Listed REITs Have Likely Priced in a Recession; Analysis Points to a Recovery Next

Investors have priced in a negative, forward-looking view of listed real estate. Slowing growth and higher inflation have created a stagflationary backdrop that has been especially challenging for REITs. The result is that there has been a dramatic performance difference between listed and private real estate in 2022. While REITs, as measured by the FTSE Nareit All Equity REITs Index, are down -27.9% through September and down -21% through November, the NCREIF ODCE index, a measure of private real estate that is calculated quarterly, is up 13% through September on a total return basis. Based on history, we believe that gap in performance will not persist. Indeed, private real estate returns are just beginning to slow as expected. Private real estate typically lags listed real estate due to its slower-moving price discovery and transactions.

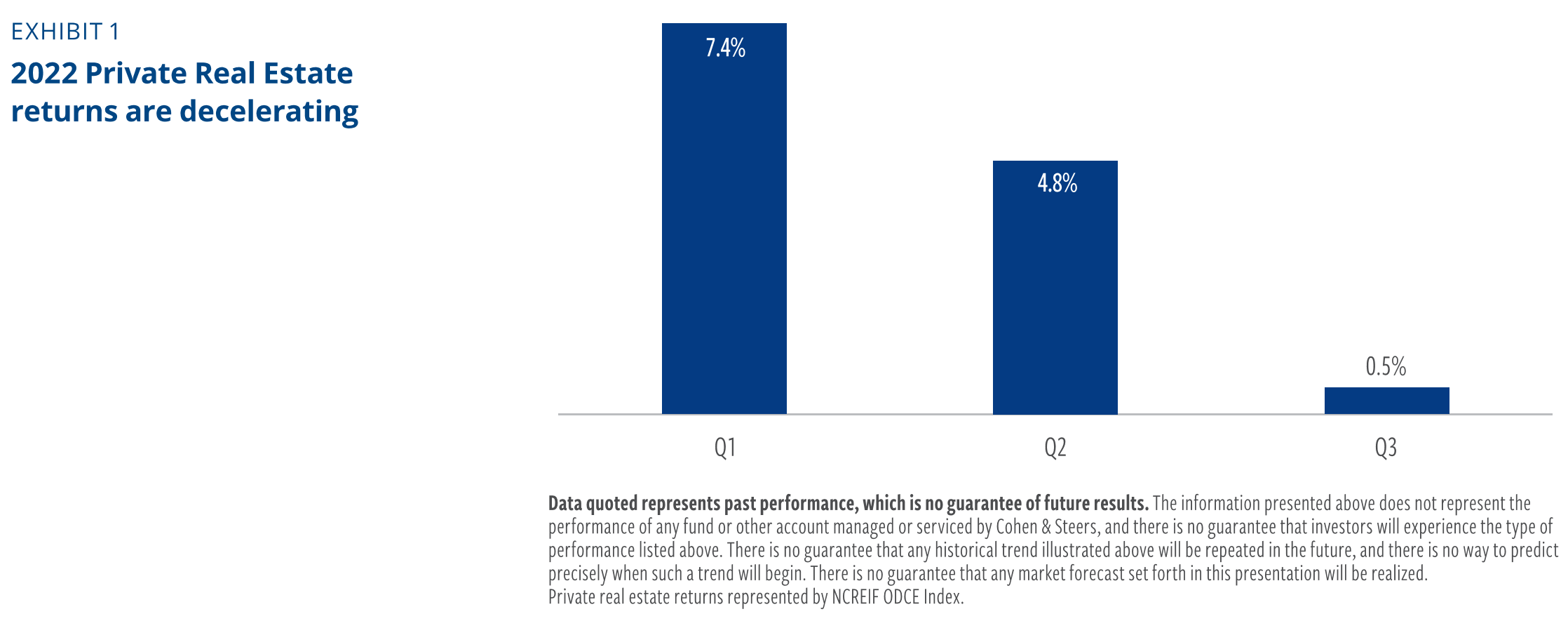

The NCREIF ODCE Index returned just 0.5% in the third quarter, representing a substantial and sequential deceleration from its 7.4% return in Q1 and a 4.8% return in Q2. That's the second-greatest deceleration since 1978 (Exhibit 1). We have advised investors to have strategic allocations to both private and listed real estate. This is not an either-or proposition. Yet, we see the current market conditions as a reason to overweight listed REITs compared to private. In fact, we see the emergence of a backdrop that supports a REIT recovery over the next 12 months.

First, real estate fundamentals are historically strong. Real estate supply vs. demand is tight, as indicated by data such as high occupancy rates. We anticipate a deceleration in REIT earnings to reflect a possible recession, but we expect REIT cash flows to be resilient, particularly compared to other asset classes.

Second, listed real estate has historically outperformed in the type of more supportive inflationary backdrop we can now see on the horizon. That is when the end of the rate-hiking cycle occurs and also when both real yields and growth are down.

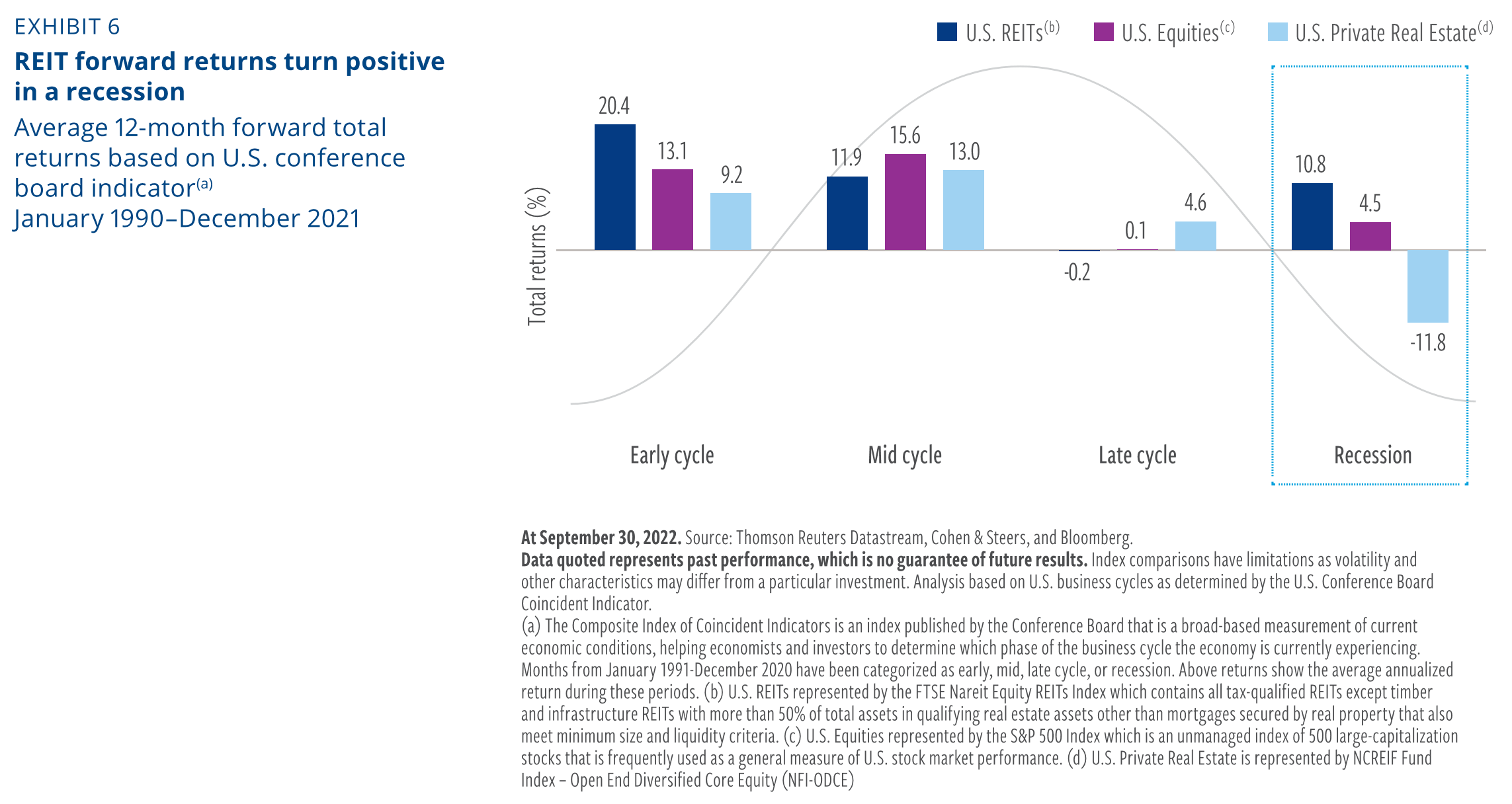

While the best returns have been earned during the early cycle, the market still generated 10.8% forward average 12-month returns following a recession (Exhibit 6). And for this cycle we have likely already experienced a majority of this recessionary decline.

Healthy REIT fundamentals

REIT fundamentals are decelerating but will remain resilient. In fact, we have lowered our 2023 growth expectations for REITs amid the slowing economic backdrop. But REITs have entered the economic slowdown in relatively healthy positions due to favorable supply-demand dynamics amid tight supply.

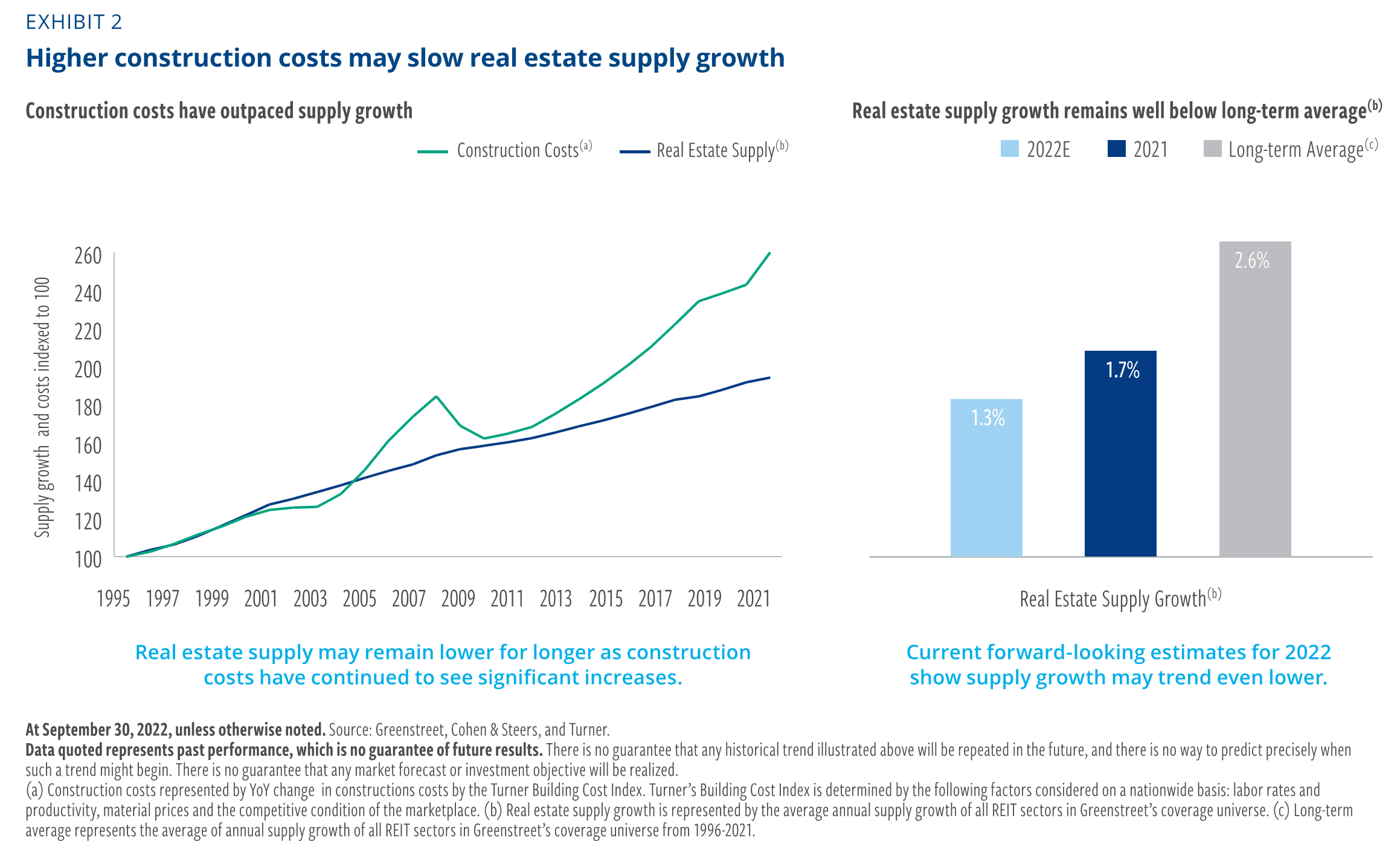

A key difference between this cycle and previous downturns is that real estate supply is likely to remain lower for longer. We expect inflation to decline but to remain elevated until at least the end of 2023. Higher costs for land, materials and labor have increased replacement costs, reducing the potential profits of development and raising the economic barriers to new supply and reducing potential competition for existing properties (Exhibit 2).

Durable and predictable cash flows may also provide defensiveness relative to other asset classes. REITs offer the potential for relative stable earnings, especially compared to equities, due to limited supply, in-place leases, high operating margins, and low labor intensity.

Moving past peak inflation

The Fed is engaged in one of its most aggressive rate-hiking cycles ever to tackle inflation. It appears to be having the intended effect.

Labor markets remain tight, and resources are constrained. This could keep inflation elevated, but leading indicators offer evidence that inflation peaked in June. Listed rental prices and housing starts are both falling, while lending standards are tightening. Manufacturing inventories have shifted from excess demand to excess supply. And corporate profit margins are falling.

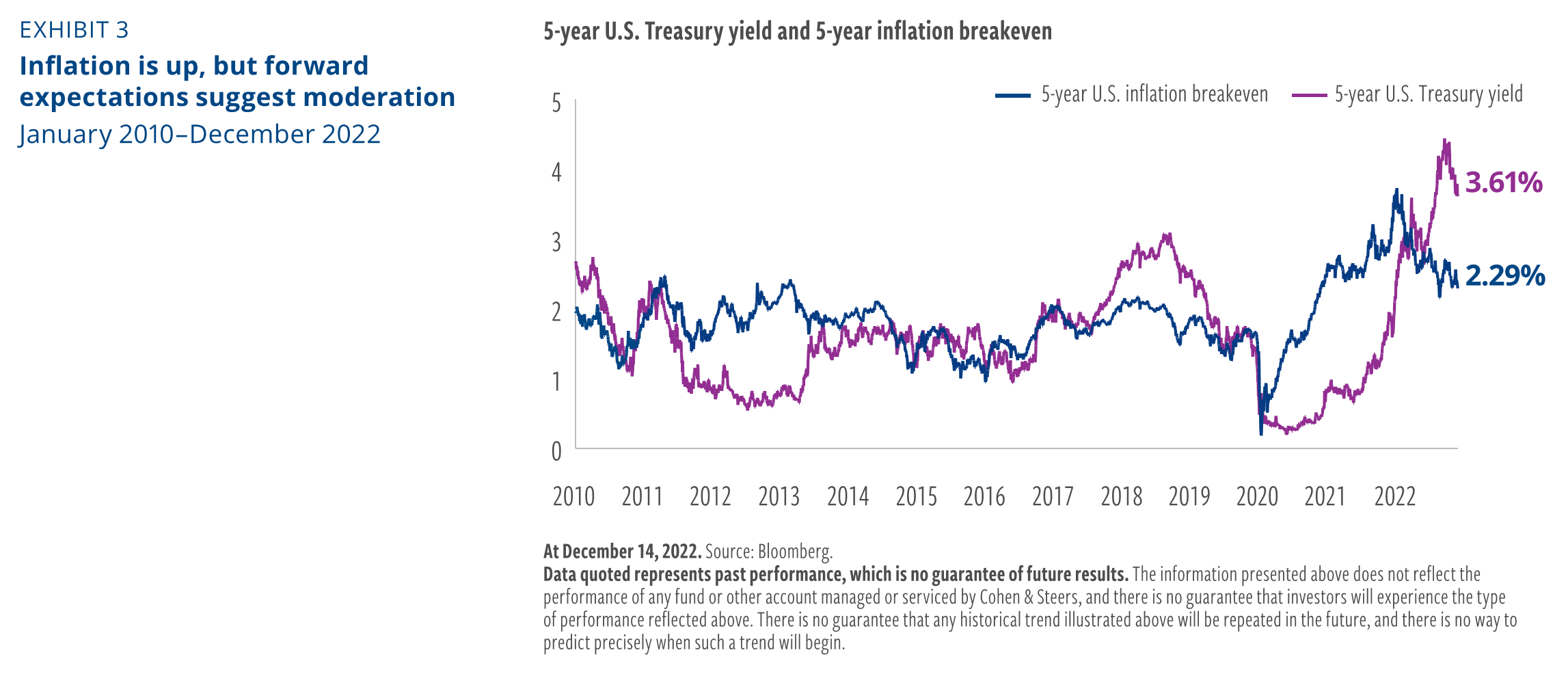

The futures market indicates the overnight lending rate will reach a terminal point close to 5% by June 2023. Moreover, the five-year breakeven inflation rate (derived from five-year Treasury inflation-protected securities) implies that market participants expect the Fed will succeed sooner rather than later (Exhibit 3). We believe this supports a more favorable backdrop for REITs for two primary reasons.

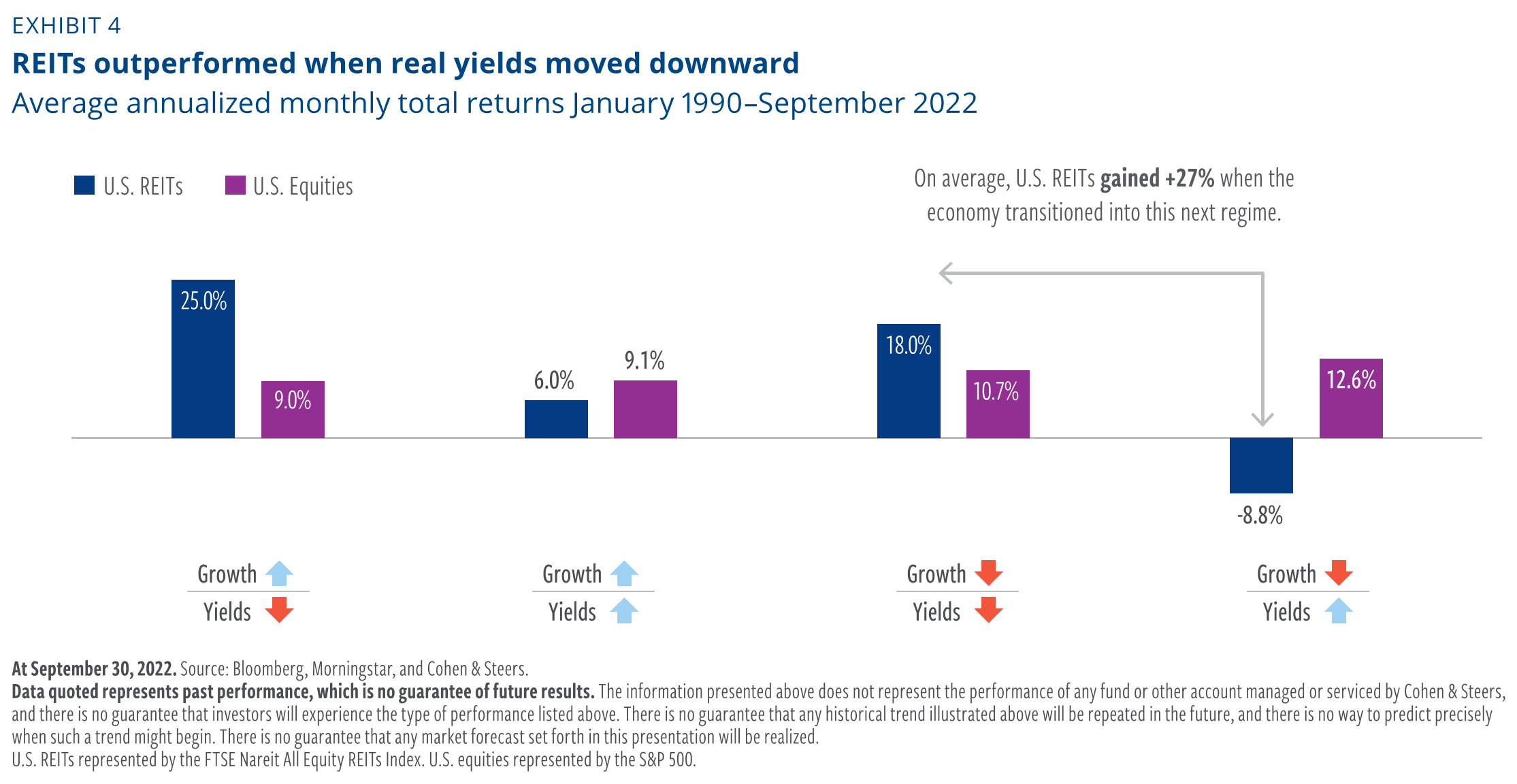

First, moving towards lower real yields. Low growth but higher yields, generally indicating stagflation, presents a headwind to real estate. Periods when both growth and yields are down, indicating a more stagnationary environment, have represented a significant tailwind to REITs. REITs, on average, have declined –8.8% in periods when growth is down but yields are up. By contrast, they have climbed 18.0%, on average, during periods when both growth and yields are down (Exhibit 4). That represented a 27% swing, on average, when the transition occurred.

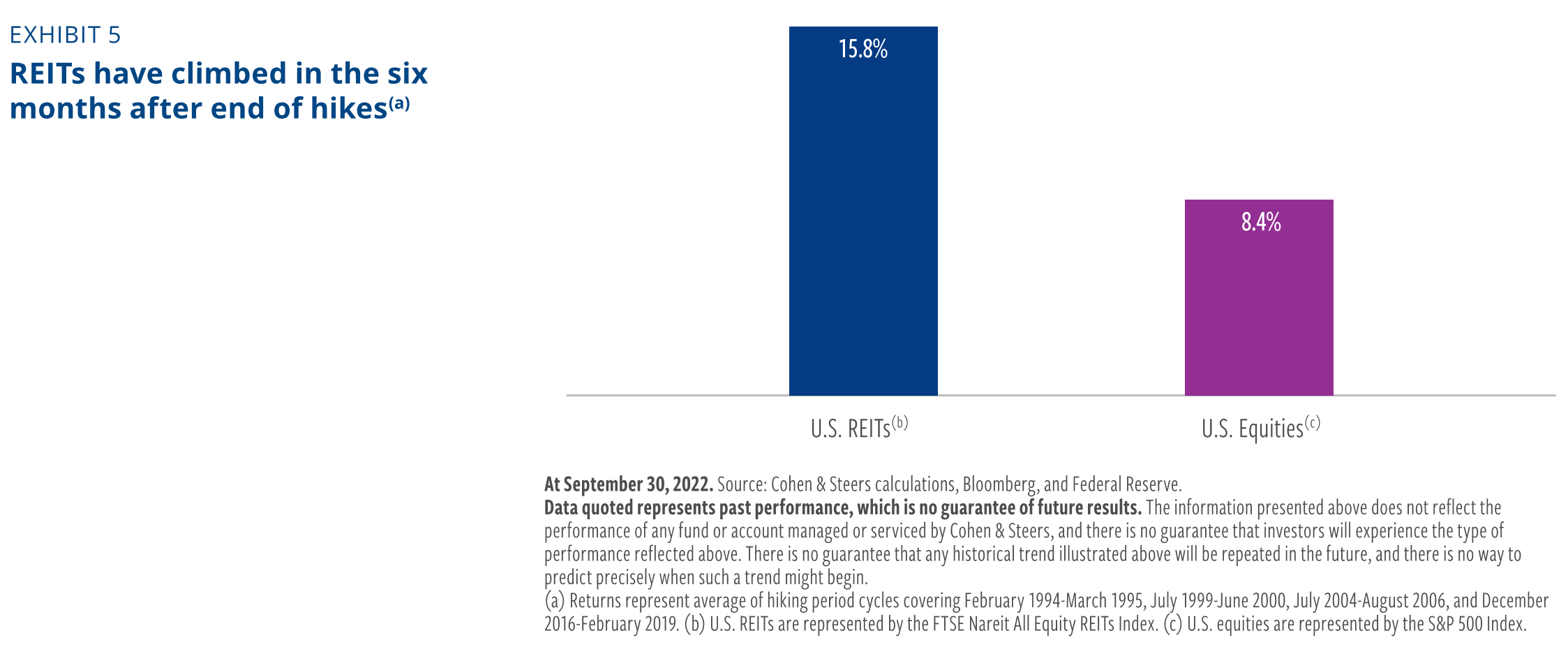

Second, REITs have performed remarkably well when rate-hiking cycles have ended. The pace of Fed hikes has moderated, and the point at which the Fed stops raising rates has historically been a critical inflection point; on average, REITs have returned 15.8% in the first six months after the Fed has stopped raising rates (Exhibit 5).

Investors may already be anticipating these two dynamics playing out. REITs gained in October—up 3.4% for the month, as measured by the FTSE Nareit All Equity REITs Index. Since then, REITs rallied more than 7% in one day (November 10th) on the news that inflation, as measured by the Consumer Price Index, had fallen to 7.7% in October. They rallied again 1.4% on December 13th after inflation fell again to 7.1% YOY in November. Just prior to finalizing this publication REITs were up 9.6% for Q4 through December 13th.

One risk to our base case, however, is the possibility that the Fed overshoots, choosing to err on the side of continuing more aggressive hikes as it seeks to win back credibility amid criticism it was slow to react to inflation. If that were to happen, it would push back the end of the rate-hiking cycle and the magnitude of the slowdown could be worse.

REITs and early cycle recoveries

Debate continues over whether we are in a recession. We think, however, that the market has priced in a worse recession than we expect.

Against this backdrop, and while past performance is not an indicator of future results, we believe the current downturn could present a similar arc to recessionary precedent. REITs have performed remarkably well after periods of downturns.

We analyzed recessionary periods dating back to 1990. This analysis shows that the best returns for REITs have been generated investing during the early cycle. However, investing during the recession has generated forward returns on average of 10.8% which is above long-term averages (Exhibit 6).

The forward REIT return of 10.8% outperforms the returns of the equity market of 4.5%. This outperformance continues as we move into the early cycle. We see even stronger relative outperformance in early cycle recovery periods when comparing private and listed real estate. Private real estate had negative 12-month forward returns of -11.8% post-recessions and then positive returns of 9.2% post early cycle periods.

By understanding the leading and lagging behaviors of listed and private markets, real estate investors can tactically allocate at different times across the two asset classes.

An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes. Index comparisons have limitations as volatility and other characteristics may differ from a particular investment.

Data quoted represents past performance, which is no guarantee of future results. The views and opinions presented in this document are as of the date of publication and are subject to change. There is no guarantee that any market forecast set forth in this document will be realized. This material represents an assessment of the market environment at a specific point in time and should not be relied upon as investment advice, does not constitute a recommendation to buy or sell a security or other investment and is not intended to predict or depict performance of any investment.

This material is not being provided in a fiduciary capacity and is not intended to recommend any investment policy or investment strategy or to account for the specific objectives or circumstances of any investor. We consider the information to be accurate, but we do not represent that it is complete or should be relied upon as the sole source of appropriateness for investment. Cohen & Steers does not provide investment, tax or legal advice. Please consult with your investment, tax or legal professional regarding your individual circumstances prior to investing.

Risks of investing in real estate securities. The risks of investing in real estate securities are similar to those associated with direct investments in real estate, including falling property values due to increasing vacancies; declining rents resulting from economic, legal, political or technological developments; lack of liquidity; lack of availability of financing; limited diversification, sensitivity to certain economic factors such as interest rate changes and market recessions and changes in supply of or demand for similar properties in a given market. No representation or warranty is made as to the efficacy of any particular strategy or fund or the actual returns that may be achieved.

Cohen & Steers Capital Management, Inc. (Cohen & Steers) is a registered investment advisory firm that provides investment management services to corporate retirement, public and union retirement plans, endowments, foundations and mutual funds. Cohen & Steers U.S. registered open-end funds are distributed by Cohen & Steers Securities, LLC and are only available to U.S. residents.

Cohen & Steers U.K. Ltd. is authorized and regulated by the Financial Conduct Authority of the United Kingdom (FRN 458459). Cohen & Steers Asia Ltd. is authorized and registered with the Hong Kong Securities and Futures Commission (ALZ367). Cohen & Steers Japan Ltd. is a registered financial instruments operator (investment advisory and agency business and discretionary investment management business with the Financial Services Agency of Japan and the Kanto Local Finance Bureau No. 3157) and is a member of the Japan Investment Advisers Association. Cohen & Steers Ireland Ltd. is regulated by the Central Bank of Ireland (No.C188319).

Publication Date: January 2023 Copyright © 2023 Cohen & Steers, Inc. All rights reserved.