The speed and extent of further monetary tightening in the United States is uncertain, and as a result, there are concerns about the impact of rate hikes on future fixed-income returns. But we do not believe investors should be concerned, and this may even be a buying opportunity.

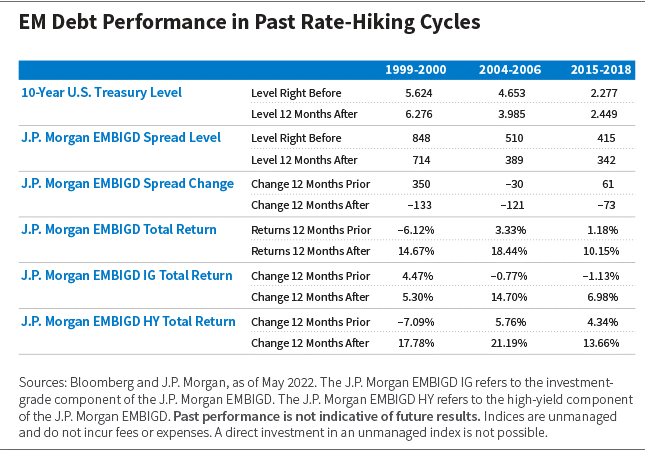

In previous posts, we considered five key fears driving concerns about the future returns of EM sovereign debt in light of three previous tightening cycles that occurred during the life of this asset class: 1999 to 2000, 2004 to 2006, and 2015 to 2018.

Although each cycle we analyzed involved unique global economic factors, EM debt returns in the 12 months following the start of a rate-hiking cycle have been strong, as the chart below shows. Double-digit returns of 14.67%, 18.44%, and 10.15% were recorded 12 months after the first rate hike in 1999-2000, 2004-2006, and 2015-2018, respectively. And in each instance spreads tightened into the hikes.

We believe the current rate-hiking cycle is unlikely to be different. Most of investors’ legitimate concerns have already played out, with much of the bad news already priced into the asset class.

In fact, we have already begun to see a significant upward rise in U.S. Treasury yields; EM debt spreads have widened materially; and the starting yield on the J.P. Morgan EMBIGD was already beginning to look attractive as the Fed began hiking. In addition, we have already seen material net outflows from the asset class this year; the U.S. dollar (USD) has strengthened to multiyear highs; and positioning is heavy.

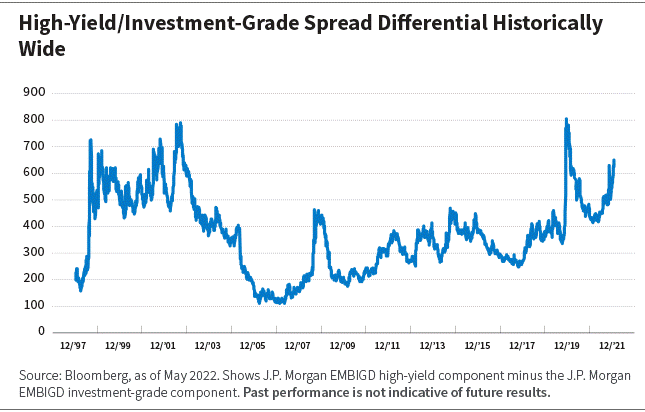

In each of the past rate-hiking cycles we examined during the life of this asset class, high-yield EM debt has outperformed investment-grade EM debt in the 12 months following the first Fed rate hike. We expect the current tightening cycle to be no different. The high-yield/investment-grade spread differential is trading at historically wide levels, as the chart below shows.

Also, as noted in the previous section, cash prices are low across the asset class, and the number of bonds trading at distressed levels has already reached an all-time high, with prices of C-rated bonds already averaging in the mid-$30s, which is well below historical recovery levels.

We thus believe it could be compelling to overweight the high-yield sector at the expense of investment-grade bonds that offer less probability-weighted upside, and to seek to take advantage of valuations in distressed credits.

We believe only a very bearish set of circumstances is likely to generate negative returns for investors over the next year. Our analysis suggests it would likely take a combination of the 10-year U.S. Treasury yield rising and EM debt spreads widening substantially for the asset class to generate a negative return.

This is unlikely, in our view, as spreads have tended to widen more than 200 bps on global recession fears (and they have widened nearly 150 bps since last year). If fears about a global recession do materialize, we expect to see a significant drop—rather than a rise—in the 10-year U.S. Treasury yield, which would likely act as a cushion against spread widening.

Our base case is that the U.S. 10-year U.S. Treasury yield stabilizes at around 3% and spreads tighten back to more historical levels. In this case, the asset class could generate compelling returns for EM debt investors over the coming year. And long-term, we believe low historical default rates and high recovery values bode well.

Thus, we now believe that EM debt may represent a buying opportunity for investors looking to take advantage of higher yields and improved valuations. Of course, in today’s environment, nothing is certain. We remain focused on navigating risks and changing market conditions to identify attractive investment opportunities on behalf of our clients.

Who Fears the Fed? Series

Post 1: Should EM Debt Investors Fear Fed Hikes?Post 2: Watching for Widening in EM Debt Spreads

Post 3: Will Fed Rate Hikes Shake Up EM Debt?

Post 4: Why EM Debt Investors Shouldn’t Fear the Fed

About the Authors:

Marco Ruijer, CFA, is a hard currency portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, Marco was the lead portfolio manager on NN Investment Partners’ EMD team, where he was responsible for managing EMD hard currency portfolios. Before joining NNIP in 2013, Marco was a senior fund manager for EMD at Mn Services in the Netherlands, where he managed various EMD portfolios. Before that, he worked with Mn Services’ investment strategy and risk management team. Marco began his career in 1998 as an investment trainee at Mn. Marco received an M.A. in international financial economics from the University of Amsterdam.

Marco Ruijer, CFA, is a hard currency portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, Marco was the lead portfolio manager on NN Investment Partners’ EMD team, where he was responsible for managing EMD hard currency portfolios. Before joining NNIP in 2013, Marco was a senior fund manager for EMD at Mn Services in the Netherlands, where he managed various EMD portfolios. Before that, he worked with Mn Services’ investment strategy and risk management team. Marco began his career in 1998 as an investment trainee at Mn. Marco received an M.A. in international financial economics from the University of Amsterdam.  Daniel Wood is a local currency portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, he was a senior portfolio manager on NN Investment Partners’ EMD team. Before joining NNIP in 2017, he was a portfolio manager at BNP Paribas. Before that, he was an analyst on the emerging markets fixed-income team at Rexiter, where he was instrumental in the setup of the investment process and responsible for raising capital and investment performance. Daniel began his career in 2000, holding various middle-office, marketing, and client service roles for Fidelity, Schroders, and State Street. He received a B.A., with honors, in finance and accounting, economics, accountancy from the University of Brighton.

Daniel Wood is a local currency portfolio manager on William Blair’s emerging markets debt (EMD) team. Before joining William Blair, he was a senior portfolio manager on NN Investment Partners’ EMD team. Before joining NNIP in 2017, he was a portfolio manager at BNP Paribas. Before that, he was an analyst on the emerging markets fixed-income team at Rexiter, where he was instrumental in the setup of the investment process and responsible for raising capital and investment performance. Daniel began his career in 2000, holding various middle-office, marketing, and client service roles for Fidelity, Schroders, and State Street. He received a B.A., with honors, in finance and accounting, economics, accountancy from the University of Brighton.

Disclosures:

William Blair is an Associate Advisor Member of TEXPERS.

The J.P. Morgan Emerging Markets Bond Index Global Diversified (EMBIGD) is an unmanaged, market-capitalization weighted, total-return index tracking the traded market for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities. Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2022, JPMorgan Chase & Co. All rights reserved. Indices are unmanaged and do not incur fees or expenses. A direct investment in an unmanaged index is not possible.