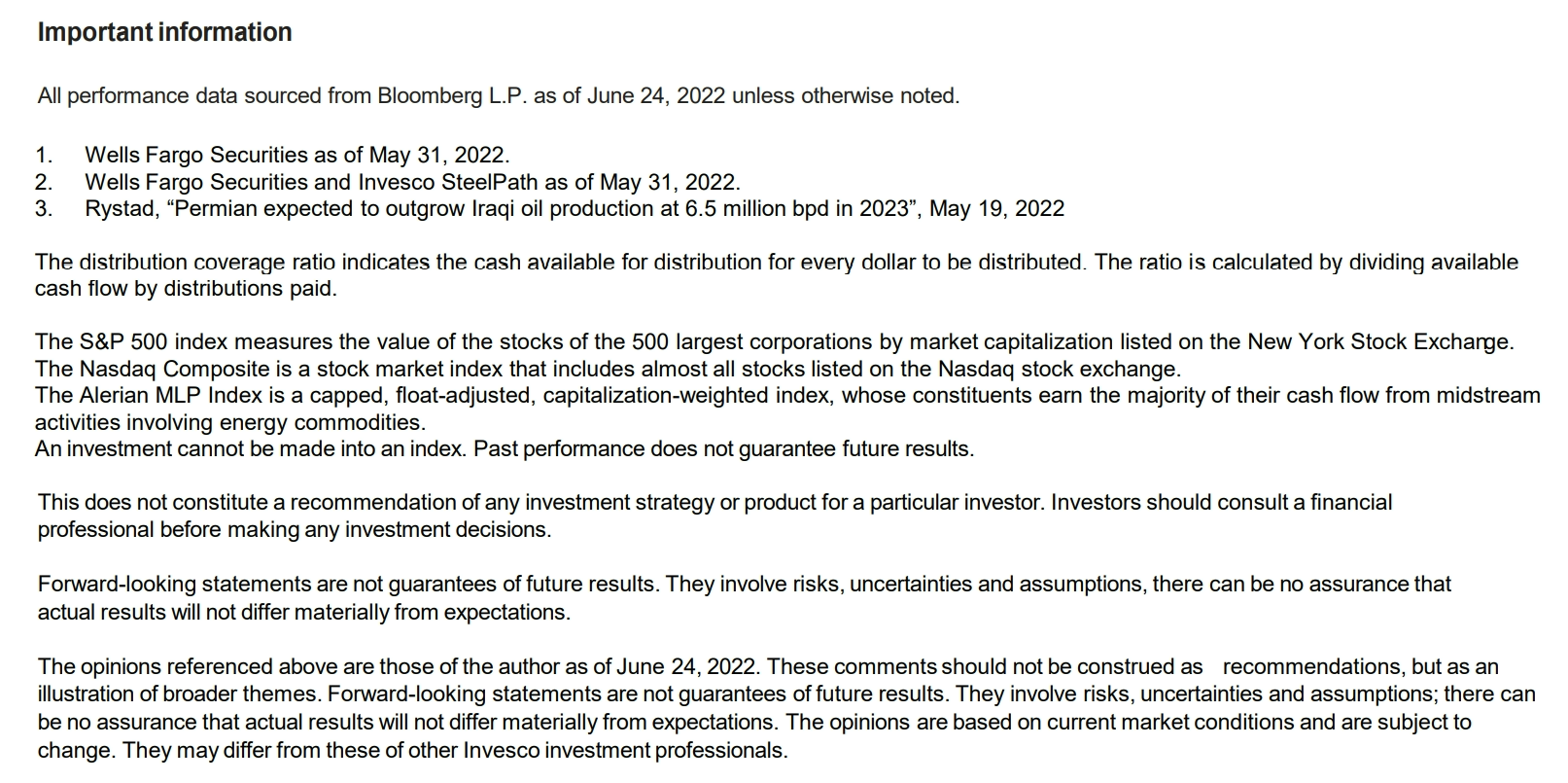

As many may recall, the broad markets reached a peak in late March 2000 and declined precipitously thereafter. As detailed in the table below, the AMZ then outperformed the S&P 500 Index and the NASDAQ significantly through 2003. In fact, the AMZ's cumulative outperformance from 2000 to 2004 was 187% relative to the S&P 500 and 221% relative to the NASDAQ.

The Great Recession

The circumstances surrounding the Great Recession appear to offer fewer parallels to today, but some similarities are notable. For instance, energy prices had been rising leading into 2008 driven by expectations that Chinese demand would lead to future supply and demand tightness, though US shale production was beginning to be unlocked and would ultimately alleviate this concern. Also different this cycle, the Federal Reserve had already exited a period of rate increases; the Fed pursued five 25 bps increases in 2004, eight in 2005, and four in 2006, but had paused for more than a year ahead of the eventual recession.

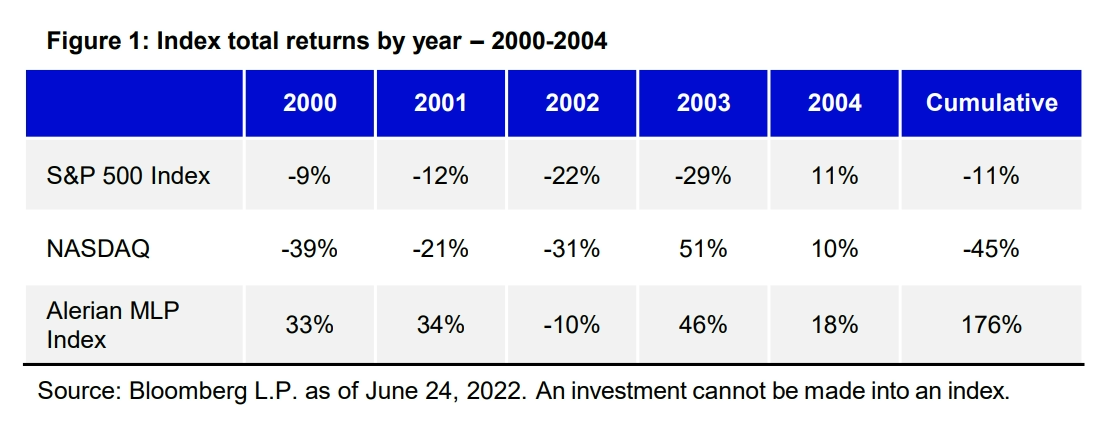

Ultimately, the recession's catalyst was, of course, a collapse in mortgage and real estate values combined with excessive leverage throughout the financial system that punctured investor confidence in, and access to credit for, many financial institutions. However, midstream energy again outperformed through and during the recession and recovery (approximately December 2007 through June 2009). In fact, the AMZ's cumulative outperformance from 2008 to 2011 was 77% relative to the S&P 500 and 69% relative to the NASDAQ.

Outlook Today

As discussed, the current environment appears to offer a surprising number of parallels to 2000. Midstream seems to be coming off a period of underperformance driven by a period of COVID-led commodity price weakness and scant investor interest. The broad market and tech sector have come off a multi-year period of strong performance (entering 2022 the S&P 500 Index was up 132% over the last five years, 18% annualized, while the NASDAQ was up 202% or 25% annualized) which likely left investors little incentive to parse the state of the energy markets.

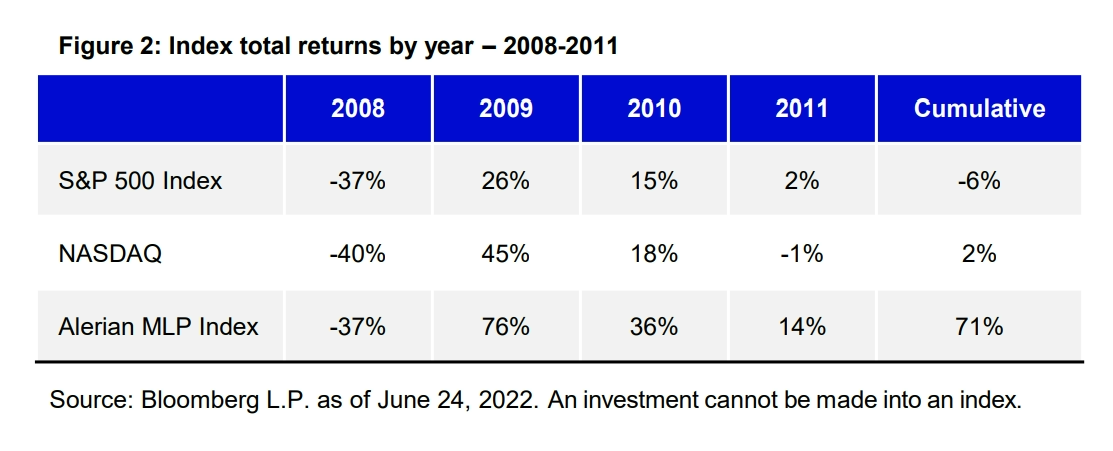

However, we believe several midstream sector fundamentals are better today than in 2000 or 2008. First, midstream companies are generating significantly more free cash flow today and have increased their distribution coverage ratios materially. Coverage ratios today are approximately 2.0x, versus approximately 1.0x in 2000 and 1.1x in 2008.1 Further, in 2008, the midstream sector was in the midst of massive capital spending requirements to accommodate new shale production resulting in a heavy dependence on outside equity funding. Today, the sector's capital spending requirements are relatively modest, and most can self-fund through retained cash flow. 1

Though free cash flow metrics for the sector have been rising for several years, most companies have been using this cash to reduce leverage thus far. 2 However, we believe sector leverage is now largely in line with company targets and thus we expect to see cash begin to more materially contribute to distribution/dividend increases or share buybacks.

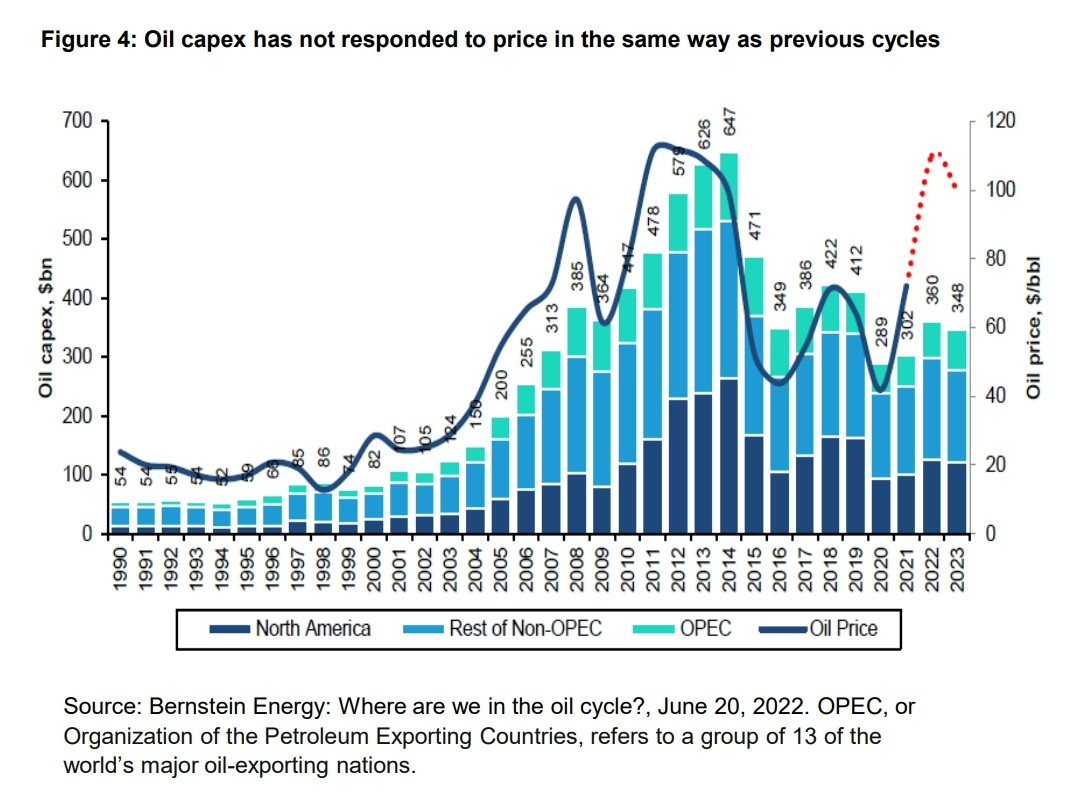

Secondly, over the past several years oil and gas producers, key customers of many midstream assets, have become far more financially disciplined than in the past. Today, crude oil is trading at just over $100 per barrel while most estimate the break-even prices to drill US shale basins is far lower (e.g. break-even pricing for the Permian basin in West Texas is estimated at $33 per barrel).3 Historically, we would think that today's high pricing would entice oil and gas producers to massively increase capital spending, potentially resulting in a likewise massive cut to capital spending and balance sheet concerns should prices subsequently retreat. However, today we view capital spending as being restrained as producers remain committed to achieving strong return metrics and potentially returning profits to shareholders.

We believe this change in producer financial discipline is healthy for midstream as well. Ratable producer spending means midstream providers are not being asked to rapidly build new capacity that then may be underutilized after a retraction in commodity pricing, in our view. Also, should commodity pricing retreat, we believe producers' spending is likely to remain fairly consistent, which should result in more stable midstream volumes than past periods of commodity price pullbacks.

Despite these macro and company fundamental improvements, midstream equities still trade at valuations substantially below the five- and ten-year averages. Therefore, we continue to believe the sector may provide investors potentially attractive yield and total return experience over the coming years despite the looming threat of a potential recession.

About the Authors:Brian Watson, CFA, is a Senior Portfolio Manager at Invesco. Chad Potter, CFA, is a Senior Analyst at Invesco. Disclaimer: Invesco is an Associate Advisor Member of TEXPERS.